Options data points to declining resistance level

The options data on NSE after Friday’s session is pointing to strong addition of Put Open Interest (OI) and drop in resistance level.

Coming to the Put side, the maximum Put base is at 17,000PE followed by 17,100/ 17,300/ 17,200/ 16,500/ 16,800 strikes. Further, 17,300/ 17,200/ 16,500/ 17,100 strikes recorded significant build-up of Put OI. The domestic stock markets are closed on April 4 (Tue) and April 7 (Fri) for Mahavir Jayanti and Good Friday respectively. Dhirender Singh Bisht, senior research analyst (derivatives) at SMC Global Securities Ltd, said: "From the derivatives front, the highest Open Interest concentration in Calls was seen at 17,700 strike, shifting from 17,500 strike, while on the Put side highest Open Interest concentration was held at 17,000 followed by 17,300 strike."

The Nifty came under pressure due to sharp uptick seen on Friday and recorded aggressive Call writing for this week ahead. Closure among Call writers may continue and Nifty may hold 17,200 in the next few sessions. Analysts attribute the reasons for upward move to quarter and year end buying. The sustainability of 17,200 is likely to trigger an extended move. "On the last week of the 2022-23 financial year, broader indices closed in green. Buying interest was seen in IT and pharma sectors whereas on the other hand, consumer durables and oil & gas remain under pressure," said Bisht.

BSE Sensex closed the week ended March 31, 2023, at 58,991.52 points, a net loss of 1,464.42 points or 2.54 per cent, from the previous week's (March 24) closing of 57,527.10 points. NSE Nifty ended the week at 17,359.75 points, a decline of 414.70 points or 2.44 per cent, from 16,945.05 points a week ago.

Bisht forecasts: "From the technical front, Nifty is still trading below its 200-day Exponential Moving Average on daily charts, whereas Nifty is trading above its recent resistance zone of 17050-17200 points, which will act now as strong support for the upcoming session whereas on the upside Nifty is expected to test the resistance area of 17,500-17,650 zone. We expect that banking stocks are likely to outperform the market with biasness likely to remain in favour of bulls."

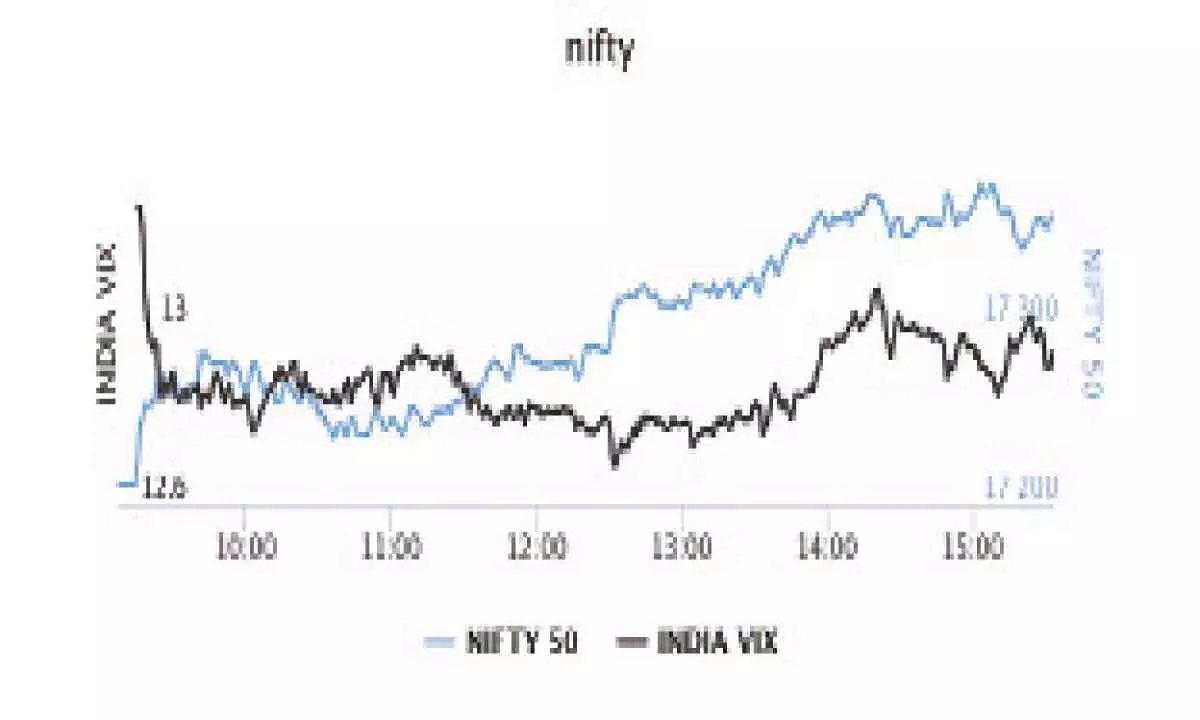

Nifty closed March derivatives series with 2.5 per cent loss. Nifty closed in red for 4 derivatives series for the first time in last 7 years. Nifty recorded 74 per cent rollover, mostly shorts, to April series as against 73% in previous monthly expiry. India VIX fell 5.14 per cent to 12.93 level. "Implied Volatility (IV) of Calls closed at 12.45 per cent, while that for Put options closed at 13.08 per cent. The Nifty VIX for the week closed at 13.63 per cent. PCR of OI for the week closed at 1.18 lower than the previous week," added Bisht. Bank Nifty rollover to April series was 93 per cent from previous 3-month average of 83 per cent.

NSE Nifty began April derivatives series with relatively higher Open Interest, while roll premium remained largely in the range of 100-120 points suggesting rollover of short positions. FII short positions of almost 1.4 lakh contracts have also been carried forward into the April series. These positions will result in short covering as the Nifty already closed above 17,200 level. According to data from ICICIdirect.com, FII activity was mostly in the index space as they closed their shorts aggressively during the monthly settlement. Net shorts in index Futures declined from almost 1.95 lakh contracts to 1.4 lakh contracts suggesting short covering during monthly settlement. FIIs reduced their bearish bets on the Put options and net long Puts declined considerably to 3.5 lakh contracts.