Craftsman Automation IPO: Opens today; find key details before subscribing

Craftsman Automation IPO: Opens today; find key details before subscribing

Craftsman Automation, an automobile component manufacturer, will open its Rs 824-crore initial public offering (IPO) for subscription on Monday, March 15, 2021.

Craftsman Automation, an automobile component manufacturer, will open its Rs 824-crore initial public offering (IPO) for subscription on Monday, March 15, 2021. The price band has been fixed at Rs 1,488-1,490 apiece. The IPO closes on March 17, 2021.

The minimum bid lot is of 10 equity shares and in multiples thereof. The minimum application size will be Rs 14,900 at the higher price band. Also, 50 per cent of the issue is reserved for qualified institutional buyers, 15 per cent for non-institutional investors and the remaining 35 per cent is reserved for retail investors. All bidders, other than anchor investors, are required to participate only through an application supported by a blocked amount (ASBA) process.

The initial public offering comprises a fresh issue of shares worth Rs 150 crore, and an offer-for-sale of up to 45 lakh equity shares by promoters and existing investors. Promoter Srinivasan Ravi is going to offload 1,30,640 equity shares through the offer for sale. Among investors, 15,59,260 equity shares will be offered by Marina III (Singapore) PTE, 14,14,050 by International Finance Corporation (IFC) and 14,17,500 by K Gomatheswaran.

Axis Capital and IIFL Securities are the lead managers to the issue. The equity shares will get listed on the BSE as well as National Stock Exchange.

The company will utilise fresh issue proceeds for repaying certain borrowings to the extent of Rs 120 crore, while the funds from the offer for sale will go to the selling shareholders— the promoter and investors.

Besides, Craftsman Automation on Friday raised a little over Rs 247 crore from anchor investors ahead of its initial share-sale. The company's IPO committee in consultation with merchant bankers has decided to allocate a total of 16.58 lakh shares at Rs 1,490 to 21 anchor investors, aggregating to Rs 247.10 crore. The anchor investors include HSBC Global Investment Funds, Tata Mutual Fund (MF), Aditya Birla Sunlife MF, The Nomura Trust and Banking Co Ltd, Max Life Insurance Co Ltd and Integrated Core Strategies Asia Pte Ltd among others.

About Craftsman Automation

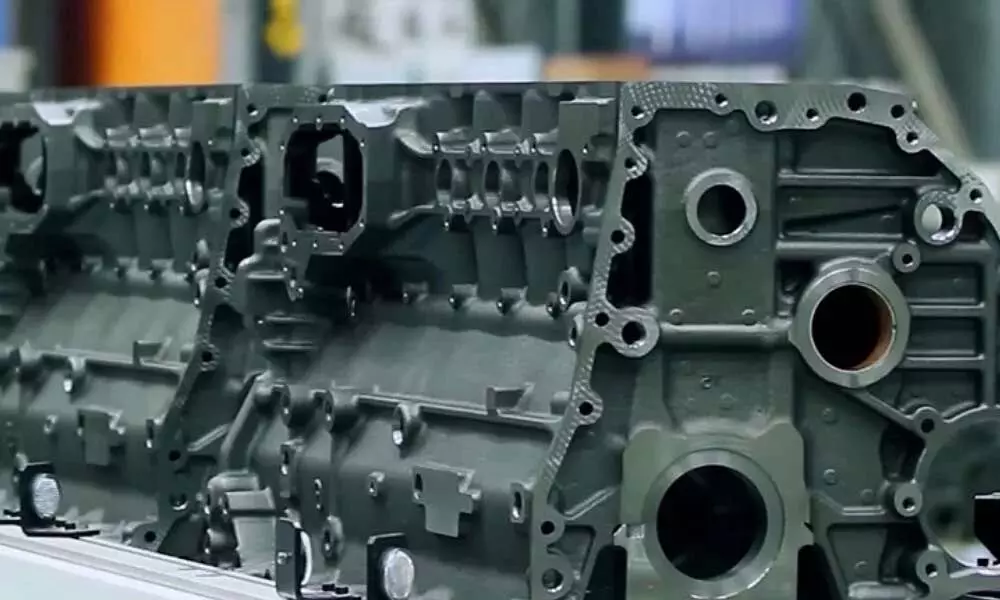

Established in 1986 in Coimbatore, Craftsman Automation is a diversified engineering company with vertically integrated manufacturing capabilities. It is engaged in three segments and they are powertrain and other products for the automotive segment, Aluminium products for the automotive segment and industrial and engineering products segment. It is the largest player in the machining of cylinder blocks and cylinder heads in the intermediate, medium and heavy commercial vehicles segment as well as in the construction equipment industry in India.

Headquartered in Coimbatore, the company has satellite units across India namely Pune, Faridabad, Pithampur, Jamshedpur, Bengaluru, Sriperumbudur and Chennai.