Live

- NASA Tracks Five Giant Asteroids on Close Approach to Earth Today

- Pushpa 2 Hits ₹1000 Crore in 6 Days: How It Compares to Other Top Indian Films

- Vivo X200 and X200 Pro Launched in India: Price, Specifications, and Features

- Nitin Gadkari Admits Feeling Embarrassed at Global Summits Over Rising Road Accidents in India

- Comprehensive Review on Indiramma Housing Survey and Welfare Initiatives Conducted via Video Conference

- Jogulamba Temple Records Rs 1.06 Crore Hundi Revenue in 150 Days

- Opposition Slams ‘One Nation, One Election’ Bill as Anti-Democratic; BJP Allies Support the Move

- Celebrate Karthigai Maha Deepam Virtually with Sri Mandir’s LIVE Darshan Experience

- BJP Extends Support to Samagra Shiksha Abhiyan Employees' Strike, Demands Immediate Regularization and Welfare Benefits

- Dr. M. Priyanka Stresses Quality Education, Nutritious Meals, and Cleanliness in Schools

Just In

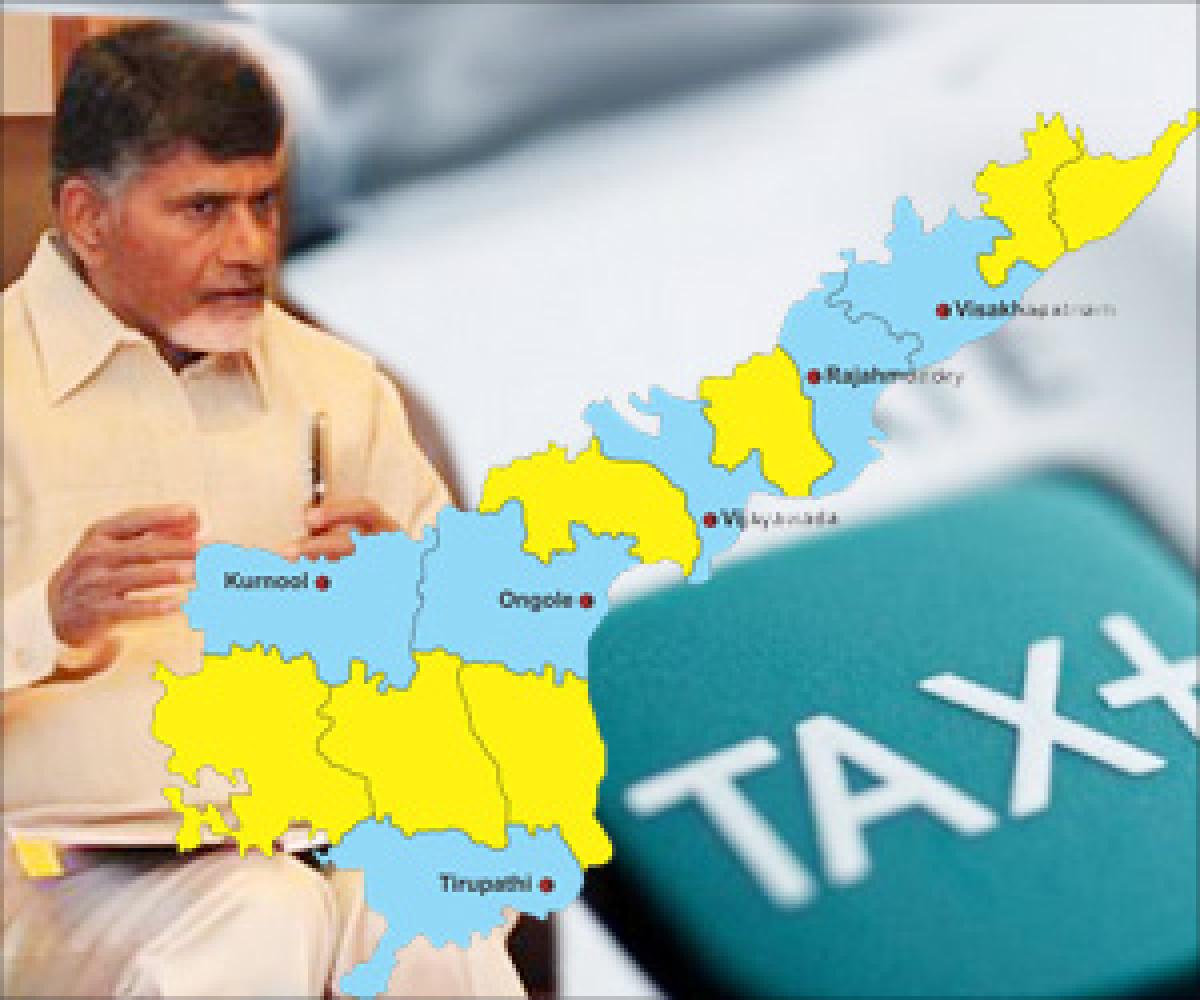

Financial position of the state of Andhra Pradesh: Is the state living beyond its means?

