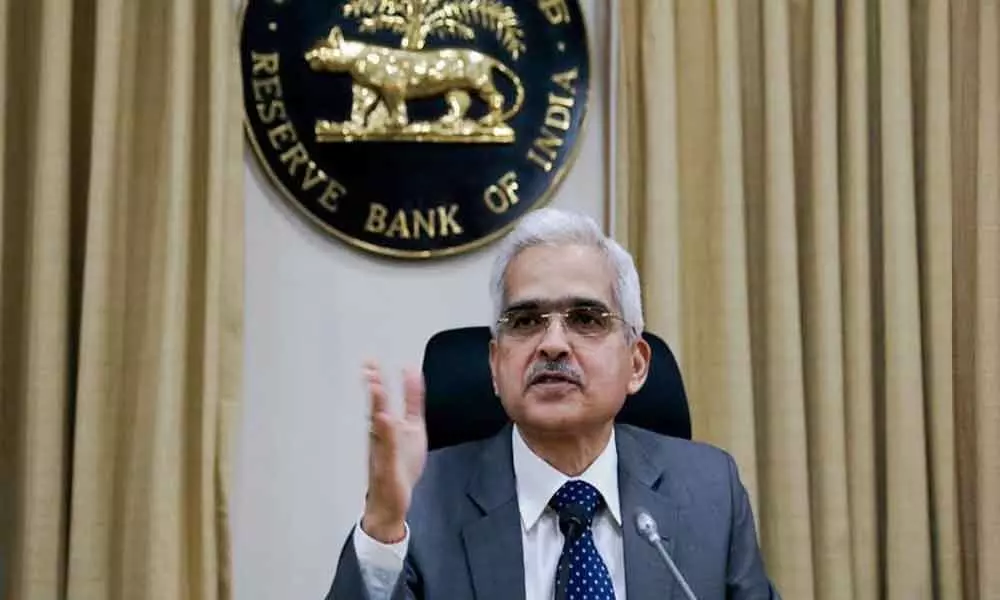

RBI maintains status quo, keeps repo rate unchanged at 5.15%

Reserve Bank of India (RBI) announced its sixth bi-monthly monetary policy statement for the current financial year today and maintained a status quo on policy rates, despite the economic slowdown.

Reserve Bank of India (RBI) announced its sixth bi-monthly monetary policy statement for the current financial year today and maintained a status quo on policy rates, despite the economic slowdown. The policy repo rate remains unchanged at 5.15 per cent under the Liquidity Adjustment Facility (LAF).

The Monetary Policy Committee (MPC), led by Governor Shaktikanta Das, said it has decided to keep the policy repo rate unchanged at 5.15% and persevere with the accommodative stance as long as necessary to revive growth while ensuring that inflation remains within the target. It estimated a 6 per cent GDP growth rate for 2020-21 while projecting a 6.2 per cent growth rate for October to December 2020.

Consequently, the reverse repo rate under the LAF remains unchanged at 4.90 per cent and the Marginal Standing Facility (MSF) rate and the Bank Rate at 5.40 per cent. The MPC also decided to continue with the accommodative stance as long as it is necessary to revive growth while ensuring that inflation remains within the target.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of plus or minus 2 per cent while supporting growth. The six-member Monetary Policy Committee (MPC) headed by Governor Shaktikanta Das unanimously voted for a status quo.

The bi-monthly monetary policy statement for 2019-20 was announced after 3 days of deliberations by the Monetary Policy Committee (MPC) that began on Tuesday. In 2019, the RBI cut rates five times in a row by a total of 135 basis points. It kept the interest rates unchanged in its previous policy review in December.