Consumer biz fuels RIL’s Q1 net to record high

Net profit for June qtr rose 78.3% on q-o-q to `26,994cr

New Delhi: India’s most valuable company Reliance Industries (RIL) on Friday reported its highest-ever quarterly profit of Rs26,994 crore for the April-June quarter, reflecting a growth of 78.3 per cent over the year-ago period, driven by a bumper showing of consumer businesses. The oil-to-retail-to-telecom conglomerate’s consolidated net profit attributable to owners of the company stood at Rs26,994 crore or Rs19.95 per share, in April-June 2025 compared to Rs15,138 crore earnings in the year-ago period, according to an exchange filing.

The net profit was also 39 per cent higher quarter-on-quarter when compared to Rs19,407 crore earnings in the preceding three months ended on March 31.

RIL Chairman and Managing Director, MukeshAmbani said that Reliance has begun FY26 with a robust, all-round operational and financial performance.

“Consolidated EBITDA for the first quarter of FY26 improved strongly from a year-ago period, despite significant volatility in global macros. During the quarter, energy markets encountered heightened uncertainty, with sharp fluctuations in crude prices. Our O2C business delivered strong growth, with thrust on domestic demand fulfillment and offering value-added solutions through the Jio-bp network. Performance was supported by improvement in fuel and downstream product margins,” Ambani said.

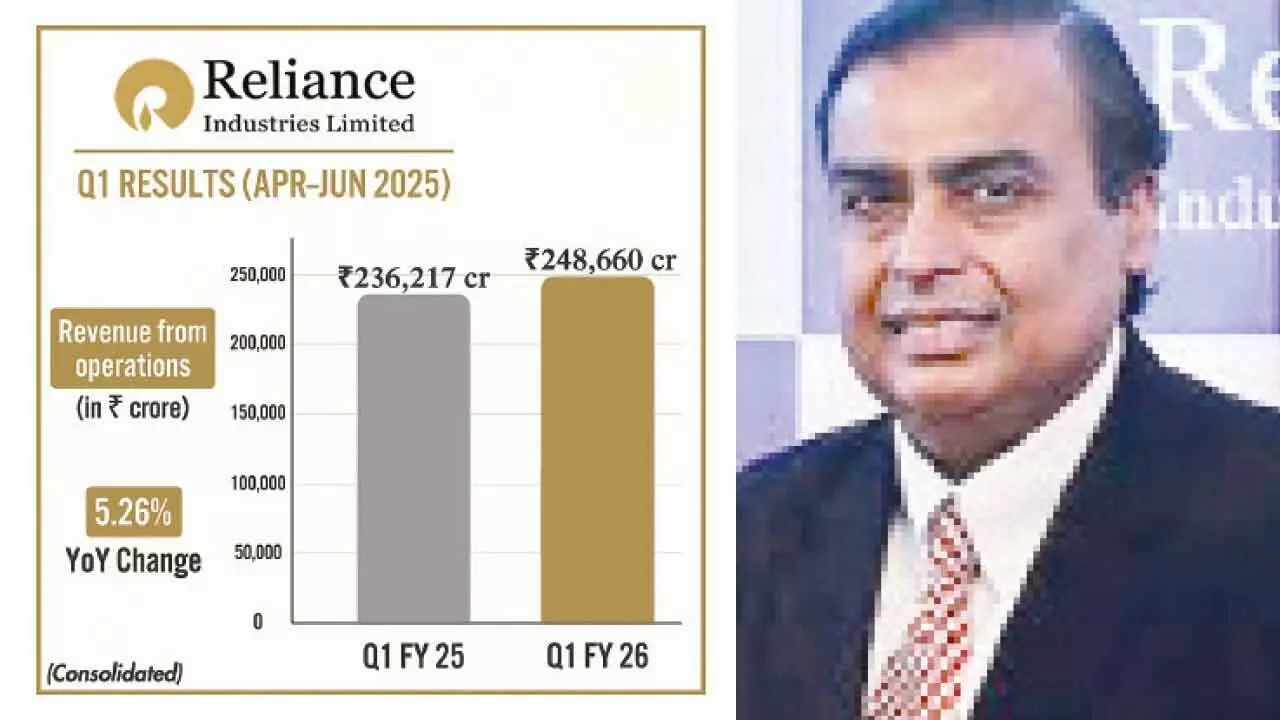

The firm helmed by billionaire MukeshAmbani continued to post an uptick in consumer businesses -- retail and telecom. While Jio was helped by a rise in consumer base, the retail business delivered steady performance due to an increase in footfalls at its expanded store network. Revenue from operations was up by 5.26 per cent to Rs2.48 lakh crore in the first quarter of 2025-26 compared to Rs2.36 lakh crore in the year-ago period.

The mainstay oil refining and petrochemicals business, called O2C, posted a 1.5 per cent decline Y-o-Y due to a fall in crude oil prices and lower volumes on account of the planned shutdown. Segment revenues were supported by increased domestic placement of transportation fuels through Jio-bp, a company statement said.