After assuming office on June 8, 2014, the present Government had the chance of presenting three Budgets to the Assembly for the years 2014-15, 2015-16 and 2016-17.

1. Macro Level Budgetary Position:

After assuming office on June 8, 2014, the present Government had the chance of presenting three Budgets to the Assembly for the years 2014-15, 2015-16 and 2016-17. In spite of the fact that the new State had lost the substantial income generating Hyderabad and 10 districts like Ranga Reddy, the Budget volume (the total amount of expenditure) was put at a fabulous amount of Rs.1,1,824 core for 2014-15, Rs.1,13,049 crore for 2015-16 and Rs.1,35,689 crore for 2016-17. Expectations at the time of bifurcation were that the Budget volume of the new State may not exceed about Rs.80,000 crore, taking into account the income generating capacity. Reversing all those estimations, the new Government had surprised everyone with a Budget volume crossing the one lakh crore mark. While presenting the Budget for 2016-17, on 10th March 2016, the Finance Minister Sri Yanamala Ramakrishnudu has claimed that he could spend almost 99.26 percent of the amount earmarked. This really speaks to the resilience of the Government in raising revenues and loans for incurring the proposed expenditure.

In spite of the above, Analysts have been expressing doubts on two counts. One, the perennial deficit under revenue account. The criticism is that the Government is over-projecting the revenue receipts and inflating the expenditure to rise the Budget volume and thus the revenue deficit is made to be a permanent feature. Second, the Government is excessively depending on the public debt (especially on market borrowings). In all the three Budgets, the net amount of public debt has remained about 15 percent of the total expenditure proposed. This is a significant amount, constraining the Government to pay heavy interest, always above Rs.11,000 crore (about 13.0 percent of total revenue receipts).

2. Trends in Revenue Receipts:

The strength in the finances of any Government is revealed through the revenue receipts, i.e., the income generating capacity of the State. The surprising fact is that the new Government is projecting almost the same volume of receipts under this account, even after bifurcation. While the total revenue receipts of the combined state stood at Rs.80,996 crore for 2010-11, the same was projected to be Rs.109,300 crore for 2016-17; a quantum jump in the revenue-generating a capacity of the State. However, in relative terms, the share of own tax revenue has fallen sharply from the undivided position of 55.73 per cent to 47.87.

Quite surprisingly the share of State excise also has gone down substantially from 10.20 per cent to 5.27 per cent; in spite of the all-out effort of the Government to increase revenue from Abkari and liberal licensing to Bar and Restaurants. Another case observation that could be made from the trends is that the Grant-in-aid from the Central Government is forming about one-fourth. In the context of reducing the share of taxes from the divisible pool to the Central Government by virtue of significant rise from 32 to 42 per cent and reduction in the number of centrally sponsored schemes, it is highly precarious to depend on the Central assistance (by way of Grant-in-Aid )any longer.

3. Trend in Revenue Expenditure:

It had been the experience of many a State Government that they suffer from huge deficits under this account. In view of the fixed commitments towards running the Government, their administrative expenditure would outweigh the income generated. Hence, they would be suffering from the huge revenue deficit. An analysis of the trend in the revenue expenditure of the State of Andhra Pradesh would reveal many interesting aspects. First, there was no revenue deficit in the undivided State of Andhra Pradesh. Either due to increasing in the receipts (than expected) or due to cut in the allocated expenditure to various departments, the erstwhile Government appears to have taken adequate care to see that the finances of the State did not land in deficit. It is only after the new Government (after bifurcation) assuming office in June 2014, could find a large volume of a deficit of Rs.24,315 crore; which is, in fact, the contentious issue now between the Central Government and the State Government.

The State had been arguing that the centre has promised to reimburse the entire revenue deficit for the year 2014-15; in view of the fact that the new State was unfavourably placed in terms of the infrastructure and revenue generating capacity. Second, there was huge revenue expenditure in the very first year of the new Government. Viewed otherwise, the revenue had fallen down by about Rs.20,000 crore over the previous; resulting in a huge deficit. The expenditure towards social services covering education, health, family welfare, water supply, sanitation, housing, urban development, and nutrition had been significant at above 40 per cent always, except in the year 2014-15. This was followed by expenditure on General Services including the maintenance of the State Departments, fiscal services, and pensions.

