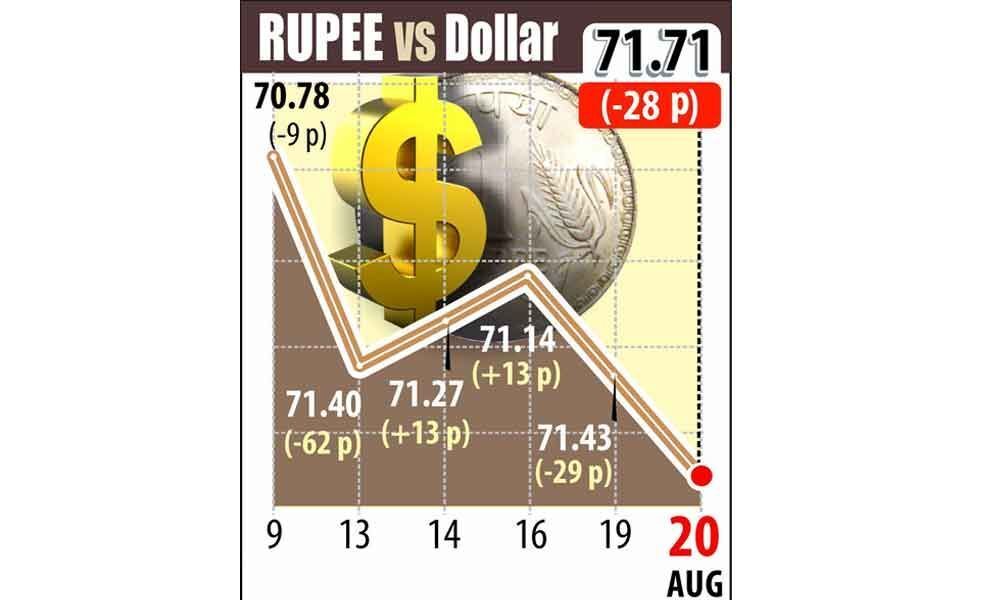

Rupee hits 6-month low of 71.71

Higher crude oil prices also had its impact on rupee's trading pattern

Mumbai: The Indian rupee on Tuesday furthered its loss by another 28 paise to close at a new six-month low of 71.71 against the US dollar as economic uncertainties continued to weigh.

Investors remained risk averse considering a host of factors including fast-spreading economic slowdown, outlook on foreign fund outflows and weakness in most emerging market currencies, according to forex traders.

However, there are expectations that the government will soon come out with stimulus measures to arrest slowdown in consumer demand in various sectors. Meanwhile, higher crude oil prices also had its impact on rupee's trading pattern.

Brent crude futures, the global oil benchmark, rose 0.07 per cent to trade at $59.78 per barrel. Starting off on a weaker note, the rupee fell to a day's low of 71.80 against the $ before settling at 71.71 against the $, down 28 paise over the previous close.

This is the lowest level for the local unit since February 4, when it closed at 71.80 a $. On Monday, the Indian rupee had settled at 71.43 against the US dollar.

Meanwhile, the dollar index -- which gauges the greenback's strength against a basket of six currencies -- rose 0.06 per cent to 98.40. The 10-year Indian government bond yield was steady at 6.58 per cent on Tuesday.

"Indian rupee declines for a second day as importers and foreign banks rush for the dollar amid recovery in crude oil prices.

Market is also expecting fund outflows of around $102 million on the back of Shell selling stake in Mahanagar gas," said V K Sharma, Head PCG & Capital Markets Strategy, HDFC Securities.

The dollar Index hovered near a three-week high as expectations of fresh stimulus drove an improvement appetite for riskier assets and lifted US government bond yields, he said, adding that the next support for the rupee is seen at 72.5 odd levels.

In equities market, the BSE Sensex settled 74.48 points, or 0.20 per cent, lower at 37,328.01; while the NSE Nifty ended 36.90 points, or 0.33 per cent, down at 11,017.

Foreign institutional investors (FIIs) bought equities worth Rs 373.23 crore on Tuesday, according to provisional exchange data.

Meanwhile, Financial Benchmark India Private Ltd (FBIL) set the reference rate for the rupee/$ at 71.3419 and for rupee/euro at 79.1386.

The reference rate for rupee/British pound was fixed at 86.8026 and for rupee/100 Japanese yen at 67.05.