FIIs liquidated longs in Index futures

The latest options data on NSE after the last Friday session is pointing to indecisiveness in the market as the resistance level moved up by 200 points to 20,000CE and the support level marginally eased by 100 points to 19,500PE

The latest options data on NSE after the last Friday session is pointing to indecisiveness in the market as the resistance level moved up by 200 points to 20,000CE and the support level marginally eased by 100 points to 19,500PE. The 20,000CE has the highest Call OI followed by 20,550/ 19,900/ 20,200/ 19,700/ 19,800/ 19,950/ 19,600 strikes. Further, 20,500/ 20,000/ 19,900/ 19,950/ 20,100/ 20,200/ 19,700 strikes.

Coming to the Put side, maximum Put OI is seen at 19,500 followed by 19,600/ 19,000/ 19,400/ 19,300/ 19,250 strikes, while 19,600/ 19,000/ 19,500/ 19,650/ 19,500/19,250 strikes recorded heavy Put OI build-up. Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “In the Nifty option market, the highest Call Open Interest was observed at 20,000 and 19,700 strikes, indicating potential resistance levels. Conversely, the highest Put Open Interest was recorded at 19,600 and 19,500 strikes, suggesting that these levels may act as significant support zones.”

Marginal OI closure in Nifty as long positions continue to unwind. Call options concentration remained significantly higher suggesting expectations of limited upsides in the near term.

“The market witnessed a relatively subdued performance in the past week. NSE Nifty closed flat, while the Bank Nifty experienced a marginal loss of 0.5 per cent. This suggests a cautious sentiment among investors, possibly driven by a combination of global uncertainties and domestic factors. Among the sectors, healthcare, energy and pharmaceuticals experienced declines, reflecting a shift away from defensive stocks. On the flip side, the IT, media and realty sectors showed noteworthy gains,” added Bisht.

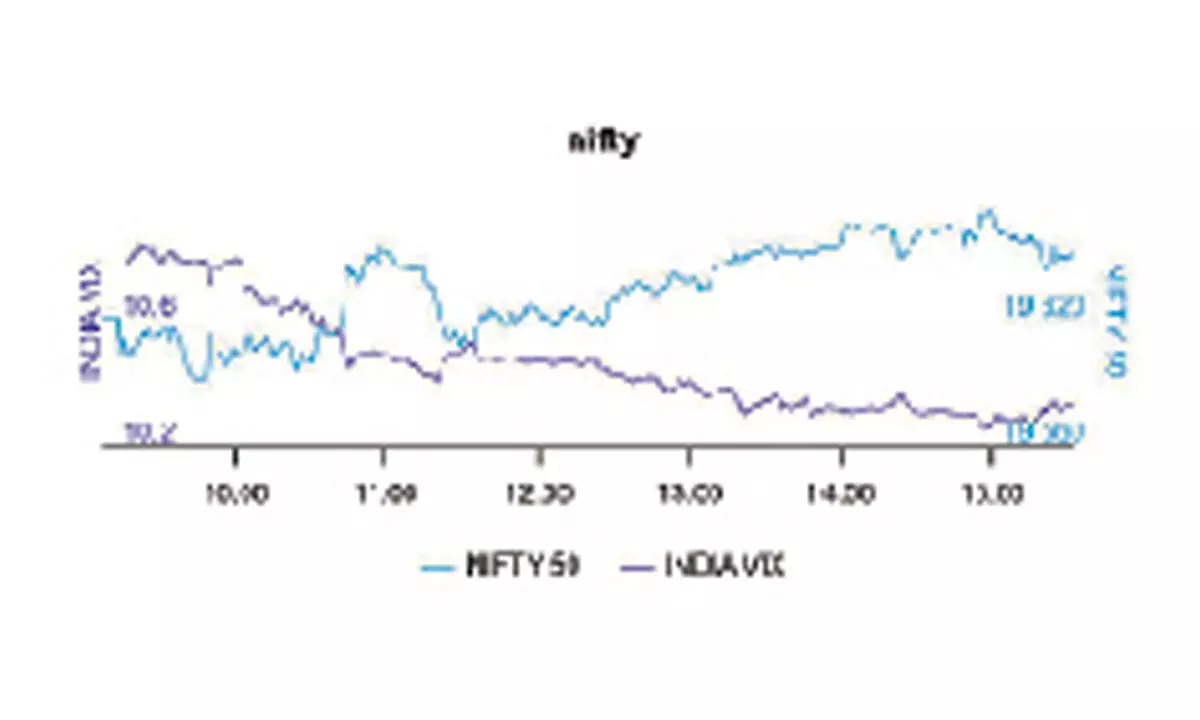

BSE Sensex closed the week ended October 6, 2023, at 65,995.63 points, a modest recovery of 167.22 points or 0.25 per cent, from the previous week’s (September 29) closing of 65,828.41 points. During the week, NSE Nifty too edged up by 15.20 points or 0.07 per cent to 19,653.50points from 19,638.30 points a week ago.

Bisht forecasts: “The market is currently at a critical juncture with a delicate balance between support and resistance levels. Traders and investors are advised to closely monitor the mentioned strike levels in both Nifty and Bank Nifty options, as they are likely to play a pivotal role in shaping market movements. In the upcoming week, Nifty is likely to trade in the range of 19,800 and 19,400 whereas either side breakout can give further momentum. However, uncertainties in the global economic landscape will continue to influence market sentiment.”

“In terms of Implied Volatility, Call options for Nifty settled at 10.04 per cent, while Put options concluded at 10.93 per cent. The Nifty VIX, which serves as a gauge of market volatility, closed the week at 10.94 per cent. The Put-Call Ratio of Open Interest stood at 1.31 for the week,” remarked Bisht.