Defence industry’s upward trajectory stems from focus on indigenisation

India hopes to be a global defence manufacturing hub, driven by DPSUs, private enterprises and MSMEs

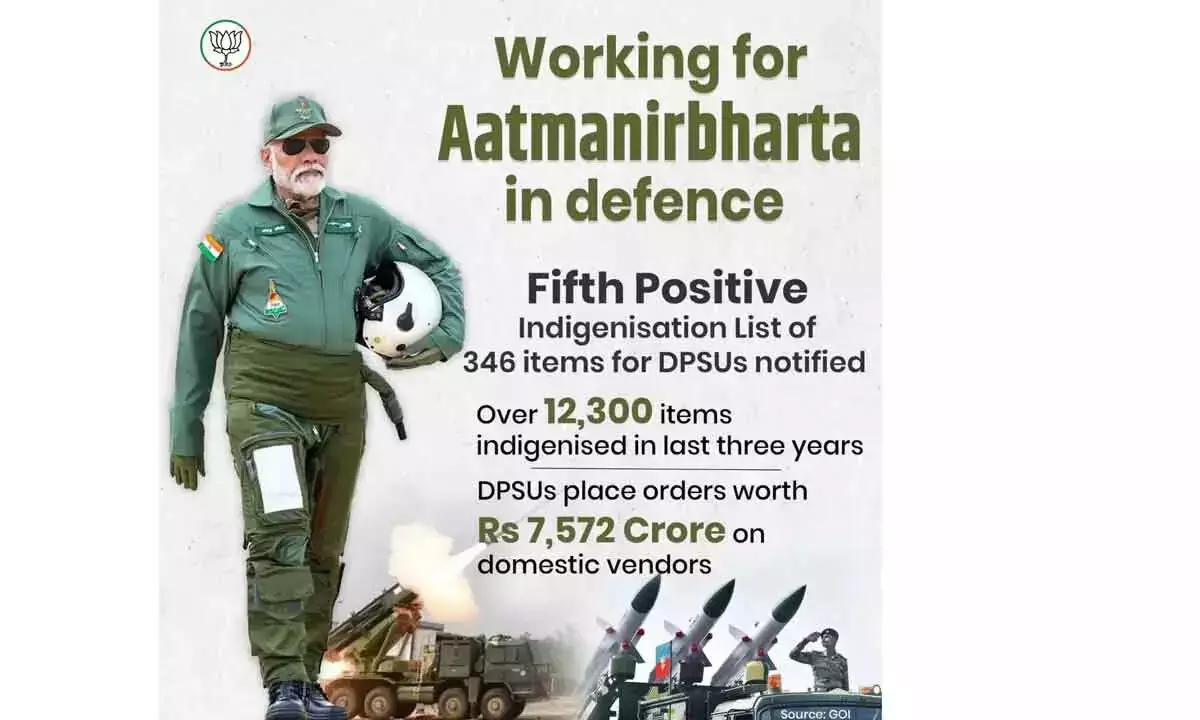

The Ministry of Defence has achieved its highest-ever growth in indigenous defence production in value terms during the Financial Year (FY) 2023-24, on the back of successful implementation of several policies and initiatives of the Union Government, focusing on achieving ‘Aatmanirbharta’.

As per data received from all Defence Public Sector undertakings (DPSUs), other PSUs manufacturing defence items and private companies, the value of defence production has gone up to a record-high figure at Rs. 1,26,887 crore, reflecting a growth of 16.7 per cent over the defence production of the previous financial year, which in FY 2022-23 was valued at Rs. 1,08,684 crore. The defence exports have surged from Rs. 15 billion in 2017 to Rs. 210 billion in 2024, growing at a CAGR of 46 per cent. The country is striving to emerge as a global defence manufacturing hub, driven by DPSUs, private enterprises and MSMEs. With a defense budget allocation of $72.2 billion for 2023-24, reflecting a 13 per cent increase from the previous year, the report underscores the country’s commitment to modernising its armed services and achieving self-reliance in manufacturing. A key focus of the report is the remarkable surge in exports, which have grown by 334 per cent over the past five years.

The government’s strategic policies like the Defence Acquisition Procedure (DAP) 2020 and the Defence Production and Export Promotion Policy (DPEPP) 2020, aim to boost domestic production and reduce dependence on imports. The report also highlights the top defence stocks in India, offering insights into companies like Hindustan Aeronautics Limited, Bharat Electronics Ltd, and Paras Defence and Space Technologies Ltd., which are piloting the growth charge. The most recent data from the Ministry of Defence reveals that in 2023-2024, defence exports reached a record Rs. 21,083 crore, marking a 32.5 per cent increase from the previous fiscal.

India’s defence exports have surged more than 30 times in the past 10 years, with the ongoing Russia-Ukraine war and the Israel-Hamas conflict giving a fillip to more growth as several countries look at beefing up their arsenal. The country’s growing defence industry now supplies to over 90 countries globally, with the government actively pushing easier licensing systems and approvals and shedding its reservations when it comes to supplying lethal arms.

Government sources said that while defence exports have increased, the real impact of the new policies and steps undertaken will be felt in the coming years. They said another big-ticket item that India is offering to countries is the ability to manufacture and supply fast patrol vessels, among others.

“A defence ecosystem is taking shape. You will see the results in the coming years. We are also making our forces handhold the industry and desist from imports unless very important,” another source said. They said that these initiatives have led to setting up of a private assembly plant for military transport aircraft, the C-295, and one for commercial helicopters.

“These plants can eventually cater to global demand also. Along with a manufacturing base, the effort is to establish India as an MRO (Maintenance, Repair and Overhaul) hub. All this is a work in progress,” the source said. Defence exports by state-owned and private sector companies include ammunition, small arms—including sniper rifles and specialised sight systems—bulletproof jackets and helmets, electronic items, armoured vehicles, lightweight torpedoes, simulators, drones and fast-attack vessels.

While Myanmar has traditionally been a big export destination—mainly fuses and ammunition—Israel and Armenia have also emerged as important buyers in recent years. Israel imports certain sight systems, small arms manufactured by its subsidiary here along with certain fuses and ammunition besides drone structures and parts.

While India has signed some big-ticket standalone deals, like the BrahMos contract with the Philippines and one for artillery guns and air defence systems with Armenia, the biggest importer of Indian defence goods is the US, which accounts for nearly 50 percent of the country’s total defence exports.

This is primarily because American companies now source over a billion dollars’ worth of systems, subsystems and parts from India annually to feed into their global supply chain network and as part of their offset commitments. “The idea is for India not just to emerge as a global manufacturing hub for complete defence systems but to be part of the global supply chains for big players,” said a source in the defence establishment.