Unlikely to expect inflation to cool off in the near term

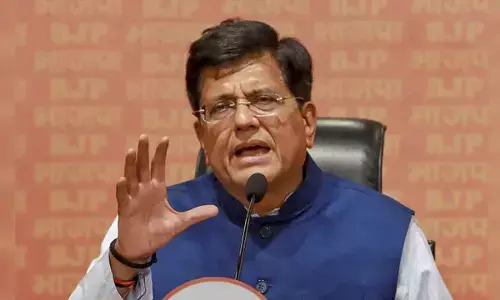

The RBI is scheduled to hold its monetary policy review on tomorrow and its RBI Governor\'s last policy meet. Here\'s what is market expert Abnish Kumar Sudhanshu, (Director & Research Head, Amrapali Aadya Trading & Investments Pvt Ltd) has to say about expectations.

The RBI is scheduled to hold its monetary policy review on tomorrow and its RBI Governor's last policy meet. Here's what is market expert Abnish Kumar Sudhanshu, (Director & Research Head, Amrapali Aadya Trading & Investments Pvt Ltd) has to say about expectations.

“Against the RBI inflation target of 5% for march 2017, CPI has been soaring from 5.3% to 5.7% in Q2 CY16 for the third consecutive months, hence we believe the upcoming RBI policy to remain more focused in taming rising inflation rather than growth. Moreover, we expect the RBI to keep rates unchanged and leaving it to his successor to decide if inflation is subsiding enough after the monsoon to take decision on rate cut. Going ahead, we believe above-average level monsoon to drive the agricultural sector, hence increasing the farm output and rural income, which in-turn would help in cooling the food prices along with giving the boost to economic growth. However, up a recent seventh pay commission to central government employees are likely to disburse in the current to next month only, are likely to encourage demand and drive inflation higher. Eventually, we are unlikely to expect inflation to cool off in the near term. Additionally, IIP data are due on Friday along with CPI data, is also not expected to be encouraging on the back of sluggishness in economic activities. Therefore, we are likely to witness some pressure on the market for the short term.”

By Abnish Kumar Sudhanshu, (Director & Research Head, Amrapali Aadya Trading & Investments Pvt Ltd)