Essential Features of a Financial Dashboard

A well-designed financial dashboard changes complicated data into accurate useful intelligence, and business owners, executives, and finance professionals can observe trends, recognize opportunities, and make adjustments before they become crises.

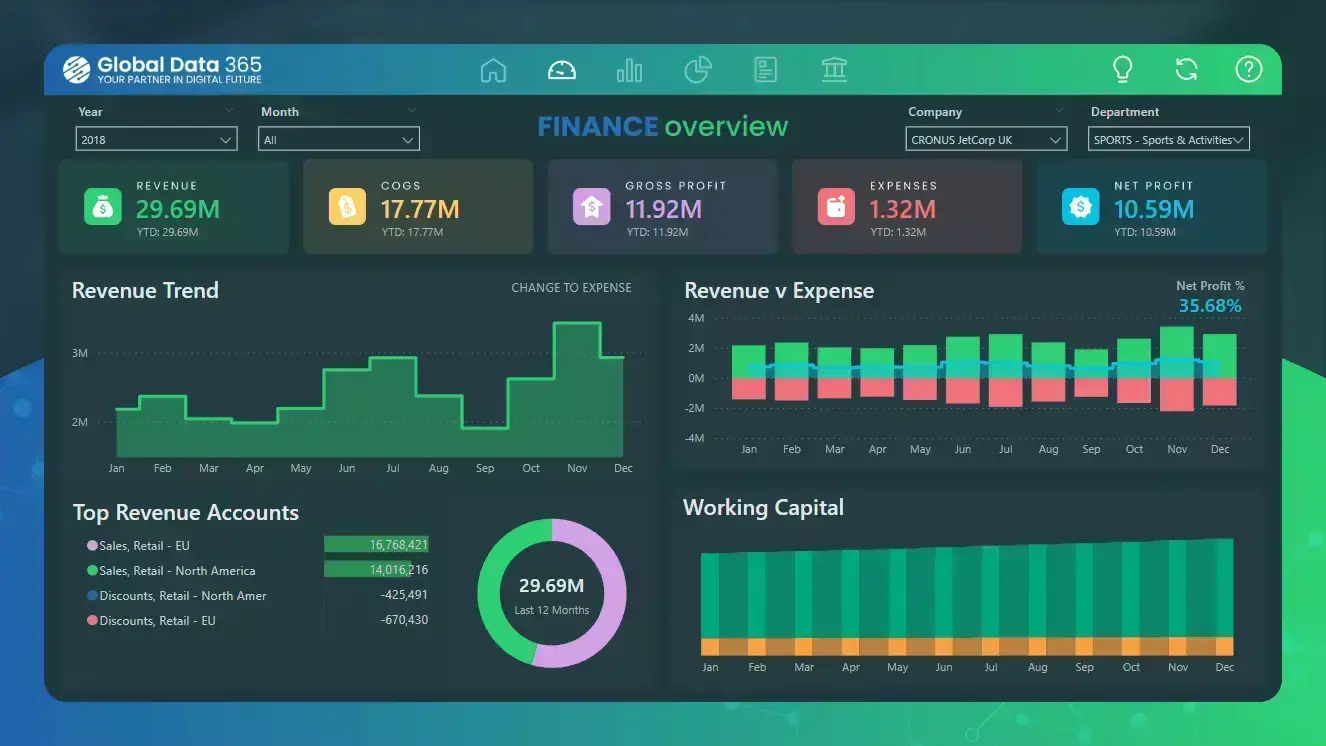

In this data-hungry modern world of business, immediate access to precise financial data becomes more important than ever for possible good decisions. A financial dashboard is a graphical presentation of a company's relevant financial indicators and performance metrics that would allow stakeholders to monitor the company's financial health in the instant. A well-designed financial dashboard changes complicated data into accurate useful intelligence, and business owners, executives, and finance professionals can observe trends, recognize opportunities, and make adjustments before they become crises. Right financial dashboard will provide a way to streamline financial reporting processes and make financial management much easier for organizations.

Real-Time Financial Insight

A defining potential of the modern financial dashboard, perhaps its most valuable function, is that it promises current insight into the financial condition of an organization. A dashboard can present cash flow, accounts receivable, accounts payable, and all other important numbers as they are changing minute by minute, rather than retrospectively for a given month or quarter. In that sense, the real-time feature keeps decision makers constantly connected to the industry's latest financial data sufficiently enough for them to respond quickly to changing market conditions or emerging financial problems.

