Understanding The Budget

Asthe linchpin of a nation’s economic framework, the budget serves as a paradigmatic representation of a government’s fiscal policy and socio-economic priorities.

Asthe linchpin of a nation’s economic framework, the budget serves as a paradigmatic representation of a government’s fiscal policy and socio-economic priorities. This intricate document, replete with numerical intricacies and fiscal allocations, presents a fascinating tapestry of economic theory, political pragmatism, and social welfare. In this treatise, we shall endeavor to deconstruct the budgetary paradigm, elucidating its constituent elements, examining the underlying economic principles that govern its formulation, and exploring the far-reaching implications of fiscal policy on the economy and society.

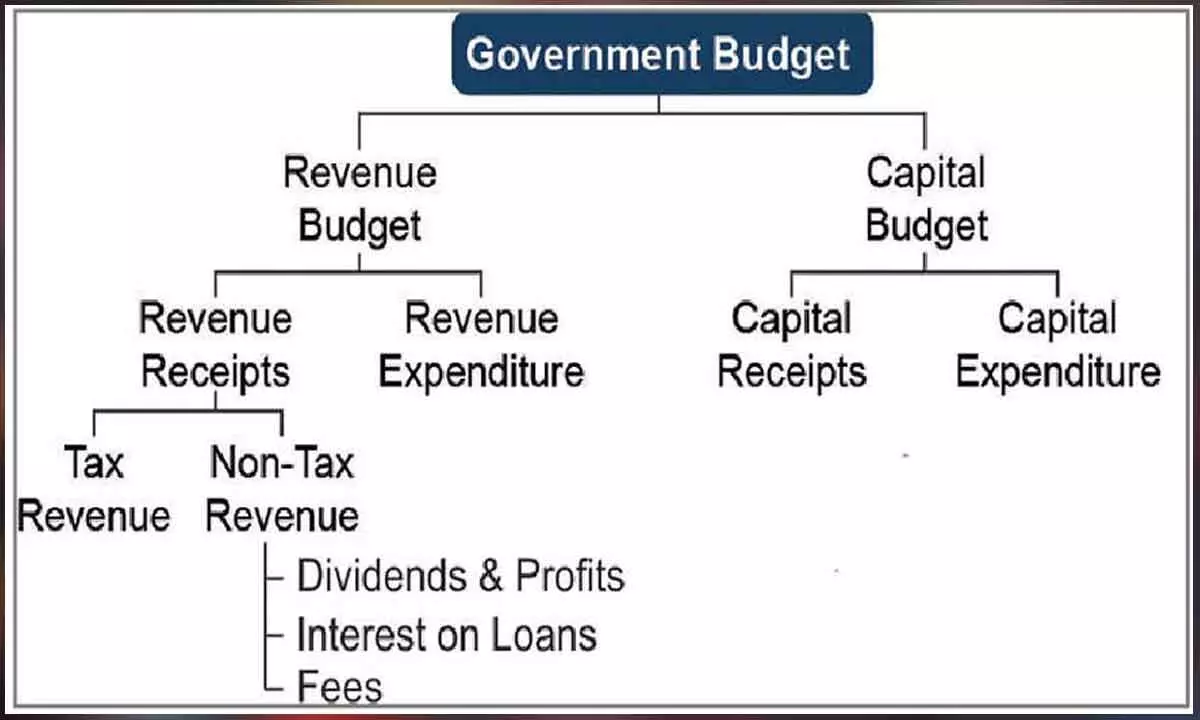

The budget, in its most rudimentary form, represents a financial plan outlining projected revenues and expenditures over a specified period, typically a fiscal year. This document serves as a critical instrument of fiscal policy, enabling governments to allocate resources, prioritise expenditures, and redistribute income. The budget’s cardinal objective is to strike a delicate balance between competing socio-economic imperatives, including economic growth, social welfare, and fiscal prudence.

The revenue side of the budget presents a fascinating mosaic of fiscal instruments, including taxes, fees, and other non-tax revenues. Taxes, as the primary source of revenue, play a pivotal role in shaping the budget’s fiscal architecture. The tax structure, comprising direct and indirect taxes, influences the distribution of income, economic incentives, and ultimately, the overall economic efficiency. Direct taxes, such as personal income tax and corporate tax, impact the economy by influencing labor supply, investment decisions, and entrepreneurship. Indirect taxes, including value-added tax (VAT), excise duties, and customs duties, affect consumption patterns, production costs, and international trade.

The government’s tax policy, therefore, warrants meticulous consideration, as it can have far-reaching consequences on the economy and society. A well-designed tax system can promote economic growth, reduce income inequality, and enhance social welfare. Conversely, a poorly designed tax system can lead to economic inefficiencies, social injustices, and fiscal instability.

The expenditure side of the budget presents an equally complex landscape, replete with competing demands for resources. Governments must allocate expenditures across various sectors, including defense, education, healthcare, and infrastructure. These allocations reflect the government’s socio-economic priorities, influencing the distribution of resources, economic growth, and social welfare. The expenditure structure, therefore, serves as a critical indicator of a government’s policy priorities and fiscal prudence.

The allocation of expenditures across different sectors has significant implications for the economy and society. For instance, investments in education and healthcare can enhance human capital, improve productivity, and reduce poverty. Investments in infrastructure, such as transportation networks and public utilities, can promote economic growth, improve living standards, and enhance competitiveness. Conversely, excessive allocations to defense expenditures can divert resources away from essential social services, compromising human security and social welfare.

The budget deficit, representing the excess of expenditures over revenues, constitutes a critical fiscal variable, influencing the economy’s overall macroeconomic stability. A budget deficit can be financed through borrowing, either domestically or internationally, or by printing money. While a moderate budget deficit can stimulate economic growth, an excessive deficit can lead to fiscal instability, inflation, and crowding out of private investment.

The management of public debt, therefore, assumes critical importance in maintaining fiscal sustainability. Governments must balance the need to finance essential public expenditures with the imperative to maintain a stable debt-to-GDP ratio. This requires prudent fiscal management, including the implementation of fiscal rules, the establishment of independent fiscal councils, and the promotion of transparency and accountability in public finances.

In addition to its macroeconomic implications, the budget also has significant microeconomic effects. The allocation of expenditures across different sectors and programs can influence the distribution of resources, economic incentives, and social welfare. For instance, targeted transfers to low-income households can reduce poverty and inequality, while investments in social services, such as healthcare and education, can enhance human capital and improve living standards.

Furthermore, the budget can also play a critical role in promoting sustainable development and environmental protection. Governments can allocate expenditures to support green infrastructure, renewable energy, and sustainable agriculture, while implementing fiscal incentives to promote environmentally friendly behaviors.

The budget of a country presents a fascinating paradigm of economic theory, political pragmatism, and social welfare. Understanding the budget’s constituent elements, including revenues, expenditures, and fiscal deficits, is essential for policymakers, economists, and citizens alike. By deconstructing the budgetary paradigm, we can gain a deeper understanding of the intricate relationships between economic variables, fiscal policy, and socio-economic outcomes. This understanding is essential for fostering informed public discourse, promoting fiscal transparency, and ensuring that the budget serves as a powerful instrument of economic development and social welfare.