NBBL unveils UPMS to simplify bill payments

NBBL unveils UPMS to simplify bill payments

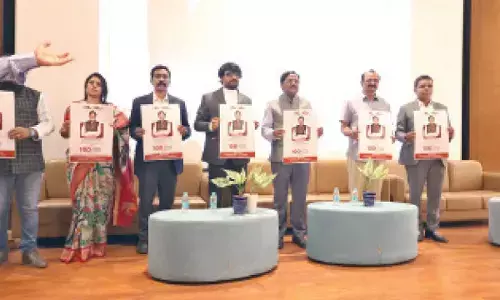

NPCI Bharat BillPay (NBBL), the wholly-owned subsidiary of National Payments Corporation of India (NPCI), has introduced the ‘Unified Presentment Management System’ (UPMS) to simplify bill payments in the country.

Hyderabad: NPCI Bharat BillPay (NBBL), the wholly-owned subsidiary of National Payments Corporation of India (NPCI), has introduced the 'Unified Presentment Management System' (UPMS) to simplify bill payments in the country.

NBBL through UPMS will enable the customers to set up standing instructions – from any channel and for any mode on their recurring bill payments. The bills will be automatically fetched from the billers and presented to customers for their action, in terms of auto-debit and bill payment management, NPCI said in a statement.

With the UPMS launch, the intent is to enable all the Bharat BillPay Operating Units (BBPOU) to extend this facility to their customers/corporate clients with minimal effort through the centralized infrastructure and application support provided by Bharat BillPay Central Unit (BBPCU). UPMS will help in democratizing recurring bill payments and making them further convenient for customers, the statement added.

According to NPCI, the UPMS provides a great opportunity for the service providers and fintechs of the digital payments ecosystem to run through this innovative feature in the sandbox environment of BBPS. Several Operating Units (OUs) and Technical Service Providers (TSPs) are actively coming forward in the rapid deployment of UPMS.

Noopur Chaturvedi, CEO, NPCI Bharat BillPay Ltd said: "The UPMS will add enhanced convenience in the bill viewing as well as payment experience for the customers as it will help them seamlessly create auto-mandates for their upcoming bills. For billers, UPMS eases the operational management of collections while reducing the infrastructure overheads on their systems that come during billing cycles.