Term Life Insurance emerges as crucial tool for family financial security

In an era marked by uncertainty, term life insurance emerges as a beacon of financial security for families. With its straightforward mechanism and wide eligibility, term insurance offers a lifeline to loved ones in the face of unexpected events. From providing crucial support in times of loss to ensuring continuity in lifestyle and aspirations, term insurance stands as a cornerstone of responsible financial planning. Delve into its intricacies and discover how term life insurance can be your family's shield in times of need

In today's unpredictable world, ensuring the financial stability of one's family in the face of unforeseen circumstances is paramount. Recognizing this need, term life insurance has emerged as a vital instrument for safeguarding the economic well-being of loved ones. As families increasingly seek avenues to protect their future, term insurance offers a robust solution, providing peace of mind and security in times of uncertainty.

Understanding the significance of term life insurance in securing one's family, individuals are exploring its intricacies and benefits. Term insurance acts as a safety net, offering a financial cushion to dependents in the event of the policyholder's demise. This critical support system comes in the form of a sum assured, or death benefit, which ensures the continuity of financial stability for beneficiaries during challenging times.

Exploring the workings of term insurance reveals its simplicity and effectiveness. Policyholders make regular premium payments to the insurance company over a specified period, known as the premium payment term. In return, the policy provides coverage for a predetermined duration, termed as the policy term. In the unfortunate event of the policyholder's death during this term, the insurer disburses the sum assured to the beneficiaries, thereby fulfilling its commitment to provide financial security.

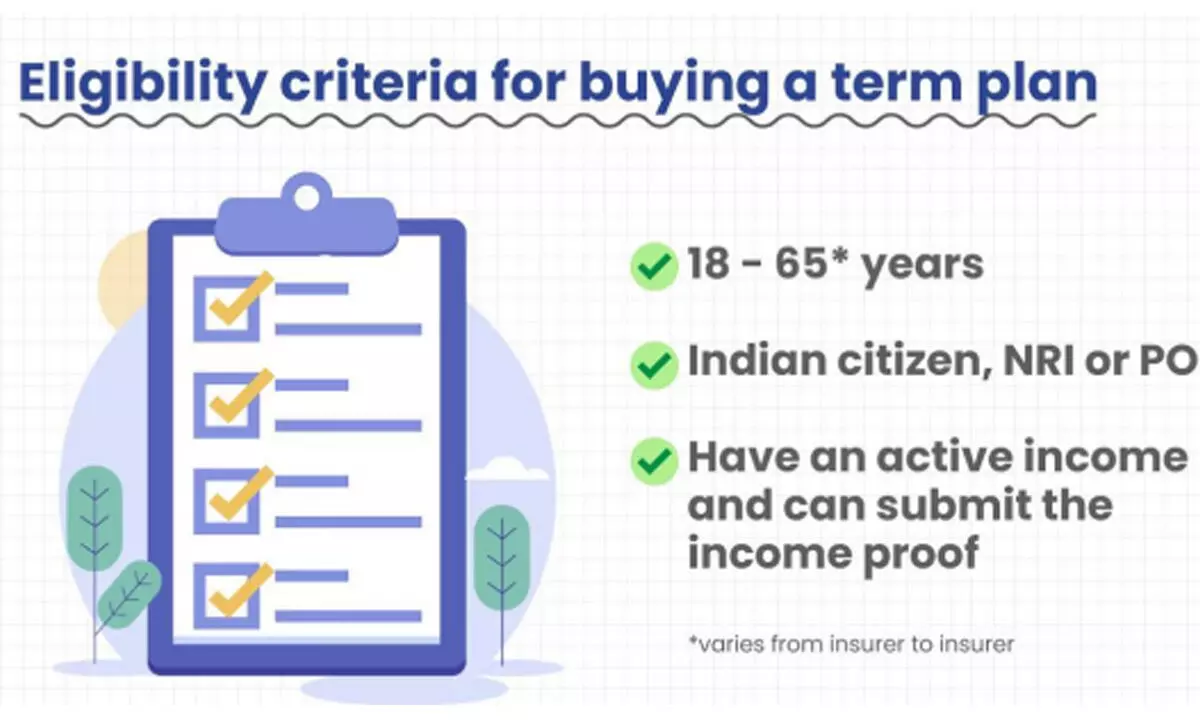

Delving deeper into term insurance eligibility criteria unveils the accessibility of this financial tool to a wide spectrum of individuals. Typically, individuals aged between 18 to 65 years, regardless of their occupation or residency status, are eligible to purchase term insurance plans. However, approval of the application is subject to various factors, including income, lifestyle habits, and health conditions. Smokers, for instance, may encounter higher premiums due to increased health risks.

The importance of term life insurance transcends mere financial prudence; it embodies a commitment to one's family's well-being. By proactively securing a term plan, individuals safeguard their loved ones from potential monetary hardships, ensuring continuity in their lifestyle and aspirations even in the absence of the breadwinner.

For those navigating the complexities of term insurance for the first time, access to comprehensive guides facilitates informed decision-making. By leveraging available resources and disclosing accurate information during the application process, individuals can streamline their journey towards securing their family's future with term life insurance.