Banks squeeze customers

Sending the Modi government\'s laudable objective of bringing all the Indians into the banking fold for a full toss, banks are trying to squeeze more charges out of their account holders these days, in an ill-advised move that could potentially drive people back to the old ways of hoarding cash at home and keeping away from the banking system.

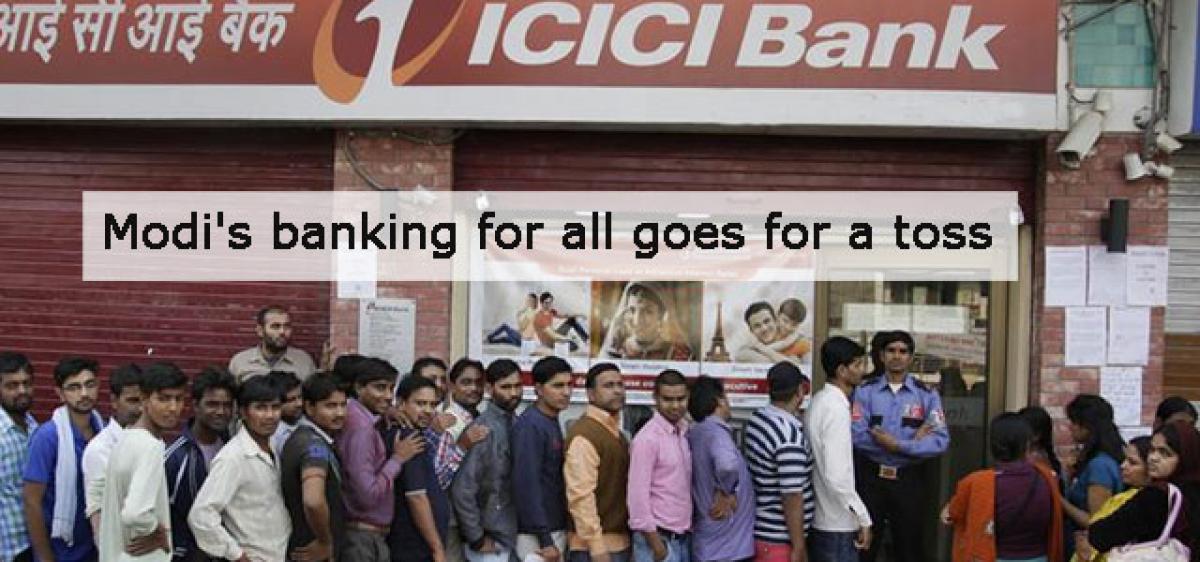

Hyderabad: Sending the Modi government's laudable objective of bringing all the Indians into the banking fold for a full toss, banks are trying to squeeze more charges out of their account holders these days, in an ill-advised move that could potentially drive people back to the old ways of hoarding cash at home and keeping away from the banking system.

The first signal of banks' thirst for more charges, known as fee income in the banking parlance, came forth when private sector banking behemoths such as HDFC Bank, ICICI Bank and Axis Bank started imposing charges on cash withdrawals and deposits exceeding certain limits in terms of amount and the number of transactions.

State Bank of India (SBI), the country’s largest lender, also joined them last week with its own set of charges. “But this is a retrograde step from the banks. It will impact every one – general public, traders and companies.

It is surprising that banks have gone ahead and started levying these regressive charges without consulting anyone,” Prem Chand Kankaria, chairman, Banking & Finance Committee, Federation of Telangana Chambers of Commerce and Industry (FTAPCCI), told The Hans India.

Last week, HDFC Bank started levying Rs 150 plus taxes for each of cash withdrawals and deposits at branches beyond four free transactions in a month. These charges are applicable to all saving, salary and current accounts with immediate effect.

ICICI Bank has also restricted free transactions at the branches to four in a month. Thereafter, it will charge Rs 5 per thousand rupees subject to a minimum of Rs 150 in a month. In the case of non-home branches, only one free transaction is free while charges are same as at home branches.

However, Axis Bank is little generous by offering five free transactions or Rs 10 lakh cash deposits or withdrawals in a month. Taking cue from them, State Bank of India (SBI) came out with its own plans to squeeze more charges from its customers.

In its case, it is the minimum balance charges that have come back to haunt the customers of the country's largest lender, after a gap of five years. Besides, there will be a charge of Rs 50 plus taxes on cash deposits beyond three transactions in a month.

The public sector bank waived minimum average balance (MAB) charges way back in 2012 to attract more customers into its fold. Now, they will be back with a bang from April 1. Accordingly, customers will have to shell out a minimum of Rs 50 month for not maintaining MAB of Rs 5,000 in their accounts in metro cities.

The bank will levy Rs 100 plus taxes if the shortfall is 75 per cent or more. The MAB and charges are a little lower in urban branches, but customers will have to cough up significant amounts as charges there too. SBI alone has 30 crore customers across the country and most of them will be impacted by the decisions.

“It’s shocking for us that bank will collect charges even for deposits and withdrawals. If that’s the case, why do we need banks? It will be better for us to keep cash at home instead of depositing it in the banks and then paying charges,” Rajasekhar, an SBI customer, said outside a branch in Habsiguda in Hyderabad.

Experts and others warned that the move by banks would go against the Modi government’s plan to take banking to every doorstep in the customer through the Pradhan Mantri Jan Dhan Yojana (PMJDY).

Over 27.77 crore bank accounts were opened under this scheme till February 2017. Though there are no levies on these accounts as of now, there is no guarantee that banks will continue that luxury for long.