The most significant of this is the servicing of the Debt and interest payments, always accounting for more than Rs.10,000 crore. Interest payments were projected to be the highest at Rs.12,853 crore during 2016-17. Next in the series of expenditure was towards Economic services consisting of agriculture and allied activities, rural development, irrigation and flood control, energy, industry and minerals, transport, science, technology and environment. It is evident from the pattern of expenditure that there had been a sub-still shift in the priorities of the new Government. While the previous Government in the undivided State had focused much on the irrigation and flood control during the years 2010-14, by allocating between Rs.6,500-8,900 crore; the new Government has reduced this expenditure to just Rs.600 core. In contrast, the new Government’s allocations towards Rural Development and Agriculture remained substantial.

3.1. Estimates of Fourteenth Finance Commission:

It would be relevant in the present context to juxtapose the estimates of Fourteenth Finance Commission (FFC) with the actual situation available, so as to gain a reasonable understanding of the finances of the new State. The Commission has made an objective assessment of the finances of both Andhra Pradesh and Telangana, basing on the data of the years 2004-05 to 2012-13. Basing on this, the Commission made a projection as to the strength of the finances of both the States on Revenue Account for a period of five years from 2015-16 to 2019-20. As per the projections of the Commission, the new State of Andhra Pradesh would suffer from revenue deficit through the five year period, totaling about Rs.1,92,798 crore. In contrast, it is projected that the Telangana would end up with a surplus for all the five years, amounting to about Rs.21,972 crore.

A comparison of the estimates of the FFC and the State Budget reveals many interesting aspects. First, the FFC estimated that the State’s own revenue would be about Rs.58,624 crore for 2015-16 and Rs.68,332 crore for 2016-17; whereas the Budget documents projected that it would be Rs.71,659 and Rs.82,451 crore respectively. Basing on its estimates, the FFC projected the pre-devolution deficit to be around Rs.31,646 crore and Rs.33,823 crore for the two years respectively. Second, the State expected that the Central Government would extend a grant-in-aid of Rs.17,722 crore for 2015-16 and Rs.26,849 crore for 2016-17. By virtue of the increased revenue, the State itself is projecting the revenue deficit at very low levels of Rs.4,140 crore for 2015-16 and Rs.4,868 crore only for 2016-17. These estimates are significantly lower than those of the FFC. If the State sticks to its own estimates and that the same are proving to be true, there is no case for much worry on account of the revenue and fiscal deficits. But the reality does not appear to be supporting these estimates. Going by the all-out efforts of the State of Andhra Pradesh for raising resources through market borrowings and other sources of public and private debt, one naturally doubts about the genuine of these estimates.

4. Position on Capital Account:

Capital Account is meant for recording transactions relating to long-term activities. Development activities categorized under plan and non-plan are shown under this head. Receipts under this head would generally arise on account of sale of assets/property and borrowings. Since there is no receipt under the first category, loans, advances and borrowings play the major role under this account. The balance had been always negative and the same has gone up from Rs.7,070 crore in 2014-15 to Rs.15,388 crore in 2016-17. The various items of expenditure on Capital Account included Irrigation and Flood Control, Transport and Welfare of SC, ST, and BC communities. A closer examination of the pattern of Capital expenditure reveals the fact that the Government had been very keen for the past decade on developing irrigation facilities in the State. More than half of the amount is spent for this purpose, followed by the creation of facilities for transportation of persons and goods.

5. Public Debt and Guarantees Outstanding:

That the State is running the show based on the borrowings from the market is quite evident from the financial data of the Government. While the Government has proposed about Rs.20,466 crore receipts during the Budgeted and Revised Estimates for the year 2015-16, got enhanced by another Rs.4,000 crore to Rs.24,028 crore during 2016-17. After meeting the annual payments, the net amount is estimated to be the Rs.19,458 crore for 2016-17. For a State having the own tax receipts of the order Rs.80,000-90,000 crore only cannot afford to meet heavy interest burdens; which is hovering at present around Rs.13,000 crore and the same is expected to grow to the tune of Rs.16,470 crore by 2019-20, as per the estimates of FFC.

An analysis of the outstanding public Debt reveals the fact the public debt which was Rs.1,12,743 crore in 2010-11 has scaled up to Rs.1,90,513 crore by 2016-17 (vide Budget Estimates of 2016-17); an increase of 56.48 percent over six years. As per cent of GSDP, the outstanding debt has gone up from 20.67 percent in 2010-11 to 27.88 percent in 2016-17. Examined from the point of view of source from which this debt is mobilized, we would notice that about 60.46 per cent is raised in the open market as loans through RBI, about 7.58 percent through loans from Central Government, 16.04 percent from Autonomous Bodies, and about 15.91 percent from PF Fund and small savings organizations. This is the data as projected for the year 2016-17 through its Budget Document by the new Government. As per the indicative calendar of Market Borrowings by various State Governments released by the Reserve Bank of India, the State of Andhra Pradesh has planned to borrow an amount of Rs. 2,000 crore every month during 2016.

