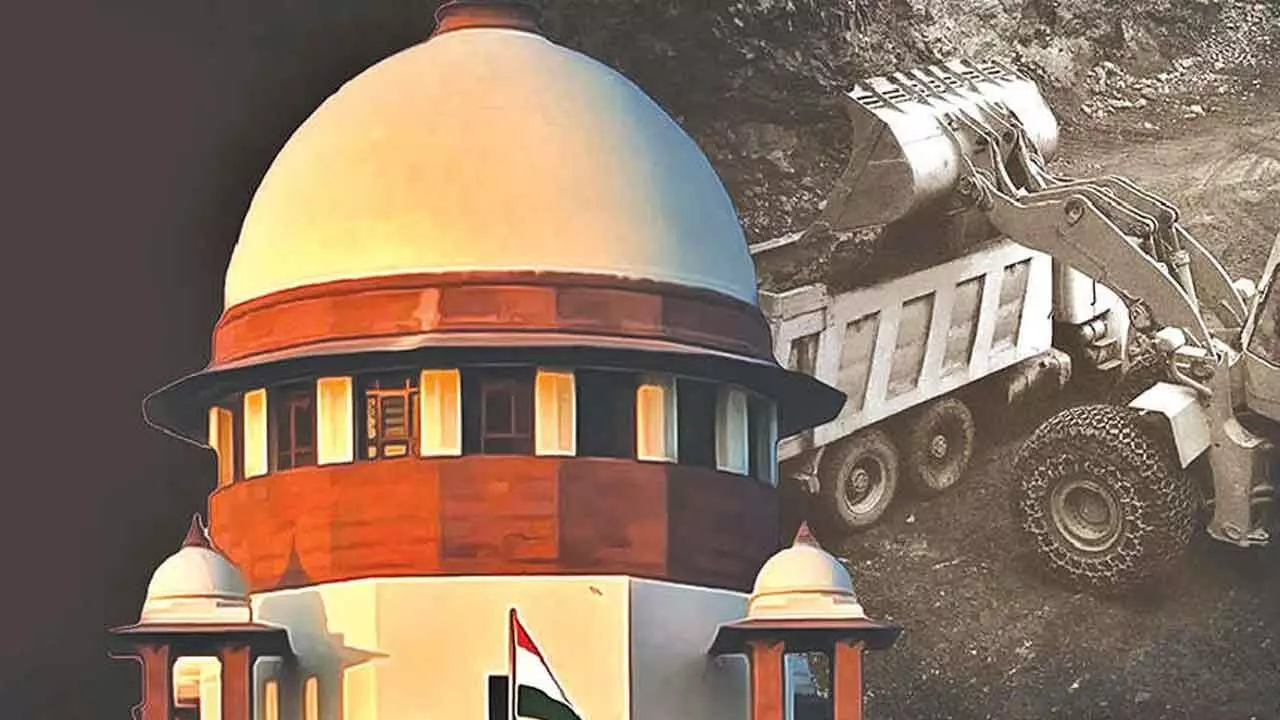

Boost for mineral-rich states: States can recover tax dues on mining from 2005 says SC

Chief Justice DY Chandrachud rejected the arguments of the Centre and mining companies, including public sector undertakings, for operationalising the July 25 verdict with prospective effect

New Delhi: In a major victory for mineral-rich states, the Supreme Court on Wednesday allowed them to recover from the Centre and mining companies royalty and tax dues on mineral rights and mineral-bearing lands worth thousands of crore of rupees since April 1, 2005 over a period of 12 years.

In a majority 8:1 verdict on July 25, the top court had ruled that the legislative power to tax mineral rights vests in states and not Parliament. On Wednesday, pronouncing a related judgement on behalf of the nine-judge constitution bench, Chief Justice DY Chandrachud rejected the arguments of the Centre and mining companies, including Public Sector Undertakings (PSU), for operationalising the July 25 verdict with prospective effect.

During a hearing on the issue on July 31, the Centre had opposed the demand of states for refund of royalty levied on mines and minerals since 1989, saying if the July 25 verdict is implemented with retrospective effect, the PSUs, according to initial estimates, would lose more than Rs 70,000 crore. The bench, also comprising Justices Hrishikesh Roy, Abhay S Oka, JB Pardiwala, Manoj Misra, Ujjal Bhuyan, Satish Chandra Sharma and Augustine George Masih, noted the submission of the Steel Authority of India Limited (SAIL) that it stands to lose around Rs 3,000 crore in the event of the judgement coming into force retrospectively.

CJI Chandrachud said Wednesday’s verdict will be signed by eight judges of the bench who had delivered the majority judgement on July 25. He said Justice Nagarathna will not sign the verdict as she had given a dissenting view on July 25. “While the States may levy or renew demands of tax, if any, pertaining to Entries 49 and 50 of List II of the Seventh Schedule in terms of the law laid down in the decision in MADA (Mineral Area Development Authority) (July 25 verdict) the demand of tax shall not operate on transactions made prior to April 1, 2005,” the court ordered. It said the time for payment of the demand of tax by the states shall be staggered in instalments over a period of 12 years commencing from April 1, 2026.