Live

- NASA Tracks Five Giant Asteroids on Close Approach to Earth Today

- Pushpa 2 Hits ₹1000 Crore in 6 Days: How It Compares to Other Top Indian Films

- Vivo X200 and X200 Pro Launched in India: Price, Specifications, and Features

- Nitin Gadkari Admits Feeling Embarrassed at Global Summits Over Rising Road Accidents in India

- Comprehensive Review on Indiramma Housing Survey and Welfare Initiatives Conducted via Video Conference

- Jogulamba Temple Records Rs 1.06 Crore Hundi Revenue in 150 Days

- Opposition Slams ‘One Nation, One Election’ Bill as Anti-Democratic; BJP Allies Support the Move

- Celebrate Karthigai Maha Deepam Virtually with Sri Mandir’s LIVE Darshan Experience

- BJP Extends Support to Samagra Shiksha Abhiyan Employees' Strike, Demands Immediate Regularization and Welfare Benefits

- Dr. M. Priyanka Stresses Quality Education, Nutritious Meals, and Cleanliness in Schools

Just In

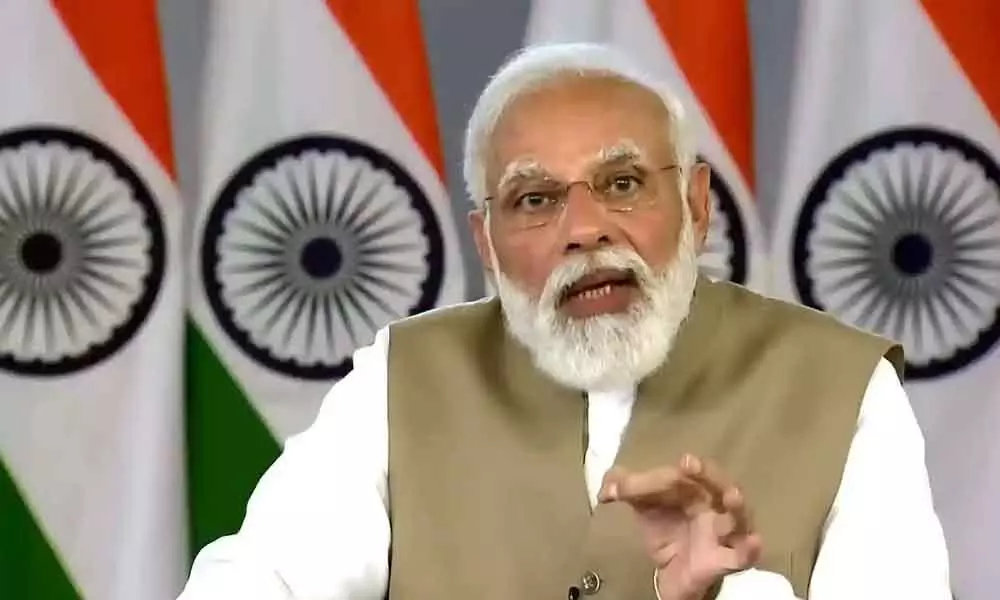

PM Modi launches scheme for retail participation in govt securities

Prime Minister Narendra Modi

Prime Minister Narendra Modi on Friday launched two customer-centric initiatives of the Reserve Bank of India (RBI) intending to provide opportunities to retail investors to participate in the government securities market and contribute towards nation-building.

Prime Minister Narendra Modi on Friday launched two customer-centric initiatives of the Reserve Bank of India (RBI) intending to provide opportunities to retail investors to participate in the government securities market and contribute towards nation-building.

The two initiatives of RBI -- retail direct scheme and integrated ombudsman scheme -- will also promote financial inclusion, he said.

The Prime Minister, while launching two innovative, customer-centric initiatives, said these schemes would expand the scope for investment and improve the customer grievance redressal mechanism.

The retail direct scheme, he said, would provide access to small investors to earn assured returns by investing in securities and it will also help the government to garner funds for nation-building.

On the Reserve Bank-Integrated Ombudsman Scheme (RB-IOS), he said, it is aimed at further improving the grievance redress mechanism for resolving customer complaints against entities regulated by the central bank.

With the launch of the scheme, he said, ''One Nation-One Ombudsman'' has become a reality. The RBI Retail Direct Scheme is aimed at enhancing access to the government securities market for retail investors. It offers retail investors a new avenue for directly investing in the securities issued by the center and the state governments. The investors will be able to easily open and maintain their government securities accounts online with the RBI for free. Leveraging technological advancements, the scheme offers a portal avenue to invest in central government securities, treasury bills, state development loans, and sovereign gold bonds.

The scheme places India in a list of select few countries offering such a facility.

This scheme (RB-IOS) will do away with the jurisdictional limitations as well as limited grounds for complaints. RBI will provide a single reference point for the customers to submit documents, track the status of complaints filed and provide feedback. The complaints that are not covered under the ombudsman scheme will continue to be attended to by the Customer Education and Protection Cells (CEPCs) which are located in the 30 regional offices of RBI.

With increased awareness, digital penetration, and financial inclusion there was a steep rise in the number of complaints against various regulated entities. The number of complaints shot up from 1.64 lakh in 2017-18 to 3.30 lakh complaints in 2019-20, as per RBI data.

The RBI in the recent past took several steps to strengthen the customer grievance redressal system of regulated entities including the issuance of guidelines for strengthening of Internal Ombudsmen, graded regulatory and supervisory actions, and launch of Complaints Management System (CMS) in 2019.

The RBI after review decided to integrate the three ombudsman schemes into one and also simplified the scheme by covering all complaints involving deficiency in service by centralizing the receipt and initial processing of complaints to enhance process efficiency.

RBI's alternate grievance redress mechanism currently comprises of three ombudsman schemes viz – the Banking Ombudsman Scheme (BOS), launched in 1995, the Ombudsman Scheme for Non-Banking Financial Companies (OS-NBFC), 2018 and the Ombudsman Scheme for Digital Transactions (OSDT), 2019.

The schemes are administered through 22 offices of the RBI Ombudsman (ORBIOs). Complaints that do not fall within the ambit of the Ombudsman mechanism are handled by the Consumer Education and Protection Cells (CEPCs) functioning at 30 regional offices of RBI.

The three schemes, having evolved over different periods, had specified grounds of complaints that acted as a limiting factor, had different grounds of complaints, which led to uneven redress across the customers of different entities, and had different compensation structures.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com