Boundary lines blur amid growing concerns

Among the other important statutory and constitutional bodies in the country, whose functions are of public importance, are the Finance Commission

Among the other important statutory and constitutional bodies in the country, whose functions are of public importance, are the Finance Commission, the Human Rights Commission, the Union Public Service Commission, the Election Commission, the Chief Information Commission, the National Commission for Women and the SC and ST Commission.

Experience has shown that the respect these institutions command often depends on the individuals heading them. T N Seshan, for instance, merely used an existing statutory instrument, the Representation of Peoples Act and breathed life into that legislation.

On account of his dedication to duty and a totally fearless and firm approach to his functions, he established a platform which forever ensured that elections in the country could be conducted freely, fairly and impartially.

So much so that, in a recent case, the Supreme Court, while ordering the suspension of campaigning by contesting candidates in Uttar Pradesh State, found fault with the commission for having defaulted in its duty to enforce the provisions of the electoral laws.

In fact, the court had to tell the commission to rediscover its powers. And the commission, as a result, accepted having done so!

The anti-defection law was enacted by Parliament in 1984 to curb the practice of elected representatives of people shifting loyalties from one party to another, making a mockery of democracy and ridiculing the will of their electors.

But, although hundreds of defections have taken place since that enactment came into force, very few disqualifications have actually taken place.

The few that were done by the Speakers of the State Assemblies concerned, largely guided by political compulsions. The Election Commission seriously ought to consider whether, as part of its legitimate mandate, it ought not to recommend to the government of India to bring in suitable amendments to the anti-defection law to remedy this unfortunate situation.

It after all, takes prompt follow-up action in situations such as when the Supreme Court of India strikes down certain provisions of the ROP act, disabling convicted legislators from continuing as such. Such action can very well follow in case of defection also if only the requisite legal provisions are obtaining.

However, it is not that the statutory and constitutional institutions have always used their powers and authority entirely in the interest of the public.

Not so long ago ,the Comptroller and Auditor General of India, in the process of faulting the Central government in the matter of awarding licenses for the 3G telecommunication spectrum, arrived at a totally indefensible figure of the hypothetical losses incurred on account of the alleged default on the part of the Minister concerned.

Further, the whole country has seen how, after two successive RBI Governors refused to oblige it, the Central government managed to get a Governor of the Reserve Bank of India to agree to release to the GoI a colossal sum of Rs 1.76 lakh crore from the Reserves of RBI.

The manner in which the RBI abdicated its responsibilities in the matter of resisting the hasty and ill-conceived plan of the government of India for demonetisation of the currency had earlier attracted the adverse attention of all sections of the country.

What is more, the Central bank also failed in its very fundamental duty firstly to prevent commercial banks from accumulating non-performing assets and, secondly, to prevent the government of India from repeated recapitalising the banks merely to cleanse their balance sheets at the cost of the taxpayer, contrary to the accepted practice in the private sector banks and other institutions, where the losses are born by shareholders!

In the context of the Centre-State relations of the country being governed by the principle of cooperative federalism, the manner in which the Union and the State governments share the divisible pool of tax revenues assumes significance.

Therefore, the agency entrusted with this onerous task, namely the Finance Commission of India, has a crucial role to play in providing an impetus to the processes of development and growth in the country.

It was originally conceived by the Constitution makers as a non-political institution that will remain above conflicts of interest and prove to be an important instrument in sustaining the fledgling democratic polity of India.

Over the years, however, there has been a marked, and regrettable decline in the value of its contribution vis-a-vis the expectations generated by the constitutional mandate given to it. Several reasons have contributed to this unfortunate situation.

The primary cause is the interference by powerful sections of society in the process of deciding the composition of the Commission, its terms of reference and, on occasion, even its recommendations.

The entire process has been a victim of manipulation by vested interests to serve narrow sectional and regional interests. The emergence of coalition politics in the country only made the situation worse by increasing the politicisation of important institutions including the Finance Commission.

And, with the increased importance attached to the process of planned economic growth and the significant role accorded to the Planning Commission in that process, the mandate of the Commission, that of providing uniform public services and equalising opportunities for the citizens of the country, got diluted over time.

Informed observers feel that, now that the process, which began with the advent of the forces of liberalisation, privatisation and globalisation in the early 90s of the previous century, has taken the form of a critical mass of change with the planning process being more or less discontinued.

Successive Finance Commissions (FCs) have kept the Indian federation going by adjudicating between the Centre and the States. As a non-political body, above conflicts of interest, it is one of the sterling institutions that sustain Indian democracy.

But as Plan expenditures were prioritised under planning, the original constitutional mandate, which was to equalise opportunities for every citizen by ensuring uniform public services, got diluted.

Still the 12th FC brought in a major reform with a combination of carrots and sticks – by making debt restructuring of the States conditional on acceptance of State-level Fiscal Responsibility and Budget Management (FRBM) legislation.

History can be a trap. Past FCs were normally reluctant to rock the boat and lose credibility by doing anything very different.

And the average Indian continued to suffer from poor public services. Improving the level and uniformity of public services can be a useful lens through which to look at the Terms of Reference (TORs) of the 15th FC.

The emphasis in the TORs on incentives has created considerable unease. Tax share is regarded as a right, and therefore States resist conditionalities in devolution.

But States themselves have not devolved funds and functionaries to the third tier as required in the 73rd and 74th Amendments to the Constitution, or in some cases even set up State Finance Commissions (SFCs) to do so.

The present, namely the 15th Commission has an opportunity to play a major role in correcting the inadequacies in the functioning of India's Federation.

It could, for instance, incentivize the much-neglected devolution of functions, functionaries and funds of the third tier, of the Panchayati Raj hierarchy in the States.

(To be continued)

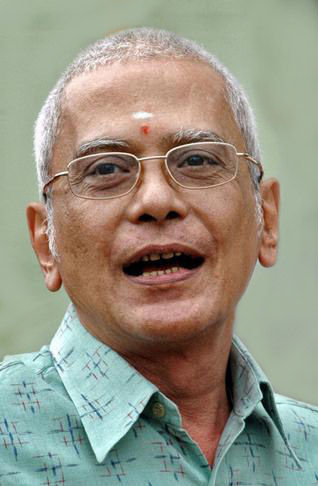

(The writer is former Chief Secretary, Government of Andhra Pradesh)