Secure environment vital for investments

We live in an era of indices. The Human Development Index, of course, is a well-known one. And this columnist is preparing, a new Disaster Preparedness Index for the country, albeit on a pilot basis.

One index which should interest all of us is that which pertains to the Ease of Doing Business (EoDB) index in a country. That index, evolved by the World Bank, is a benchmark study of the regulation in place in a country in respect of industrial activity.

A nation's ranking in the index is based on the average of 10 sub-indices such as the time and cost (among other things) required to start a business, obtaining construction permits, getting an electricity connection etc. Incidentally, Singapore stands first in the global ranking followed by Hong Kong.

We must note, to begin with, EoDB and its use are not free from controversy and doubt. The index has many passionate critics and a number of devoted fans. Its objectivity has also often been called into question. Still, one must accept that, for what it is worth, it is a measure that reflects the extent to which a potential investor finds it easy or difficult to start and continue to run an industry in a given country.

Perturbed by the fact that India had a very poor ranking in the EoDB, the government of India, in 2014, launched an ambitious programme of regulatory reforms aimed at making it easier to do business in India. Thereafter many positive changes have taken place, including making it easier and quicker to get construction permits and obtaining electric connections.

Consequently, India's ranking has improved substantially and now stands at 63 among 190 countries. And even within India, of late, EoDB or conditions conducive for investments are being assessed in States and indices determiner for each State.

It is said that Alexander the Great, after completing his conquest of the world, approached his guru Diogenes and asked his mentor what he (Alexander) could give him in return for the wisdom and education imparted to him. The great teacher, in his reply, merely requested Alexander to move a bit as he was standing in the way of the sunshine! Somewhat similar was the advice this columnist received from his own mentor A Krishnaswamy more than five decades ago.

Upon being posted as the Collector of Guntur district (in the then Andhra Pradesh State), he went to Krishna Swamy and sought advice about how he was to conduct himself in that position. Krishna Swamy's reply was that every district needed a Collector and so did Guntur. So, the thing was just to "be" a Collector! His point was that civil servants primarily need to perform competently and effectively, the functions attached to the office to which they are posted.

While, undoubtedly, an incumbent can add to (or, on occasion, take away from) the efficacy and promptitude with such functions are performed, there is, by and large, not too much by way of extraordinary changes that is expected from a single person in a given period.

It was the same Krishna Swamy, who earlier when this columnist had been posted as a Deputy Commissioner of Commercial Taxes, (in the same State) had counselled him in a similar vein but, covering a slightly different context. The advice then was that, while it was undoubtedly one's duty to "catch" a businessman found to be infringing the law or evading a tax, it was quite unnecessary to treat him as a petty thief.

While fear needed to be put in the minds of erring businessmen, creation of panic was undesirable. It was they, after all, it was pointed out, who generated the activity from which taxes become due; and governments found it possible to provide things such as drinking water, housing, health and education.

These allusions have been used by way of introducing the reader of the column to the position in which India's industrialists or businessmen generally find themselves vis-a-vis the bureaucracy and the political leaders. The situation is not entirely dissimilar to that in which successful actors/actresses find themselves before and after they attain stardom, especially in the cinema field.

Initially, when the would-be actor is soliciting roles, it is he (or she) who is at the receiving end. Directors/producers rarely answer telephone calls, appointments not easy to get, auditions even more difficult, and, opportunities to exhibit one's talent almost impossible/difficult to come by. Once, a beginning is made, however, and the audiences approve the artistes' performance, well, the situation undergoes a literal transformation.

Now, as far as the directors/producers are concerned, the shoe begins to pinch on the other foot. It is they, who have now to run after the artiste, desperately seeking a few minutes' time to make a booking for an upcoming film, or to settle the fees et cetera.

Similarly, the governments, both at the Centre and in the States, mount extravagant campaigns, including investment summits, to woo investors and to introduce potential entrepreneurs to opportunities for attracting capital. Dozens of Memoranda of Understanding (MoUs) being signed, with much fanfare, about the total amount of investment expected to arise out of them and the employment to be generated. But when it comes to the crunch, the rate of conversion of MoUs into actual investment remains very poor on account of various reasons.

Foremost among such reasons, of course, is the fact that most of the enthusiasm shown by the government initially does not get reflected in the attitude of their administrations. Many hurdles, legal, administrative and cultural are placed in the way of the investors.

The Central and State governments must appreciate the importance of attracting private investment, both domestic and foreign, to spur the process of growth and development. The days of the commanding heights of the public sector having finally receded into the background, it is now essential that substantial incentives are offered and a positive and enabling environment created in which their activities can thrive and flourish.

Innovative arrangements such as "single window" clearances need to be put in place, and improved upon, in consultation with the potential investors. In the absence of such an aggressive policy for attracting investment, the country's reputation for being a bad place for investment will not only continue but perhaps substantially deteriorate in the years to come.

A disturbing feature that has emerged recently is that of a change in government, especially in some States, resulting in a violent change in the approach to industrial policy. Abruptly, and sometimes, arbitrarily, decisions taken by the previous regimes are completely reversed, taking by surprise the industrialists, as well as those who supported them financially.

And such changes are unfortunately driven largely by personal and political considerations. Large scale flight of capital away from such States is the inevitable consequence of such impulsive and irrational attitudes.

When all is said and done, the bottom line for the intending investor is the knowledge that the destination of their capital is free from strife and unrest. The existence of infrastructure such as housing, water, power, roads, schools and hospitals is no doubt an essential prerequisite to attract a person to a place.

However, the reassurance that everything is being done to maintain law and order, and to provide a secure environment is, obviously, a paramount consideration. Thus, governments will do well to attend to fundamental housekeeping duties such as the maintenance of law and order and control of crime before thinking in terms of incentives and the like.

Incidents such as the Nirbhaya incident in Delhi in 2012, the Disha episode that occurred in Hyderabad recently, or the gang rape of an old lady in East Godavari district of Andhra Pradesh yesterday, are bound to unsettle people intending to establish industries. Safety and security, in the ultimate analysis, are the sine qua non on for attracting investments.

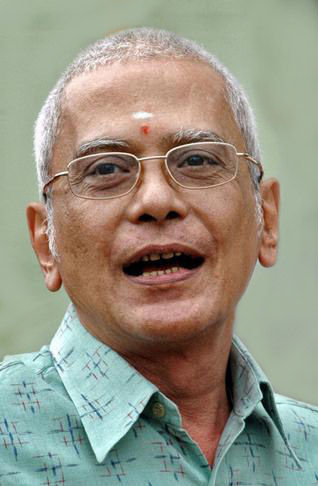

(The writer is former Chief Secretary, Government of Andhra Pradesh)