GST shocker to middle class

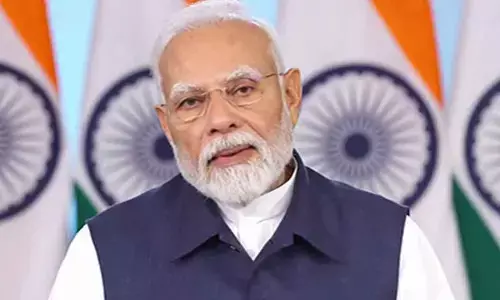

Ramana Murthy, a middle-aged private employee, watched in awe as the Narendra Modi government took wraps off the Goods & Services Tax (GST) at a glittering event in the historic Central Hall of Parliament in New Delhi at the stroke of midnight on Friday.

From small cars to cosmetics, all goods & services turn costlier for them

Hyderabad: Ramana Murthy, a middle-aged private employee, watched in awe as the Narendra Modi government took wraps off the Goods & Services Tax (GST) at a glittering event in the historic Central Hall of Parliament in New Delhi at the stroke of midnight on Friday.

As scores of his fellow citizens across India, he too believed that GST, touted by many as the game changer, would change the fortunes of the country and with it, his fate for better.

As new tax era dawn on Saturday (GST came into force on July 1), Murthy, a middle class family man, began to realise how this new indirect regime would be pricking a hole into his not-so-enticing salary.

The first shocker dawned on him as he brushed his teeth: He should use the current brush longer as a new one will cost him more. As he moved to bathroom to enjoy his shower, he was reminded of higher tax on shampoos under GST. For him, breakfast tasted bitter thanks to more tax on packaged idli and dosa flour.

But unfortunately, his worries have not ended there. Now, he will have to shell out more for buying a small car, new television, refrigerator, mobile phone, note books for his school-going children and what not.

His family’s visit to any restaurant will make a bigger hole in his monthly budget now. So is also any visit to cinema hall, the middle-class Indian’s biggest entertainment spot. Financial services such as cash withdrawals from ATMs will be expensive.

Welcome to the new world of GST that will take a heavy toll on the measly budget of a middle-class Indian while the rich and wealthy pay far less for luxury cars and swanky sports utility vehicles (SUVs).

Under the new tax regime, small cars will attract a tax rate of up to 31 per cent against 28 per cent now while luxury cars will be taxed at 43 per cent against 55 per cent earlier. Eating out will be expensive now as tax at AC restaurants will go up to 18 per cent from 14 per cent in the past.

The tax increase is far higher in the case of non-AC restaurants. Services at these places will attract 12 per cent GST as compared to five per cent under valued added tax (VAT) regime. Insurance premiums will cost more now as service tax will increase to 18 per cent from 15 now.

Transaction fee on banking and financial services is expected to go up as service tax on them has been increased to 18 per cent from 15 per cent now. Taxes on textiles have also gone up from zero to five per cent. Therefore, middle class Indians are going to bear the brunt of new tax regime.