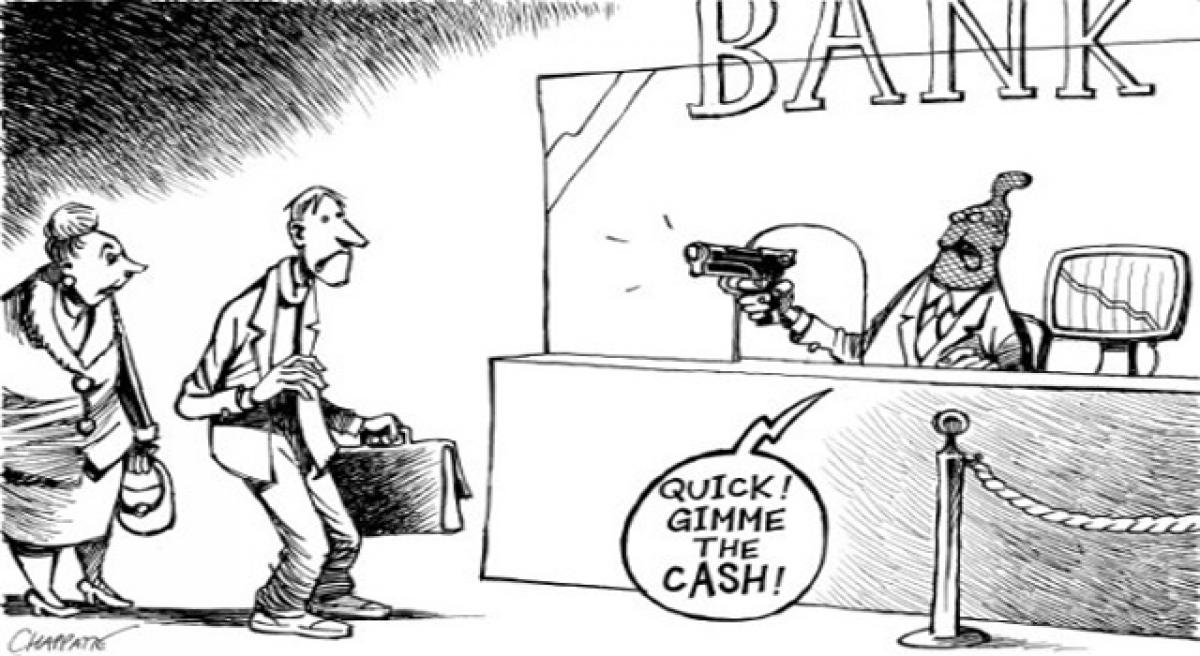

FRDI Bill and bail-in

Seeking to allay concerns of depositors over provisions of a draft law, Finance Minister Arun Jaitley today said the government will fully protect public deposits in financial institutions even as he hinted at openness to changes in the proposed FRDI Bill.

Seeking to allay concerns of depositors over provisions of a draft law, Finance Minister Arun Jaitley today said the government will fully protect public deposits in financial institutions even as he hinted at openness to changes in the proposed FRDI Bill.

The FRDI Bill proposes to create a framework for overseeing financial institutions such as banks, insurance companies, non-banking financial services (NBFC) companies and stock exchanges in case of insolvency. The government said it is committed to strengthen PSU banks and financial institutions. About Rs. 2.11 lakh crore is being pumped in to strengthen the public sector banks, the FM said.

Jaitley assurance came as an online petition by a Mumbai woman against allowing "a government entity to use depositors' money to save a bank on the verge of bankruptcy" got over 40,000 sign-ups in just 24 hours, writes NDTV.

The petition appeals to the Finance Minister not let the FRDI bill pass with the 'bail-in' provision, stating, "Our hard earned money that we have saved for our children and for our future will be used to bail-in the banks." Some financial analysts have suggested that "bail-in", as against bailout in which outside money is used to save a financial institution, may eat into funds parked by depositors.

Opposition parties have alleged that the government could use people's money to save financial institutions that have made bad lending calls. Banks are struggling under the burden of bad loans of around Rs 10 lakh crore ($150 billion).

Currently, people's deposits of up to Rs. 1 lakh are insured under the Deposit Insurance and Credit Guarantee Corporation Act, 1961, if a financial institution were to fail. Depositors are concerned that the proposed "bail-in" provision might remove that protection.

The FRDI Bill, 2017, tabled in the Lok Sabha on August 11 in the monsoon session, provides for an independent regulator, the Resolution Corporation, which will comprise representatives from other financial regulators such as the Reserve Bank of India and the Securities and Exchange Board of India.