Live

- Megastar Chiranjeevi to Visit Allu Arjun’s Residence at 12 PM Today

- Nilima Rane: Trailblazer in Nursing

- Casual yet stylish office outfits for all-day comfort

- TTD to suspend all special darshans from January 10 to 19 amid Vaikuntha dwara darshans

- Naidu pats TDP leaders, cadres for enrolling 73L members

- Rupali Ganguly says for 20 years she never got an award

- Advanced anti-drone systems deployed for devotees’ safety at Mahakumbh

- Workshop on ‘Industry-Academia Practices in Civil Engineering’ concludes

- Revanth assures Kurma community of its due

- 204 cadets pass out of AFA

Just In

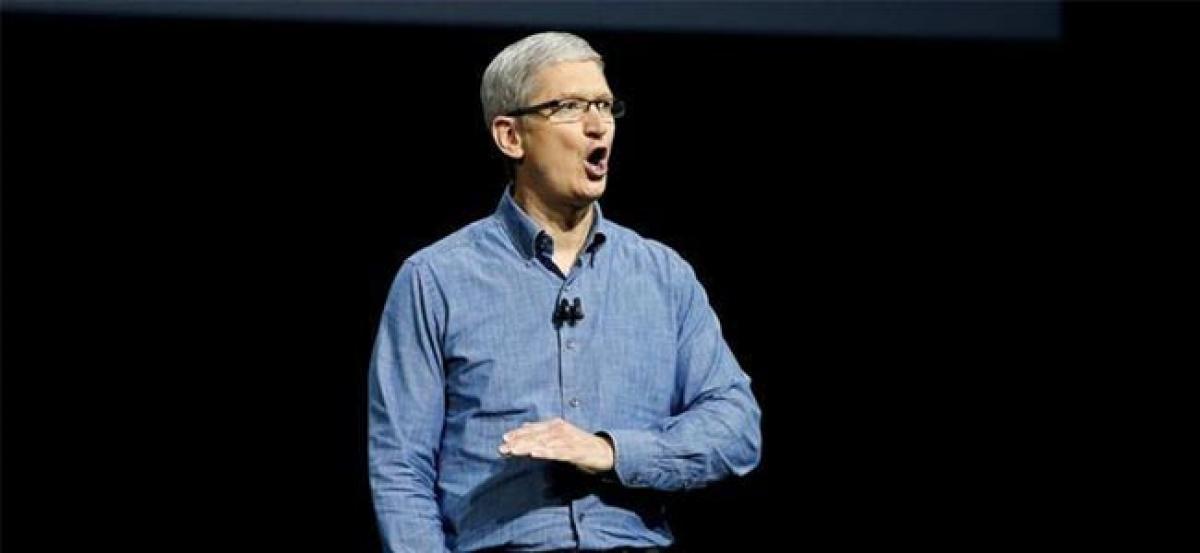

Apple\'s Chief Executive Tim Cook described an EU ruling that it must pay a huge tax bill to Ireland as \"total political crap\", but France joined Germany on Thursday in backing Brussels as transatlantic tensions grow.

Apple's Chief Executive Tim Cook described an EU ruling that it must pay a huge tax bill to Ireland as "total political crap", but France joined Germany on Thursday in backing Brussels as transatlantic tensions grow.

European Competition Commissioner Margrethe Vestager dismissed Cook's broadside, saying the demand for a 13 billion euro ($14.5 billion) back tax payment was based on the facts.

Washington has lined up with the tech giant, accusing the European Union of trying to grab tax revenue that should go to the U.S. government.

But in Ireland itself, public opinion and the government are divided over whether to take the windfall - which would fund the country's health system for a year - or reject it in the hope of maintaining a low tax regime that has attracted many multinationals and the jobs they create.

Apple has said it will appeal the ruling which Cook attacked in an interview with the Irish Independent. "No one did anything wrong here and we need to stand together. Ireland is being picked on and this is unacceptable," the newspaper quoted him saying. "It's total political crap."

Vestager has questioned how anyone might think an arrangement that allowed the iPhone maker to pay a tax rate of 0.005 percent, as Apple's main Irish unit did in 2014, was fair.

She said on Thursday that the calculations were based on data provided by Apple itself and evidence presented during hearings on Apple tax issues in the United States.

Asked if she accepted Cook's comments on the ruling, she told a news conference: "No, I will not. This is a decision based on the facts of the case."

The battle lines are forming on both sides of the Atlantic. In Paris, French Finance Minister Michel Sapin backed Vestager's view that Apple's Irish tax arrangements amounted to abnormal state aid. "The European Commission is doing its job," he told a news conference. "It's normal to make Apple pay normal taxes."

German Economy Minister Sigmar Gabriel also supported the Commission on Tuesday. However, Britain - which voted in June to leave the EU - has stayed out of the row, saying it is an issue for the Irish government, Apple and the Commission.

"DOING THE WRONG THING"

Opinion is divided on the streets of Dublin. Some argued Ireland had to keep drawing foreign investors with low tax rates to provide jobs.

But others said the government should drop the idea of appealing the decision and take the money.

"They are doing the wrong thing. They don't care about the normal people," said Louise O'Reilly, 57, a full-time carer for her diabetic and partially blind mother. "The money should be spent on the old-age pensioners who worked all their lives and are struggling to survive."

O'Reilly's mother pays 10 euros tax on a monthly pension of 1,050 euros ($1,170), a higher rate than the EU said Apple's main Irish unit paid on its profits in 2014.

By contrast, Cook estimated Apple's average annual tax on its global profits at 26 percent. "They just picked a number from I don't know where," he said. However, in a separate radio interview he promised to boost tax payments by repatriating billions of dollars in global profits to the United States next year.

"I think that Apple was targeted here," he said. "And I think that (anti-U.S. sentiment) is one reason why we could have been targeted ... I think it's a desire to reallocate taxes that should be paid in the U.S. to the EU."

Apple would fight closely with Ireland to overturn the ruling - by far the largest anti-competition measure imposed on a company by the EU - which he said had "no basis in law or in fact".

IRELAND CONSIDERS APPEAL

Finance Minister Michael Noonan has insisted Dublin would appeal any adverse ruling ever since the EU investigation began in 2014.

However, the cabinet failed to agree on Wednesday whether to accept his recommendation of an appeal. A group of independent lawmakers represented in the minority coalition say they need to consult further with Noonan, tax officials and independent experts.

After five hours of discussion, the cabinet adjourned until Friday when the government said a decision would be made. Any failure of the Independent Alliance group to come on board would cast doubt on the government's survival prospects.

Cook played down the possibility of the government failing to appeal the decision.

"The future investment for business really depends on a level of certainty," he told RTE radio. "I'm pretty confident that the government will do the right thing."

In Washington, U.S. Treasury Secretary Jack Lew criticised the ruling. "I have been concerned that it reflected an attempt to reach into the U.S. tax base to tax income that ought to be taxed in the United States," he said on Wednesday.

Apple was found to be holding over $181 billion in accumulated profits offshore, more than any U.S. company, in a study published last year by two left-leaning nonprofit groups, a policy critics say is designed to avoid paying U.S taxes.

But Cook said part of the company's 2014 tax bill would be paid next year when the company repatriates offshore profits to the United States.

"We provisioned several billion dollars for the U.S. for payment as soon as we repatriate it and right now I forecast that repatriation to occur next year," he told RTE.

($1 = 0.8969 euros)

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com