Options data points to limited decline

The 23,000CE has the highest Call OI followed by 22,500/ 22,800/ 23,100/ 23,200/ 22,900/ 22,600/ 22,400 strikes, while 23,100/ 23,000/ 22,400/ 22,600/ 22,400 strikes recorded significant build-up of Call OI.

The 23,000CE has the highest Call OI followed by 22,500/ 22,800/ 23,100/ 23,200/ 22,900/ 22,600/ 22,400 strikes, while 23,100/ 23,000/ 22,400/ 22,600/ 22,400 strikes recorded significant build-up of Call OI.

Coming to the Put side, the maximum Put OI is seen at 22,000PE followed by 21,500/ 21,600/ 21,700/ 21,800/ 22,200/ 21,300/ 21,400 strikes. Further, 21,700/ 22,000/ 21,800 strikes witnessed reasonable addition of Put OI.

Nifty respected its Call base of 22,000 strike in the last weekly expiry, however, the benchmark index managed to close the week above this level. Analysts expect no major Call base is in place, while Put base rose to 22,000 strike itself. The options OI points to limited decline and it’s expected that upward move may continue towards 22,400 level.

Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “In the Nifty options segment, the highest Call Open Interest is held at 22,500 strike followed by 22,300 strike whereas on the Put side, significant Open Interest is at the 22,000 strike. For Bank Nifty, the highest Call Open Interest is at the 47,000 strike, while the highest Put Open Interest is at the 47,000 strike followed by 46,500 and 46,000 strike.”

“Nifty reached record highs last week, while Bank Nifty concluded the week with marginal gains. On the sectoral front, realty, consumer durable, and FMCG stocks outperformed in the previous week, whereas PSE, IT, along with oil & gas stocks underperformed,” remarked Bisht.

Nifty leverage was relatively lower in Feb series when compared to the January with continued unwinding seen from FIIs in their net shorts in Index futures positions.

BSE Sensex closed the week ended February 23, 2024, at 73,142.80 points, a net recovery of 716.16 points or 0.98 per cent, from the previous week’s (February 16) closing of 72,426.64 points. During the week, NSE Nifty also gained by 172 points or 0.78 per cent at 22,212.70 points from 22,040.70 points a week ago.

Bisht forecasts: “For the upcoming week, we expect markets to trade in a range-bound manner. However, bias is likely to support bullish moves with stock and sector-specific actions. Traders are advised to use these dips for creating fresh long positions.”

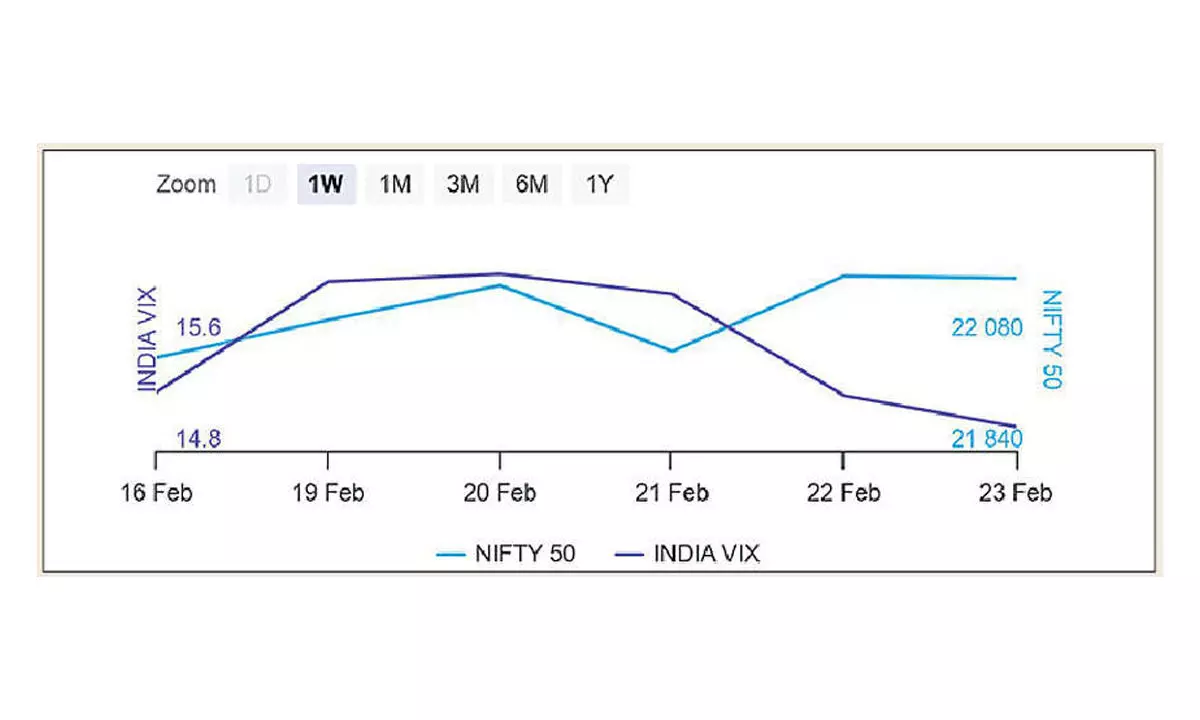

“Implied Volatility for Nifty’s Call options settled at 13.76 per cent, while Put options concluded at 14.03 per cent. The India VIX, a key indicator of market volatility, concluded the week at 15.2 per cent. The Put-Call Ratio of Open Interest (PCR OI) stood at 1.05 for the week indicating more Put writing than Call, which is a bullish sign,” added Bisht.

Analysts forecast short covering to continue with immediate support placed near 21,800 level.

India VIX fell 1.48 per cent to the 14.97 level. The volatility index cooled off marginally during the week, but still trading at a higher level above 15. Considering most of the events and the end of the result season, a further drop in volatility is expected.

Bank Nifty

NSE’s banking index closed the week at 46,811.75 points, up 426.90 points or 0.92 per cent from the previous week’s closing of 46,384.85 points.