Live

- Heavy rains cause disruptions in Tirumala and Tirupati

- Former Soldier Builds Temple for Rajinikanth, Installs New Idol on Superstar’s 74th Birthday

- Mohan Babu’s Daughter Manchu Lakshmi's Viral Post Sparks Controversy Amid Family Disputes

- NIST hosts alumni meet

- Upcoming Telugu OTT Releases: A Treat for Telugu Cinema Lovers in December

- Vedamrit Honey’ launched

- Arjun Das Brings Mufasa to Life in Tamil

- Odisha move to prepare maritime perspective plan

- Jal Jeevan Mission empowering women in rural areas: PM Modi

- Pradhan urges Nadda to set up pharmacy unit in Odisha

Just In

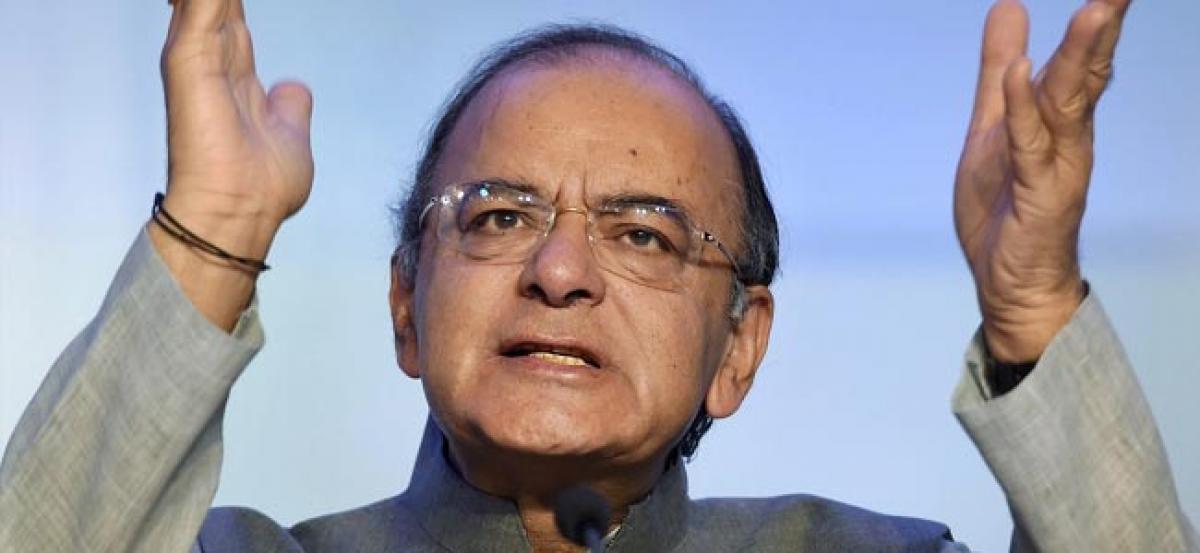

Allaying apprehension of spike in prices of goods and commodities after the roll out of the GST, Finance Minister Arun Jaitley on Wednesday said the tax rates will be kept at the current levels so as not to have any inflationary impact.

New Delhi: Allaying apprehension of spike in prices of goods and commodities after the roll out of the GST, Finance Minister Arun Jaitley on Wednesday said the tax rates will be kept at the current levels so as not to have any inflationary impact.

Introducing four bills to give effect to the Goods and Services Tax (GST), Jaitley said the legislations will have to be passed by Parliament and one by each of the state assemblies to turn India into one market with a single tax rate.

The Finance Minister said the aim of the GST Council is to decide everything relating to the tax structure with consensus and this is for the first time that such an arrangement has been made, based on the principle of shared sovereignty of both the Centre and the state governments.

“These are revolutionary bills which will benefit all. …States have pooled in their sovereignty into the GST council, and Centre has done the same,” he said.

Prime Minister Narendra Modi and several senior members of the Union Cabinet were present in the House when the four bills were taken up for consideration and passage.

The bills are the Central Goods and Services Tax Bill, 2017, the Integrated Goods and Services Tax Bill, 2017, the Goods and Services Tax (Compensation to States) Bill, 2017 and the Union Territory Goods and Services Tax Bill, 2017.

Explaining the bills, he said the Central GST or CGST will give powers to the Centre to levy tax after levies of excise, service tax and additional customs duty is subsumed.

The Integrated GST or IGST will be a tax to be levied by the Centre on inter-state movement of goods and services.

The States will pass the State GST or SGST law that will allow them to levy sales tax after levies like VAT are subsumed.

Besides, GST compensation law allows for imposition of cess on certain luxury goods like tobacco, high-end cars and aereated drinks to create a corpus for compensating states for any loss of revenue in the first five years of GST roll out.

The fourth law introduced is on Union Territory GST or UTGST for UTs like Chandigarh and Daman and Diu which do not have assemblies.

Jaitley said all decisions on GST would be taken by the GST Council, reflecting the federal structure.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com