RBI proposes to allow linking of credit cards to Unified Payments Interface

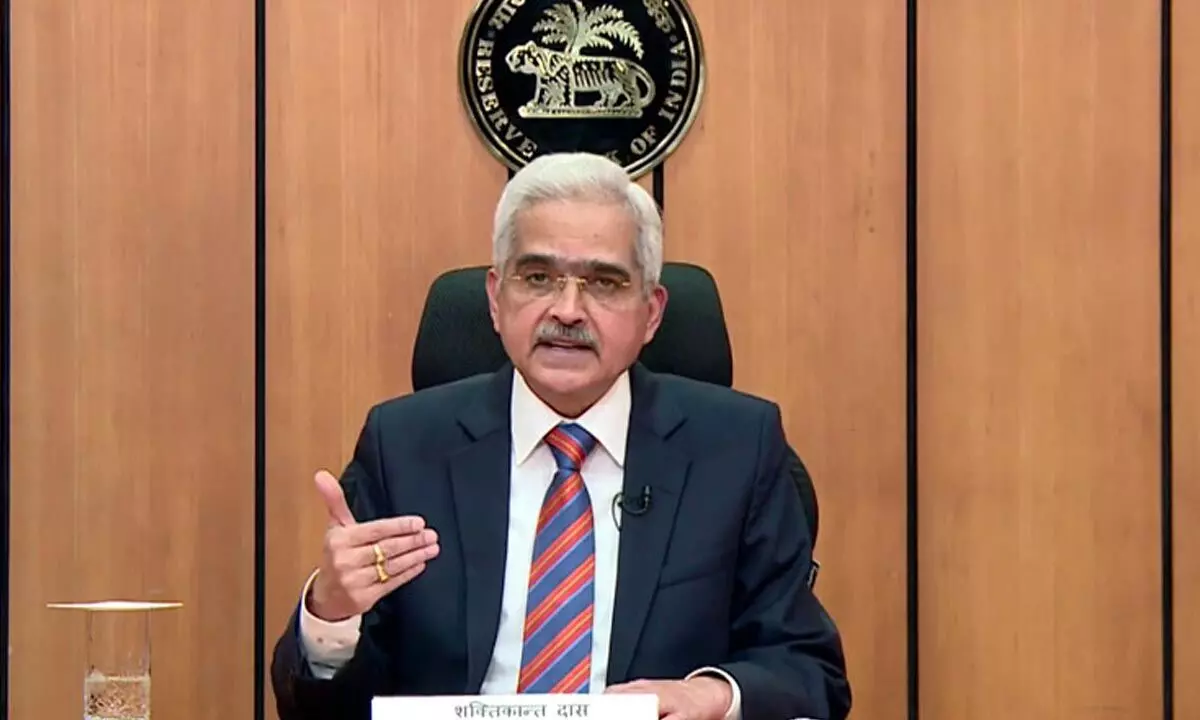

RBI Governor Shaktikanta Das

The Reserve Bank of India (RBI) today announced the outcome of the Monetary Policy Committee Meeting unanimously voted to hike the benchmark interest rate by 50 bps with immediate effect.

The Reserve Bank of India (RBI) today announced the outcome of the Monetary Policy Committee Meeting unanimously voted to hike the benchmark interest rate by 50 bps with immediate effect. With this decision, the repo rate has increased to 4.90 per cent.

During the announcement of the policy, the RBI Governor Shaktikanta Das also proposed to allow the linking of credit cards to the Unified Payments Interface (UPI). RBI said, the facility would initially be enabled for Rupay Credit Cards, that too after the required system development is complete.

It has been informed that UPI is the most inclusive mode of payment in India with over 26 crore unique users and five crore merchants onboard the platform. It added that 594.63 crore transactions amounting to Rs 10.40 lakh crore were processed through UPI in May 2022 alone.

The apex bank hopes that the linking of credit cards with UPI will provide more avenues and convenience to the customers in making payments. RBI said, the necessary instructions in this regard will be issued by the National Payments Corporation of India. It may be recalled that NPCI had developed UPI as an instant real-time payment system, facilitating inter-bank peer-to-peer and person-to-merchant transactions.

In another important announcement, the Reserve Bank has enhanced the limit for e-mandate based recurring payments from five thousand rupees to fifteen thousand rupees. In a statement issued today, RBI said, it has been receiving requests for stakeholders to increase the limit to facilitate payments of larger value like subscriptions, insurance premia, and education fees.

The apex bank informed that over 6.25 crore mandates have been registered under this framework to date. It added that the limit is being increased to further augment customer convenience and leverage the benefits like convenience, safety and security of payments.