Added to these, the States are also very active in providing Guarantees for the loans raised by its Corporations, Autonomous Bodies and sometimes on behalf of private parties too. These Guarantees amounted to around Rs.10,675 crore for 2015-16; which were three times of 2013-14. Therefore, the Government’s obligations under these two heads themselves turn out to be heavy.

6. Compliance under FRBM discipline:

In order to ensure efficient and equitable fiscal management and long-term macroeconomic stability, the Central Government has passed the Fiscal Responsibility and Budget Management (FRBM) Act, 2003. Accordingly, the Central Government shall lay in each financial year before both the Houses of Parliament its efforts and strategy to contain revenue and fiscal deficits. The same discipline is sought to be imposed on the fiscal management of the State Governments. To achieve these objectives, the Central Government has issued FRBM Rules 2014, specifying annual targets for reducing the deficits.

The ultimate objective is to eliminate revenue deficit by 31st March 2008, by reducing the same by at least 0.5 percent a year, beginning with the financial year 2004-05. Whereas the targeted reduction in fiscal deficit is by 0.3 percent or more each year and finally bring it down to 3.0 per cent. These targets could never be met and the revenue and fiscal deficits remained at 2.5 and 3.5 per cent respectively. It had been the experience of the Centre that every time at the time of Budget presentation tall claims were being made and the targets being pushed forward to the next year and the dream of eliminating them completely has been remaining elusive.

As regards the position of the new State of Andhra Pradesh, the revenue, and fiscal deficit stood at 2.61 per cent and 3.91 per cent respectively during 2014-15. The State could bring them down to 0.69 and 2.82 percent for 2015-16 (Revised Estimates). It is projected that these deficits may be around the same percentage for the year 2016-17 also at 0.71 per cent of GSDP in the case of revenue deficit and 2.99 per cent of GSDP in the case of fiscal deficit.

7. Is the State Living beyond its Means?

The moot question lingering in the minds of public as well as economists is that whether the State is attempting to live beyond its means. Going by the information contained in various Budget documents, the position does not appear to be alarming and every indicator, especially both the kinds of deficits, seem to be under control; well below the permitted levels under FRBM. What is not clear in this regard is the matter pertaining to withholding the bills pending for payment and going in for huge market borrowings. The Government has been in the news many a time, of late, that it is not able to honour its financial commitments. Whereas the Finance Minister of the State claims that the new Government has introduced several reforms in the area of fiscal management like the one pertaining to the release of the entire annual budget amount, in place of the earlier practice of quarterly release and non-imposition of any cut in the non-plan expenditure.

There is lot dust gathered around this and the same needs to be cleared. Second, the public debt being mobilized by the new Government is reaching alarming proportions. It has been reported that the total outstanding Public Debt of the undivided State at time of bifurcation stood at Rs.1,79,637 crore; which was to be distributed among the two new States in the proportion of population (being 58:42) between Andhra Pradesh and Telangana, thus, the new State of Andhra Pradesh had inherited an amount of Rs.104,189 crore. As per the recent Budget estimates of 2016-17, this figure has soared to Rs.1,90,513 crore, an increase of 82.85 percent in just 24 months. If the fiscal management had been proper as claimed, what kind of justification can we find for this phenomenal increase in the debt burden?

Further, it appears that the cost of borrowings is also working out heavy to the State. While the loans received from the Central Government carry a tag of 10 per cent, the market borrowings are also working out to about 8.00 to 9.00 percent. Whereas, the Average Interest Cost (AIC) of the Central Government has come down significantly from 8.1 percent in 2000-01 to 6.7 percent in 2014-15. It is believed that a continuously declining AIC augurs well for the stability of the Government Debt. According to the existing norms, the debt of a State shall not go beyond 25 per cent of the GSDP and interest payments beyond 10 percent of the revenue.

Viewed thus, the outstanding debt works out to about 27.88 per cent of GSDP and interest payments to about 22.23 percent of its own tax and non-tax revenues. Added to these, the latest news is that new State of Andhra Pradesh has been requesting the Centre to enhance the ceiling limit of 3.00 per cent to 3.50 per cent of GSDP in the case of a fiscal deficit so that there would be greater leeway for incurring expenditure. While the similar request of Telangana had been accepted, that of Andhra Pradesh was turned down; even when the ruling party is sharing the seat of power at the Centre and in the State. All this, in the opinion of the author, indicates the tendency of the State to fall into a ‘Debt Trap’, by overstretching its means beyond the inherent strength.

By Prof Vijayanna

The author is former VC, Acharya Nagarjuna university

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com