The history of Service Tax from 5% to 15%

With the introduction of Krishi Kalyan Cess, the Service Tax rate in India is now 15%. There are a wide variety of services on which this tax is levied and the service tax revenue has become a very important source of indirect tax revenue for the Government of India.

With the introduction of Krishi Kalyan Cess, the Service Tax rate in India is now 15%. There are a wide variety of services on which this tax is levied and the service tax revenue has become a very important source of indirect tax revenue for the Government of India. Service Tax was first introduced in 1994 when Dr. Manmohan Singh was the Finance Minister.

Service Tax was first introduced in 1994. During his budget speech for the financial year 1994-95, the then Finance Minister Dr. Manmohan Singh emphasized the need for service tax. He said that though the services sector accounted for 40% of the GDP, it was never taxed. Based on the recommendations of the tax reforms committee, he proposed to impose service tax of 5% only on 3 services namely telephone bills, non-life insurance and tax brokers.

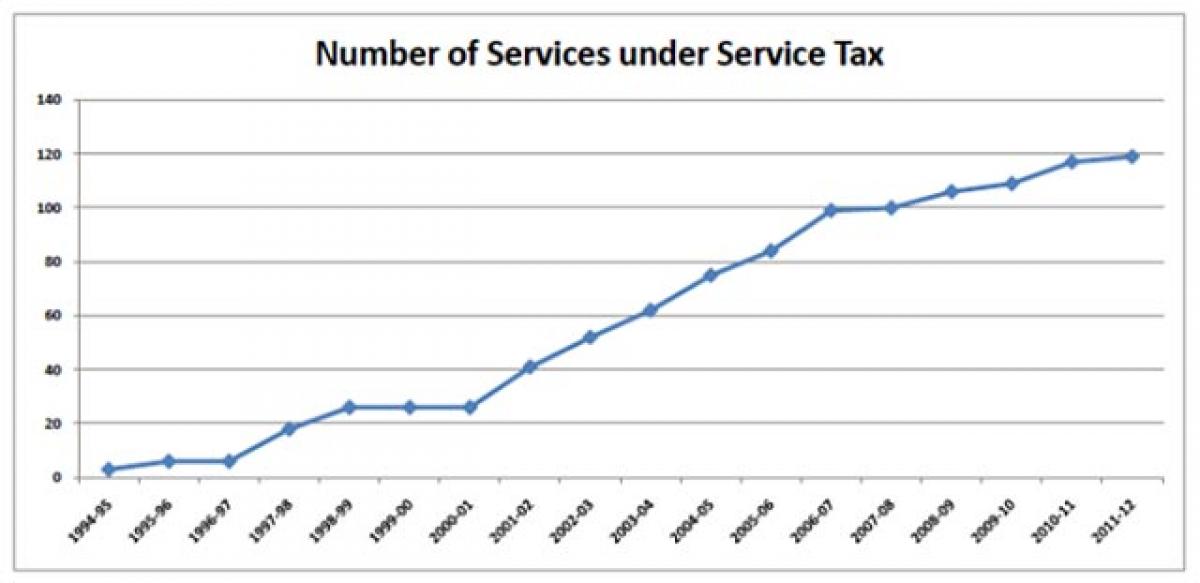

From 3 services in 1994 to a negative list regime

The service tax regime started with 3 services under the tax net in 1994 and progressively increased to 119 different services in 2011-12. In 1996, 3 more services namely advertising agencies, courier agencies and radio pager services were added to the list. In 1997, this number increased to 15 and services like air travel agents, mandap keepers, manpower recruitment agencies were brought into the tax fold. This number increased to 119 in 2011-12. The latest to be included in 2011-12 were services of air conditioned restaurants and hotel accommodation.

From 2012, there has been a paradigm shift in the levy of service tax. Instead of levying tax on certain services, tax was imposed on all services except those listed in the negative list. The negative list in 2012 had 39 different services that were exempt from service tax. Since then, the list is modified each year.

Tax rate increased 3 times in 22 yrs

The service tax rate increased from 5% in 1994 to 15% in 2016. In other words, service tax rate has tripled in 22 years. The service tax rate was more or less constant at 5% from 1994-95 to 2002-03, though the number of services under the tax net increased in each year. In 2003, the service rate was increased by 60% from 5% to 8%. In the next year, it was increased from 8% to 10%. Education cess was first introduced in 2004 by the UPA 1 government. In 2004, a 2% education cess on the amount of service tax was introduced. Hence the net tax rate became 10.2%.

In 2006, the service tax rate was increased from 10% to 12%. In addition, a Secondary & Higher Education Cess of 1% on service tax was introduced. The net service rate became 12.36%. It remained at 12.36% till 2009 when it was brought back to 10.3% under the expectation of introducing GST from 2010. In 2012, the base service rate was increased again from 10% to 12% while the overall service tax rate increased to 12.36%.

It remained at 12.36% till 2015 when the NDA government increased the service rate to 14% including the education cess. In addition, Swachh Bharat Cess of 0.5% was also introduced taking the effective service tax rate to 14.5%. In 2016-17, while the base rate remained unchanged, Krishi Kalyan Cess of 0.5% was introduced taking the service tax rate to 15%.

Service Tax revenue up 500 times in 22 yrs

From a mere Rs 407 crore in 1994-95, the service tax revenue has increased to Rs 210000 crore in 2015-16, an increase of more than 500 times. The service tax revenue started to increase steadily once the rate was revised from 5% to 8%. Except in 2009-10 when the service tax revenue decreased on account of a reduction in the tax rate, the service tax collection in rest of the years was always more than the previous year. (Courtesy: https://factly.in)

By Rakesh Dubbudu