Tightrope walk

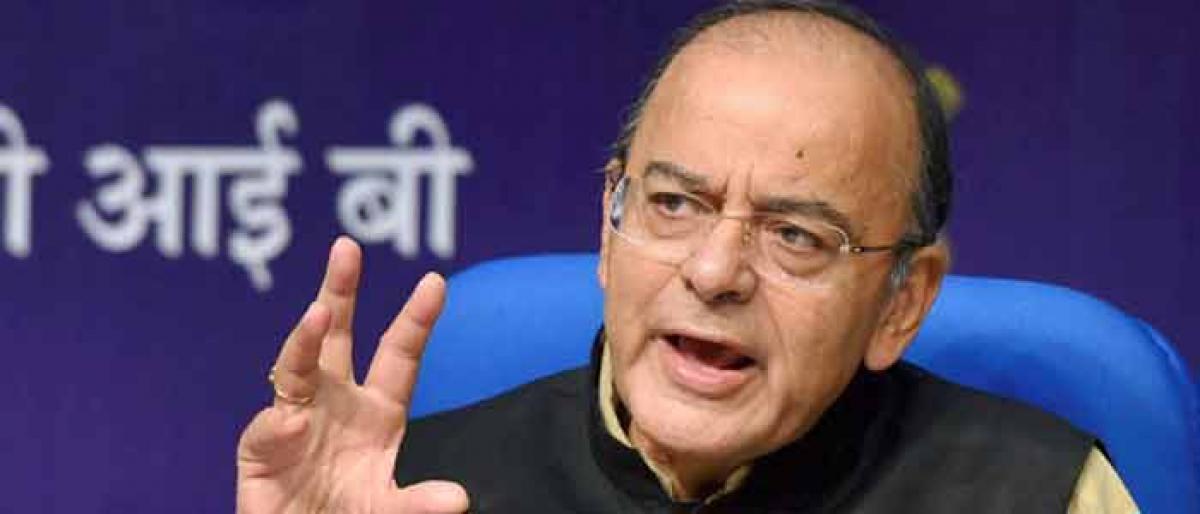

For next fiscal, Finance Minister Arun Jaitley presented a budget that did not please many. Terming it as a lacklustre exercise might seem far-fetched, but the annual ritual that set tone for the economy for next fiscal year certainly l

For next fiscal, Finance Minister Arun Jaitley presented a budget that did not please many. Terming it as a lacklustre exercise might seem far-fetched, but the annual ritual that set tone for the economy for next fiscal year certainly lacked the requisite punch and reform push that could put the country on a higher growth trajectory. Understandably, Jaitley took a course that bordered on populism as it was his last full-fledged exercise before the country goes to polls in early 2019.

The massive free health insurance policy for poor termed by many as 'Modicare' alluding to Obamacare, an affordable healthcare initiative by the US President Obama, and a steep increase in minimum support price (MSP) for farm produce, are clear pointers as to where the interests of Modi government lie this time around.

But the most displeased lot with Jaitley's budget exercise should be six members of the Monetary Police Committee (MPC) who will meet on Tuesday and Wednesday to discuss the macroeconomic signals from the budget before announcing monetary policy for the remainder of the current financial year. Thus far, the committee headed by RBI Governor treaded a cautious path.

It kept the repo rate unchanged four out of five times it met this fiscal. However, it deviated from its path in August and reduced the key interest rate at which it provides liquidity to banks, to six per cent from 6.25 per cent.

But it faces an uphill task now. Consumer price index (CPI)-based inflation hit a 17-month high of 5.2 per cent in December, which is significantly higher than the RBI target of 4 per cent. Rising crude oil prices and others played spoilsport. The government's announcement of 50 per cent higher MSP over the cost of production for agricultural commodities in the budget is laudable as it will provide much-needed relief to farmers, but the move will push up food inflation.

With expected rise in fiscal deficit to 3.5 per cent this fiscal, high yield pressures in bond markets and crude oil turning costlier, the course that retail inflation will henceforth take is upward. That will definitely keep MPC and RBI on the tenterhooks.

However, it has the option of going for a rate hike to rein in inflationary pressures. Sensing the precarious position that RBI is in, Assocham on Sunday cautioned the apex bank against turning hawkish and hiking rates.

In a way, the industry body is right. Any upside revision of the rates at this point will not only dampen economic growth, but also put more pressure on stock markets which are already going post-budgetary pangs. Moreover, the Modi government may not be happy to see bank funds getting costlier at time when it is in the process of gearing up for crucial 2019 elections.

But there is also another risky angle here. The government may also not like to see inflation going up now. Higher inflation means higher prices. Therefore, price rise before elections will not bode well for it. So, RBI may have to find ways to control inflationary pressures without tweaking the rates. A tightrope walk for it indeed!