Nifty forms 4 lower lows

Avoid aggressive position size; Watch the earnings and corporate announcements

The Benchmark index Nifty declined for the third consecutive week. NSE Nifty declined by 0.4 per cent, and the BSE Sensex went down by 0.2 per cent. The broader indices, Nifty Midcap-100, are down by one per cent, and the Smallcap-100 is up by 04 per cent. On the sectoral front. Bank Nifty is up by 1.8 per cent, and FinNifty is up by 1.3 per cent. On the flip side, Nifty Metal was down by 1.8 per cent, and FMCG declined by 1.7 per cent. The market breadth was negative for the week. The FIIs sold aggressively this week also. They sold Rs80,217.90 crore worth of equities in just 13 trading sessions in this month. The DIIs bought Rs74,176.20 crore.

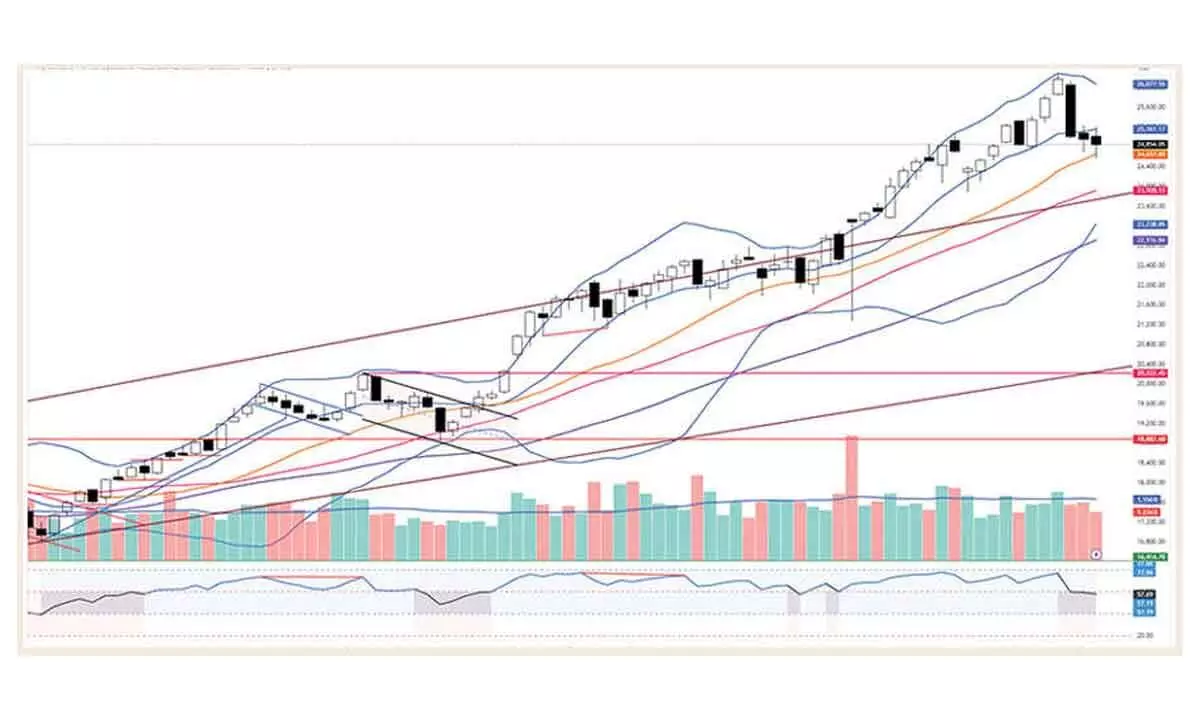

Nifty formed long shadow candles for the last two weeks, which shows an increased volatility within the range. The volumes were lowest in the last six weeks. During the week, the index has registered two distribution days. It formed four lower lows last week. The index has formed a lower swing high and two lower swing lows. This is the first sign of a strong uptrend entered into a downtrend. The index has tested the 20-week average, as we expected earlier. It has also come closer to the 100DMA (24,507). This level of support is very important for now. Earlier, the 100DMA acted as support for several times. The weekly Bollinger bands began the contraction, which is also a sign of the uptrend being halted and trade in the range for some time. The index failed to sustain above the 50DMA and closed one per cent below it by the end of the week.

The counter-trend consolidation ended at a 23.6 per cent retracement level. Normally, the 23.6 per cent and 38.2 per cent retracement levels are the maximum limits for the consolidation or continuation patterns. As the Nifty recovered with high volume on Friday, any further rally must not extend above the 50DMA of 25,105 points. As long as it trades below this level, the consolidation will continue. On the upside, this will be a strong resistance. Last week, the index broke the two strong bearish patterns. First, it broke the bearish pennant pattern on Wednesday. Secondly, it broke the Head and Shoulders patterns on Thursday. These are the most bearish and reversal patterns. The pattern implications will be negative if the price moves above the right shoulder, i.e., 25,234. The pattern breakdown target is placed at 23,651. Before this, the index may take support at 24,255 and 24,500. All the bounces will attract the profit booking or fresh selling pressure. The 30-week average of 23,920 is also a crucial long-term support.

Relative Rotation Graphs (RRG) show that the Nifty IT, Pharma, Consumption, FMCG, and Services Sector indices are inside the leading quadrant.

The Energy, Commodities, PSE, Realty, Nifty Bank, Infrastructure, Metal, and PSU Bank indices are in the lagging quadrant, improving relative momentum against the broader market. For next week, the strategy must be rangebound. The Nifty may trade in the 25,100 – 24,500 zone. The BFSI sectors are looking good as they led the recovery on Friday. Watch the earnings and corporate announcements. Continue with a selective and stock-specific approach. Avoid aggressive position size.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)