Markets likely to fall further

Weakness in global markets and profit booking at crucial resistance levels pushed markets back into red The huge fall in IT shares also dragged them down BSE Sensex fell 476 points or 13 per cent and Nifty was down by 155 points or 15 per cent last week The midcap index fell by 08 per cent and smallcap index down by 1 per cent

Weakness in global markets and profit booking at crucial resistance levels pushed markets back into red. The huge fall in IT shares also dragged them down. BSE Sensex fell 476 points or 1.3 per cent and Nifty was down by 155 points or 1.5 per cent last week. The midcap index fell by 0.8 per cent and smallcap index down by 1 per cent.

The rupee appreciation against the dollar and crude oil declining to 13-month lows had not made any positive impact on Indian markets. As there are no major trigger points for the markets and expiry is nearing, markets may witness seesaw moments next week. The elections in five states are just two weeks away and any adverse results against the BJP may dampen the market sentiment. Generally, the markets will sense the outcome of the election early. But market may take a decisive move after the November derivative series closes

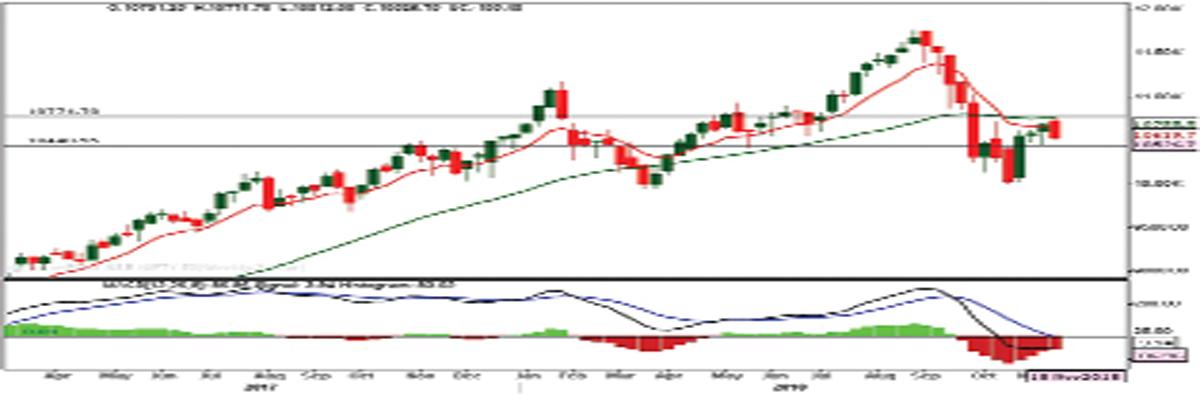

The three-week long upward trend seems to be ended on November 19 at 10775. Nifty lost 1.5 per cent from Monday's top. With this fall, the chart looks reasonably bearish and made a bearish engulfing on a weekly chart. The last week's Hanging man and engulfed with current weeks big bear candle.

As I mentioned earlier, as result of death cross, the Nifty is poised to fall further. By trading below the long-term average 200 DMA and medium-term average 50 DMA, stock market is in bearish mode. The curvature of these moving average is turning down which is a clear bearish nature. If anyone having a short position in the market, the strict stop loss could be the 200 DMA i.e., 10745.

The short-term supports are placed at 10482-10440. If this zone also breached, there are chances to test the recent lows. The technical structure is weak and derivative settlement is four days away. So, it is very difficult to move above the resistance levels. Expect further consolidation in the market between 10400-10700 zone for next week. A close below 10400 means more bearish move will take place. Take care of long positions.