Despite onions & pulses rise, inflation dips

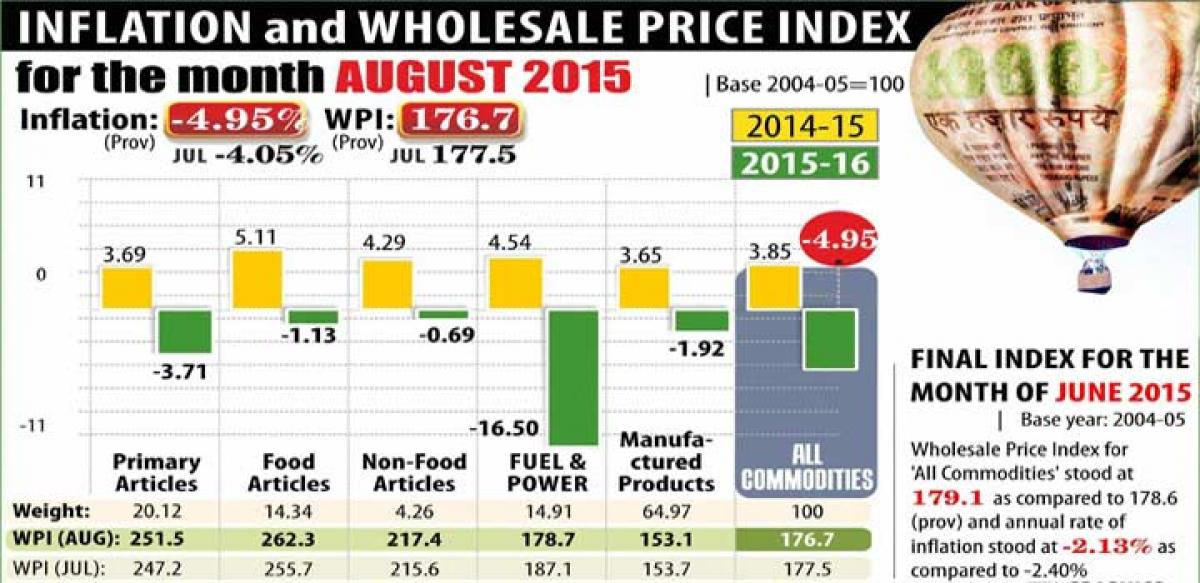

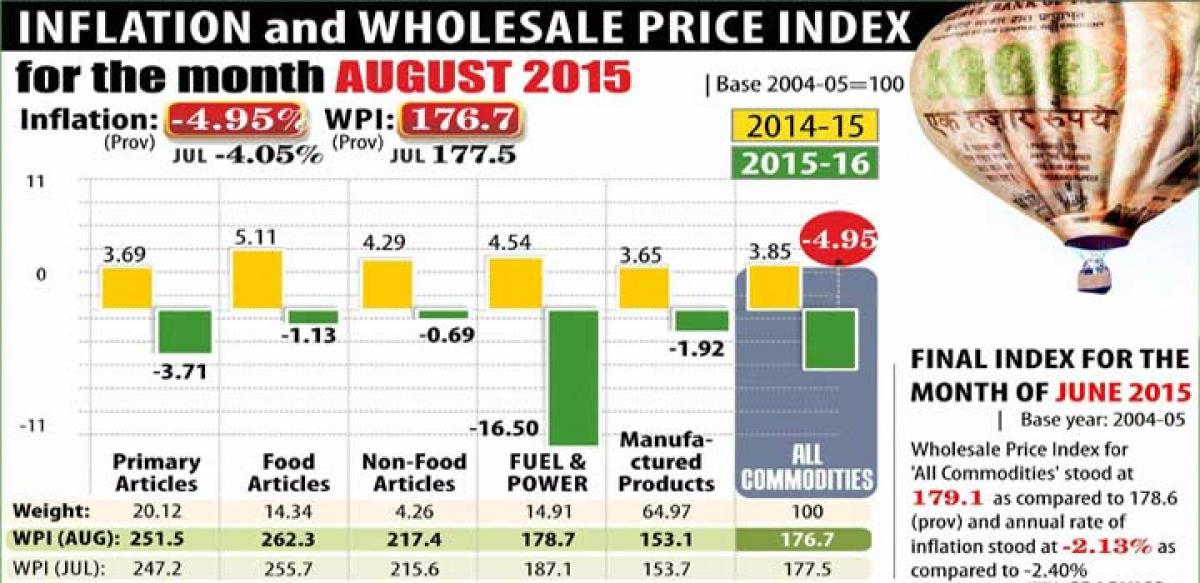

Despite onions & pulses rise, inflation dips. Stakeholders\' call for interest rate cut got sharper on Monday with the official data on wholesale and retail price indices indicating a further decline in their annual inflation rates for August, at (-) 4.95 per cent and 3.66 percent, respectively.

New Delhi: Stakeholders' call for interest rate cut got sharper on Monday with the official data on wholesale and retail price indices indicating a further decline in their annual inflation rates for August, at (-) 4.95 per cent and 3.66 percent, respectively.

Even as prices of onions and pulses continued to hit household budgets, vegetables got cheaper, as per the official data on wholesale price index (WPI) and the consumer price index (CPI) released by the commerce ministry and the Central Statistics Office, respectively.

The latest data showed that the annual food inflation, as per the retail data, increased to 2.2 per cent from 2.15 per cent in July. This apart, the general inflation for rural India also rose from 4.35 percent to 4.47 percent, while for urban areas fell a tad from 2.94 percent to 2.67 percent.

During the month under review, some commodities of mass consumption continued to upset household budgets and notably among them was onion, whose prices were higher by as much as 65 per cent over the like month of the previous year. Pulses were dearer by 36 per cent.

At the same time potatoes and vegetables were cheaper by 52 per cent and 21 per cent, respectively. Even the prices of cereals and rice dwindled. Cereals depreciated by 1.65 percent and rice cheapened by 3.48 percent.

The story was similar at the retail inflation level. The CPI showed acceleration in the prices of pluses (25.76), meat and fish (5.79), milk and milk based products (5.33), spices (8.37), oil and fast (3.06), egg (2.30) and cereals (1.22).

The fresh data comes against the backdrop of the RBI scheduled to hold its 4th bi-monthly monetary policy review on Sep 29 that has kindled expectations of a cut in interest rates -- following a status quo during the previous update on Aug 10.