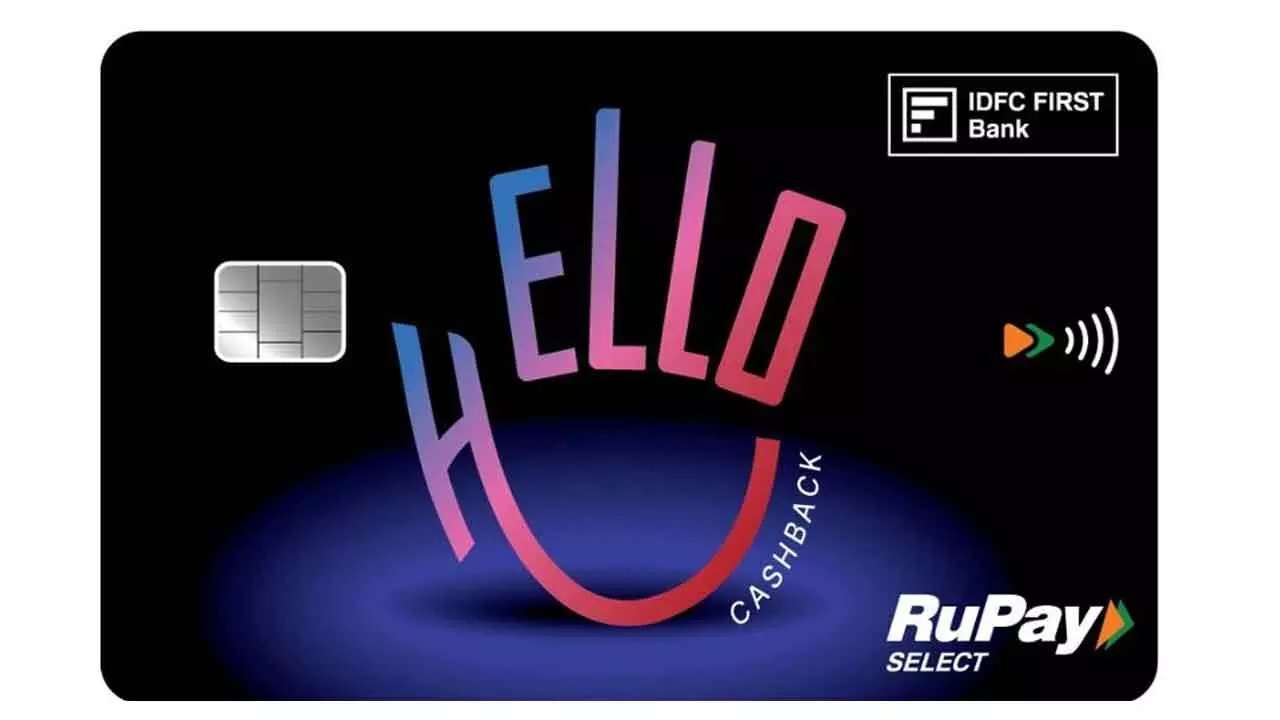

IDFC FIRST Bank launches FD backed Hello Cashback Credit Card with up to 5% Cashback

Hyderabad, February 2026: IDFC FIRST Bank launches Hello Cashback Credit Card, a fixed-deposit-backed offering designed to make credit more accessible for digitally savvy customers, especially young adults aged 18+ with online-first and UPI-led spending habits. The card enables customers to begin building their credit history while benefiting from a strong and clearly differentiated cashback proposition on everyday digital payments.

Hello Cashback features a powerful tiered cashback structure, offering 5% cashback on online spends above ₹10,000, 3% cashback on online spends up to ₹10,000, and 1% cashback on in-store, contactless, and UPI transactions. Uniquely, the 1% cashback also extends to essential categories such as utilities, education, and insurance. The card is priced at a joining fee of ₹1,000 and an annual fee of ₹1,000, with the joining fee waived until March 31, 2026, and the annual fee waived on annual spends of ₹2,00,000 in the previous year, making it a compelling combination of rewards, access, and credit building.

10 Unique benefits of the Hello Cashback Credit Card

1. Everyone is eligible.

2. Up to 5% Cashback on Online Spends: 3% cashback on online spends up to ₹10,000 per statement cycle, and 5% cashback on incremental online spends beyond ₹10,000, with cashback on online spends capped at ₹1,000 per statement cycle. No merchant restriction.

3. 1% Cashback across In-store, UPI, & Essential Spends: 1% cashback on in-store purchases, UPI spends via the Bank’s app, and essentials including utilities, education, insurance, FASTag recharge, railway bookings, govt. payments, rent, jewellery, and wallet & gift card loads.

4. Bonus Cashback on Travel Bookings: Additional 1% Bonus Cashback on flight and hotel bookings made via IDFC Bank app. Total cashback on travel bookings goes up to 6%.

5. Monthly Cashback Cap of ₹1,500 across all categories per statement cycle.

6. One fixed deposit. Two returns. The fixed deposit earns interest and powers cashback on every card spend.

7. 100% FD-Linked Credit Limit: Credit limit equal to 100% of fixed deposit value.

8. Access to FD Funds via Card: ATM cash withdrawal limit up to 100% of FD value, interest-free for up to 45 days, with a nominal ₹199 + GST withdrawal fee.

9. Instant Credit Limit Enhancement: Flexibility to link additional fixed deposits and increase credit limit instantly.

10. Built-In Safety & Convenience includes insurance covers, purchase protection, lost card liability, roadside assistance, and 1% fuel surcharge waiver, making credit safer & convenient for first-time users.

Fees & Eligibility

The Hello Cashback Credit Card is available against a fixed deposit starting at ₹10,000. The joining fee of ₹1,000 + GST is waived until March 31, 2026 as an introductory offer. The annual fee of ₹1,000 + GST is:

- 100% reversed on annual spends of ₹2 lakh or more, or

- 50% reversed on annual spends between ₹1 lakh and ₹2 lakh

This makes it one of the most affordable and rewarding secured credit cards in the market.

Shirish Bhandari, Head – Credit Cards, FASTag & Loyalty, IDFC FIRST Bank, said:

“Hello Cashback brings up to 5% online cashback to an FD-backed credit card, designed for digitally savvy customers beginning their credit journey, particularly young adults aged 18+ entering the credit ecosystem with online-first and UPI-led spending habits. With cashback across all online purchases and UPI transactions, a low entry threshold starting at ₹10,000, and flexible annual fee waivers, it makes rewarding digital payments accessible from day one.”

For Applications: The Hello Cashback Credit Card is now open for applications, and fully digital and instant. Click the link to access more information and apply: https://www.idfcfirst.bank.in/credit-card/hello-cashback-credit-card