Bureaucrats should also think out of the box at times!

In 1975, I was posted as The Deputy Commissioner (Commercial Taxes) of the Kurnool Division (comprising Kurnool and Anantapur Districts) of Andhra Pradesh state.

Work ‘on’ the system instead of merely ‘in it’

In 1975, I was posted as The Deputy Commissioner (Commercial Taxes) of the Kurnool Division (comprising Kurnool and Anantapur Districts) of Andhra Pradesh state.

Sales Tax is tax levied on transaction relating to the sale or purchase of goods or services. Entrainment Tax is levied on a per person basis on the organizers (exhibitors) of movies, plays, circuses, amusement parks etc. There was no provision originally enabling the department to make an “assessment” in cases of suspicion of evasion of entertainment tax, all though such a provision was available in respect to sales tax.

A provision empowering the department to make such assessment was brought in 1974. There was still no provision for making the “best judgment” and, therefore, to raise a demand in respect or suppressed transactions and asses/collect the revenue thereupon. Thus, tax once lost on the passage of the event could neither be levied nor collected subsequently.

Typically the revenue from ET is ploughed back from the State’s exchequer to the coffers of local bodies such as Urban Local Bodies or Panchyati Raj Institutions.

In respect of movies the rights of distribution are usually acquired for a price from the producer by the distributors for different parts of the state of country and then sold again to individual exhibitors in cities, towns and villages. Evasion of ET was known to be of a very high order.

The exhibitors used to put forth many reasons - including power failure, projector or malfunction, stoppage of the show on account of rain (in temporary structures such as tents – common in those days), the failure of rail or bus transport to deliver the film reels etc., in order to suppress the attendance and therefore, the tax payable. Often, entry tickets with seal of the CT department were not sold and cash collected in lieu thereof, with a view to declaring a lower figure of gross income to the CT department.

In order to appreciate the magnitude and spread of evasion of ET, I under took to organize a series of continuous inspections of theaters in the division. The assistance of both the District Collectors was enlisted to request all touring officers across all Departments to incorporate a visit to a theater in their tours and fill up a small cheque memo created by the CT department.

The information collected, after being collated, suggested a high order of evasion and a huge gap between the known expenditure (power consumption, salaries, carbons use in the projector, maintenance of the premises, salaries etc.) and their declined incomes in effect most theaters reported a negative income and paid no tax.

All the distributors pertaining to Kurnool division had their offices at Guntakal town. I organized a simultaneous raid of all their 17 premises. When the collection particulars brought in from the raids were cross-verified with reported figures from the theatres, it was possible to compute the hypothetical loss of ET on the basis of assumption that no theater would run below break-even point. Notices were then issued to the exhibitors demanding payment of the tax “loss”.

Clearly these notices were based on an assumption which, unlike in the case of ST, was without legal sanctity or legitimacy. Naturally the act was received with bitter resentment and anger and no compliance thereon followed. In order to precipitate matters I carried the operation to its logical conclusion and on the expiry of the date prescribed for the payment of the tax, ordered the inspection and closure of theaters in Guntakal of peak show time following the discovery of a minor violation of the conditions of the exhibitor’s license (as the non-payment of the tax demanded could not be a legitimate ground for such action).

In short my action was only marginally less than high handed all though inspired by conviction based on the principles of natural justice. All the exhibitors spontaneously declared an independent “strike” and all theaters in both districts were shut down abruptly. The impasse lasted for over fifty (50) days across more than one hundred and fifty (150) theaters.

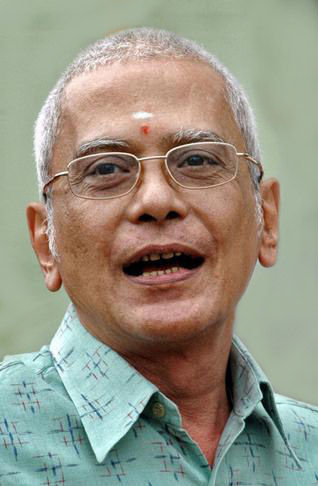

Following a representation made by the exhibitors, the state government deputed Sri A. Krishna Swamy, IAS, First Member (as the office was then known) of the Board of Revenue (also the Commissioner, CT) to inquire into the matter. CCT gave exhibitors a patient hearing.

He concluded by telling them that since the service offered by them was not like that extended by a hospital or a school, and also as their activity was not in the nature of running a public utility such as the supply of drinking water or power, it was an entirely up to them to decide whether or not to run their theaters and he returned to Hyderabad (state headquarters).

When nothing was heard of for some time and, compelled by commercial considerations, the exhibitors commenced running of the theaters. As a matter of fact, the ET law was there after amended with retrospective effect introducing a new provision for “best judgment assessment!”

This was subsequently followed by another policy reform by way of introducing the “slab” system where levy of entertainment tax in theater was fixed not on the per capita or entry basis but on the basis of the classification of the theater in accordance with parameters including, among others, the population of the city, town or village.

What had originally started out as a curiosity driven study spurred on by suspicion went viral, assumed critical mass and ended in an amendment of the law impacting a fundamental aspect of the levy and collection of Entertainment Tax.