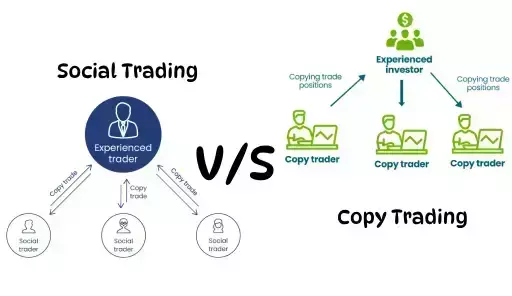

Copy Trading vs Social Trading

Social Trading

Explore the evolving world of copy trading and social trading. Understand their features, differences, and how to choose the right strategy for your financial goals.

In the evolving landscape of online trading, two concepts have gained significant traction: copy trading and social trading. Both offer innovative ways for investors to engage with financial markets by leveraging the expertise of others. While they share similarities, they cater to different needs and preferences. Understanding these distinctions is crucial for traders aiming to optimize their strategies and align them with their investment goals. This guide delves into the nuances of copy trading and social trading, highlighting their features, differences, and suitability for various types of investors.

What is Copy Trading?

Copy trading is a form of automated investing that allows individuals to replicate the trading strategies of experienced traders in real time. When a chosen trader opens, modifies, or closes a position, the same actions are mirrored in the follower’s account proportionally. This enables users to participate in the markets without having to analyze charts, monitor news, or develop their own strategies.

According to experts from Rational FX, copy trading has grown in popularity due to its simplicity and accessibility, especially among novice traders who seek exposure without building a strategy from scratch.

The process typically begins by selecting a trader from a copy trading platform based on factors like performance history, risk profile, trading style, and asset focus. Once a trader is chosen, the user allocates funds to copy their trades. The level of automation is usually high—users don’t need to intervene unless they want to stop copying or adjust risk settings.

Copy trading appeals especially to beginners or passive investors who may lack the time, experience, or confidence to trade independently. However, it’s not without risk—followers are exposed to losses just like the copied traders. Still, for many, it’s an accessible way to gain market exposure while learning through observation and results.

What is Social Trading?

Social trading is a broader, community-driven approach to investing that blends trading with social networking. Rather than simply copying another trader’s moves, social trading platforms allow users to interact, share insights, follow other traders, discuss strategies, and learn collaboratively. It creates a transparent environment where individuals can observe how others trade, review performance data, and make informed decisions based on collective knowledge.

Unlike copy trading, social trading doesn’t necessarily involve automation. Users are given access to a feed of trading activity, market commentary, and trade ideas, but they must decide for themselves whether to follow a trade or not. This makes social trading more engaging and educational, especially for those who want to develop their own trading skills.

The key benefit of social trading is the ability to learn in real time from more experienced traders and to understand the reasoning behind their strategies. It empowers users to make independent decisions with the added value of community feedback and market sentiment. For traders who prefer being hands-on and informed, social trading offers a unique balance of insight and control.

Key Differences Between Copy Trading and Social Trading

While copy trading and social trading are often grouped together, they cater to different types of traders and involve distinct processes. Here are the key differences:

Level of Automation

Copy Trading: Fully automated. Once you choose a trader, their trades are automatically replicated in your account.

Social Trading: Manual execution. You observe other traders and choose whether or not to follow their trades.

User Control

Copy Trading: Limited control. After setup, you rely on the decisions of the copied trader.

Social Trading: Full control. You decide what trades to place based on community insights and discussions.

Learning Opportunity

Copy Trading: Offers passive learning by observing outcomes, but less insight into the trader’s decision-making process.

Social Trading: Encourages active learning through interaction, trade discussions, and shared analysis.

User Engagement

Copy Trading: Set-and-forget style suited for passive investors.

Social Trading: Interactive and community-driven, ideal for those who want to develop their own strategies.

Risk Management

Copy Trading: Risk is tied directly to the copied trader’s performance.

Social Trading: You can tailor risk exposure based on your own trade decisions.

Which One Is Right for You?

Choosing between copy trading and social trading comes down to your trading goals, experience level, and how involved you want to be in the process.

Copy trading is ideal if

- You’re a beginner with limited market knowledge.

- You don’t have time to actively monitor the markets.

- You prefer a passive, hands-off approach.

- You’re comfortable letting someone else make trading decisions on your behalf.

Social trading is better suited if:

- You want to learn how to trade and understand market behavior.

- You enjoy interacting with a trading community.

- You prefer to stay in control of your trades.

- You’re interested in developing your own strategies with the help of community insights.

Ultimately, both methods offer valuable ways to engage with the markets. If you want to gain exposure without deep involvement, go with copy trading. If you're more hands-on and eager to learn, social trading could be your best fit.

Comparison Table: Copy Trading vs Social Trading

Copy Trading | Social Trading | |

Execution | Automatic – trades are mirrored in real time | Manual – users decide which trades to follow |

User Control | Minimal – trader makes decisions on your behalf | Full – you choose which trades to execute |

Engagement Level | Low – ideal for passive investors | High – encourages active participation and learning |

Learning Opportunity | Indirect – learn by watching outcomes | Direct – engage in discussions and follow strategies |

Community Interaction | Limited or none | Central to the platform – includes chats, forums, feeds |

Best For | Beginners, passive investors, those short on time | Aspiring traders, learners, those wanting more involvement |

Risk Management | Linked to the copied trader’s strategy | User-managed – decisions and risks are self-directed |

Setup Complexity | Simple – choose a trader and allocate funds | Moderate – analyze trades, join discussions, decide manually |

Conclusion

Copy trading and social trading both offer unique ways to engage with the financial markets, depending on your preferences and goals. If you’re looking for a hands-off, time-saving solution, copy trading delivers convenience through automation. On the other hand, social trading is perfect for those who want to learn, connect with other traders, and make informed decisions independently.

Each approach has its strengths—what matters most is aligning the platform with your risk tolerance, trading style, and desired level of involvement.

Explore your options, test different platforms, and choose the method that best supports your trading journey.

DISCLAIMER: "The views expressed in our content, blogs, social media, and print publications are those of the authors and not of The Hans India. We do not guarantee the accuracy of this content and are not responsible for any errors. Please verify the information independently. All trademarks and copyrights belong to their respective owners. The Hans India does not claim ownership of them.

The Company is not responsible for any loss or damage from using or relying on the content. For concerns about third-party content, please contact us at [email protected]"