The immediate nature of financial dashboards promotes proactive management instead of reactionary action. For example, instead of being apprised of it weeks later through examination of monthly reports, as cash balances begin to trend downward for unusual reasons, executives in charge of finance can investigate and remedy the situation. This redefines how organizations handle their finances and allows for more nimble decision-making company-wide.

Personalizable Key Performance Indicators

Because every organization has specific financial aims and priorities, customization is one of the most salient features of a good financial dashboard. It allows organizations to choose and show only the key performance indicators (KPIs) relevant to a specific business goal, enabling them to focus on the most pressing measures for their success. Although some elementary financial metrics such as revenue or cost, as well as profit margins, are universal, others can greatly differ by industry or business model or organization-specific goals.

Cash Flow Tracking

Cash flow is the lifeblood of any company, and it ranks among the most important components of a financial dashboard. Good cash flow tracking features should display the current balances of all the cash accounts, recent expenditures and receipts, and projected future cash availability based on the forecasted payables and receivables. By aggregating this information in a financial dashboard, businesses can maintain cash levels at their best, have confidence that they can meet financial obligations, and avoid cash shortages that can slow down operations.

An advanced financial dashboard can also include cash flow forecasting features that are based on historical trends and expected future transactions to predict cash positions for the next few weeks or months. This cash forecasting capability allows finance departments to plan in advance for periods of potential cash shortfall or to envision opportunities to invest excess cash at better returns. The presentation of cash flow trends on a financial dashboard makes it much easier to identify trends that do not show up when looking at traditional financial reports.

Budget vs. Actual Comparisons

Budgeting is the core of financial planning, but a budget only functions if actual performance is measured against it on a regular basis. A financial dashboard should have simple visual comparisons between budget amounts and actuals by various financial categories. Comparisons allow organizations to track whether they are staying within planned expenditure levels and achieving revenue objectives.

Once there is identification of budget and actual variances in the financial dashboard, finance departments can drill down to understand why these occurred and respond appropriately. For example, a manager would find out if this is an approved strategic expense or a wasteful spend issue if the money spent by the marketing expenses department far exceeded its budget. The visual nature of these comparisons on a financial dashboard renders such variances apparent at a glance, increasing budget adherence and financial conservatism throughout the organization.

Accounts Receivable and Payable Tracking

Accounts payable and receivable tracking is also effective in the sense that it directly impacts company cash flow, as well as vendor relations. A comprehensive finance dashboard should be able to capture components that report on receivable aging, raise alerts on payments past due to customers, and monitor upcoming payables to vendors. This reporting helps finance staff prioritize collections, as well as payment timing for optimal cash deployment.

By combining accounts payable and accounts receivable metrics onto a financial dashboard, firms can reduce days sales outstanding (DSO), improve collection levels, and manage outgoing payments to maximize the benefits of good supplier payment terms while keeping cash in hand for as long as reasonably possible. The dashboard can also show payment habits trends from specific customers or classes of customers to allow more successful credit policy and collection efforts.

Revenue and Expense Analysis

Detailed analyses of sources of revenue and expense categories are essential components of any financial dashboard. Such analysis gives firms insight into what products, services, or customer segments are generating most of the revenue and what cost areas are consuming most of the budget. Graphical formats like pie charts or stacked bar charts can make such distributions immediately understandable in a way that columns of figures in spreadsheets cannot.

Conclusion

A well-executed financial dashboard integrates the key financial information business leaders need to make decisive and rapid decisions with timely and pertinent data. With real-time data visibility, dynamic key performance indicators, cash flow monitoring, variance analysis of budgets, monitoring of receivables and payables, expense and revenue tracking, profitability analysis, and trend projection, a financial dashboard is a treasure for financial management.

With growing complexity and competition for companies, having such financial dashboard functionality in their pockets can be the difference between reactive management and leadership. Companies that make an investment in strong financial dashboard functionality have a deciding advantage with improved financial visibility, efficient reporting process, and data-based decision-making. By putting key financial information in their hands in easy-to-understand visual format, business leaders need to care less about getting information and more about applying insights toward driving organizational prosperity.