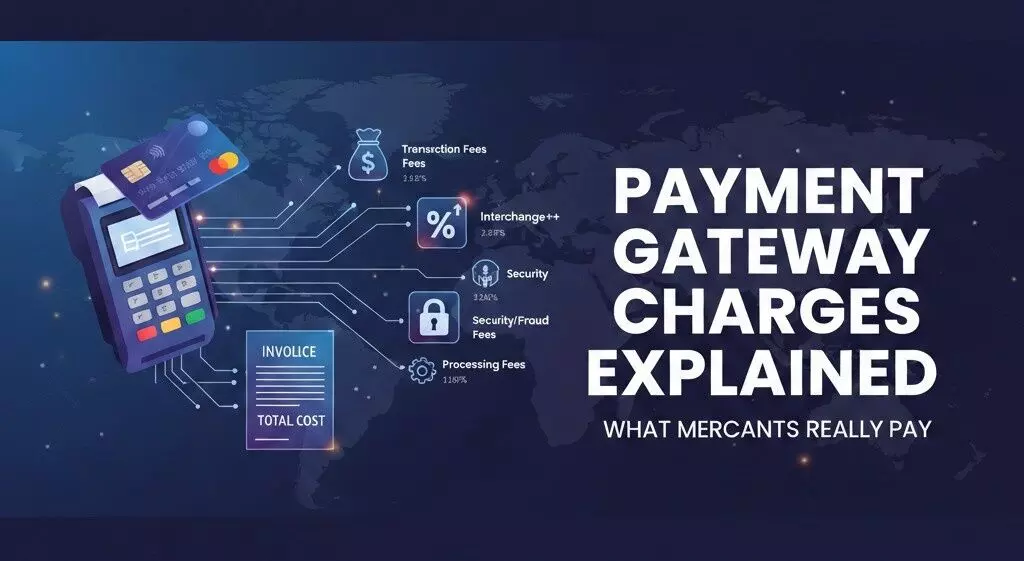

Payment Gateway Charges Explained: What Merchants Really Pay

Understand payment gateway charges in India, including MDR, GST, setup fees, and settlement costs, to protect margins in digital payments.

When choosing a payment gateway provider or payment provider, one factor that needs close

analysis is the payment gateway charges. Payment gateway charges are charged by the

gateway provider to cover the safe transfer of money. While these charges can seem a little low

for merchants to pay, if your user base is wide, they can add up to huge amounts.

So, whether you are a small B2C startup or a scaling enterprise, understanding what you are

really paying for every transaction is the difference between a healthy margin and a

disappearing profit. In this blog, we will understand what these charges are, including MDR,

platform fee, integration fee, and more.

What are Payment Gateway Charges?

In simple terms, payment gateway charges are the service fees a merchant pays to digital

middleman platforms for safely moving money from a customer’s account to theirs. In India,

these are primarily the Merchant Discount Rate (MDR), a percentage of the transaction value

and an 18% GST on that fee.

These charges cover various aspects, such as

● Cost of security encryption

● Fraud prevention

● Complex technical communication between your website and the card networks

(Visa/Mastercard/RuPay) and the banks.

Breaking Down the Components of Payment Gateway Charges

When you look at your merchant dashboard, the charges often appear as a single line item.

However, that percentage is actually a bundled fee shared across several entities. Here are the

various elements of payment gateway charges.

1. Merchant Discount Rate (MDR)

The MDR is the core fee of the overall processing cost. It is not a single fee but a combination of

three fees.

● Interchange Fees: This is the largest slice that is paid to the customer's bank (Issuing

Bank) to cover their risk and rewards.

● Network Fees: A small percentage paid to the card networks like Visa, Mastercard, or

RuPay for providing the global switching infrastructure.

● Processor Markup: The fee kept by your payment aggregator, such as Razorpay or

PayU for their technology, dashboard, and support services.

Note: The MDR varies from 0.25% to 3% based on the payment method. However, right now,

the Indian government has enforced a "Zero MDR" policy on UPI and RuPay transactions.

2. Platform or Service Fee

This is an additional platform fee charged by the payment provider either monthly or per

transaction. Note that not all providers charge this fee, but if they do, it is usually included in

MDR itself. Service or platform fee covers features, such as

● Dashboard and reporting tools

● API access for developers

● Support for multiple payment options (UPI, credit/debit cards, netbanking, wallets, etc.)

3. Setup or Integration Fees

This is the fee that platforms charge to integrate the payment gateway with your website or app.

It is a one-time charge that payment gateway providers like Cashfree take. Usually established

service providers charge this fee, newer providers do not charge any setup fee to attract new

businesses.

4. Annual Maintenance Charges (AMC)

Some legacy providers still charge a yearly fee to keep the account active and secure. Modern

gateways usually skip this, especially for startups and small businesses. It covers costs like

operations, infrastructure maintenance, software maintenance, customer support, upgrades,

etc.

5. International Transaction Fees

If you are not in India and are accepting payments in foreign currencies, you may have to pay

an extra charge. These are international transaction fees and are typically 1% to 3%. This fee is

charged to cover currency conversion and cross-border processing.

What Factors Influence The Payment Gateway Charges?

There are various elements that determine what you pay at the end of the month. Here are the

primary factors influencing Indian payment gateway charges in 2026.

1. Payment Mode: While UPI and RuPay Debit are often free, Credit Cards & Wallets

command higher rates. Add-on and advanced integrations can also boost charges.

2. Business Volume: If you have a business having high-volume transactions, you can

negotiate enterprise rates significantly lower than standard 2% pricing.

3. Industry Risk: Sectors like gaming or travel have high risk and therefore face steeper

premiums due to higher dispute rates.

4. Transaction Type: International cards and EMI options usually attract a surcharge. This

surcharge is often 3% or more.

5. Settlement Speed: Opting for instant or same-day settlement typically costs an extra

0.1% to 1.0%.

Why Choose Cashfree Payments?

Cashfree is a premium payment gateway provider that has helped over 8,00,000+ businesses

handle smooth payments in every form. If we talk about their payment gateway charges

structure, here is a list!

Type of Charges | Charges |

Maintenance charges | Zero |

Setup fees | Zero |

Integration fees | Zero |

Domestic Transactions | Standard 1.95% Charges |

International Transactions | Standard 2.99% Charges |

UPI | Zero |

Conclusion

Understanding payment gateway charges is no longer just a task for the accounting department.

It is a core strategy for maintaining profitability in India’s digital-first economy. While the

declaration of Zero-MDR via UPI provides a significant advantage, the cumulative effect of GST,

credit card markups & settlement fees can still erode your margins if left unmonitored.

By closely auditing your statements and using high-volume negotiations, you can ensure that

your payment infrastructure remains an asset to your growth, rather than a hidden tax on your

success.