Sebi seeks derivatives in calibrated manner

Exploring ways to deepen cash equities markets, while enhancing quality of derivatives through longer-tenure products

Mumbai: The markets regulator Sebi is looking to improve the tenure and maturity of equity derivatives products in a calibrated manner, its chairman Tuhin Kanta Pandey said on Thursday. He said that volumes in the cash market have grown rapidly, doubling in terms of daily traded volumes over a three-year period. “We will consult with stakeholders on ways to improve in a calibrated manner and the maturity profile of derivative products so that they better serve hedging and long-term investing,” Pandey said at the FICCI Capital Market Conference 2025.

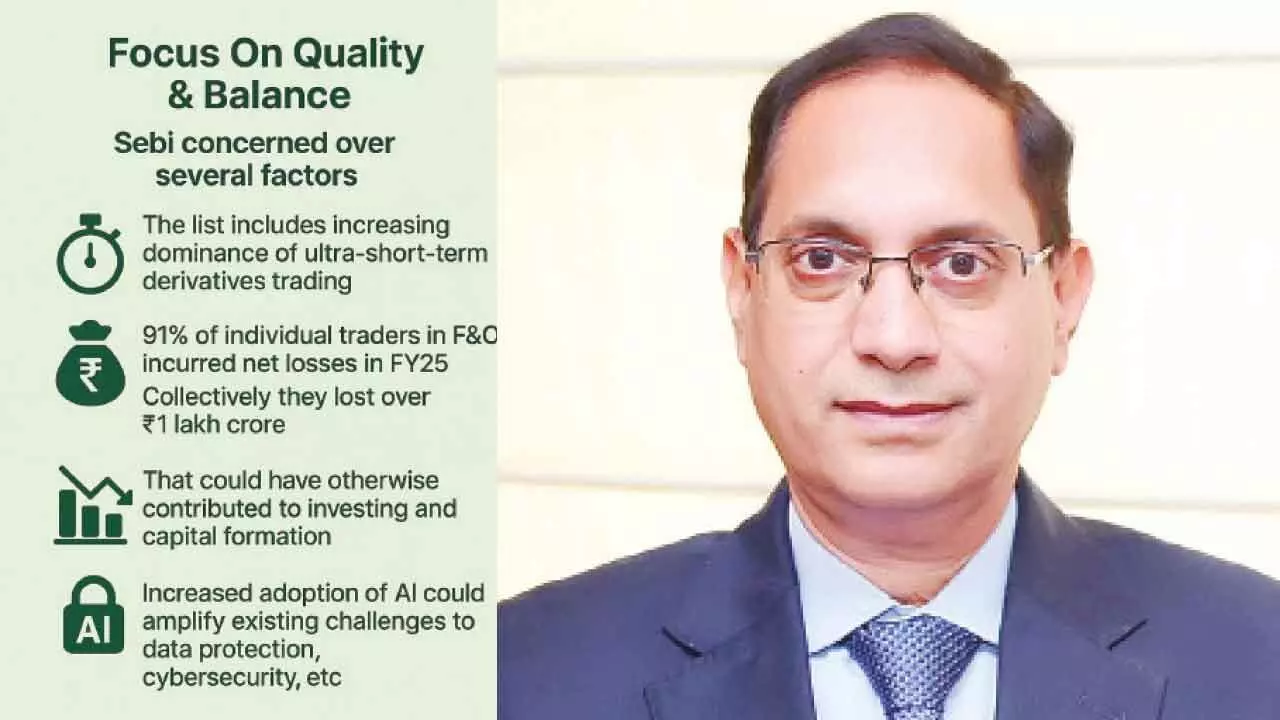

He emphasised that equity derivatives play a crucial role in capital formation, but the regulator needs to ensure quality and balance. The regulator is seeking ways to deepen cash equities markets, while enhancing the quality of derivatives through longer-tenure products. Last month, Sebi whole-time member Ananth Narayan expressed concern over the growing dominance of ultra-short-term derivatives trading and cautioned that such trends could undermine the health of India’s capital markets. Also, he contemplated steps to extend the tenure and maturity of these products. According to the market regulator’s own research, 91 per cent of individual traders in futures and options (F&O) incurred net losses in FY25, collectively losing over Rs1 lakh crore in funds that could have otherwise contributed to responsible investing.