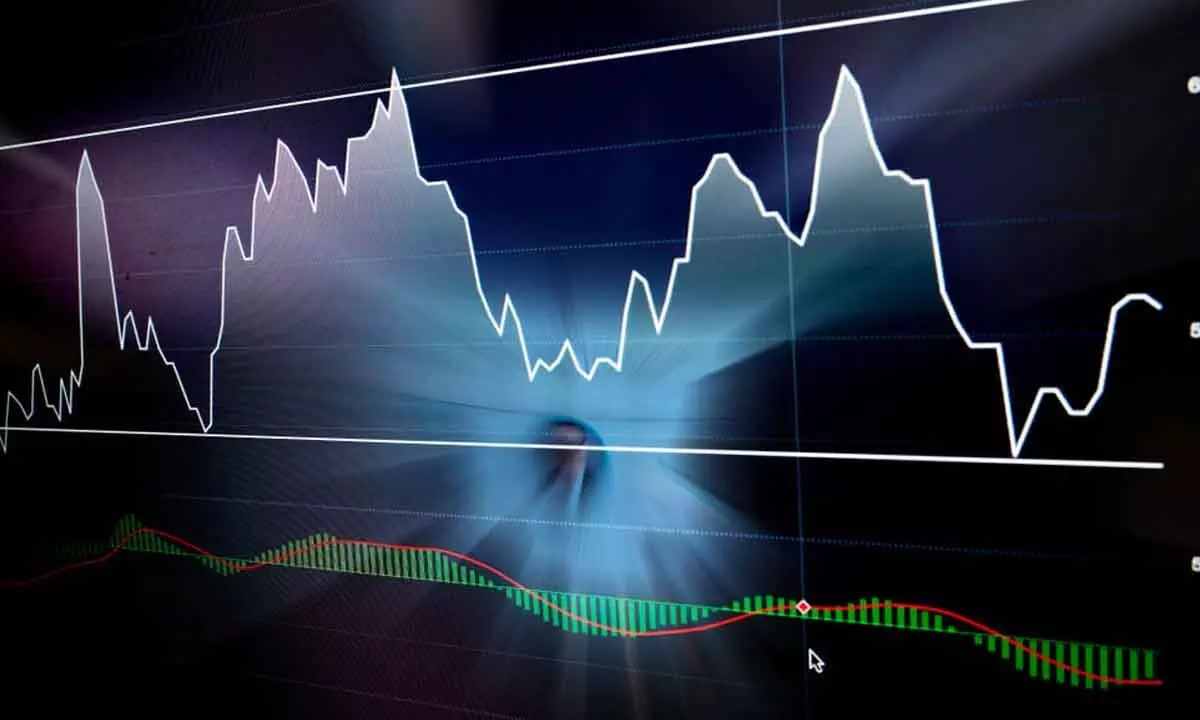

MACD indicator holds fresh sell signal

18114 is an intermediate swing high, a close below 17165 and adding two more distribution days means the Nifty will enter into a confirmed downtrend; technical evidences hints to avoid long positions

The benchmark indices closed lower with an intensified profit booking as a long weekend. The Nifty declined by 54.65 points or 0.31 per cent and settled at 17475.65. It closed almost at the day low. Interestingly, all the sectoral indices are either declined or advanced by less than one per cent. The Fin Nifty, Bank Nifty, Auto and Media indices are down by 0.80 per cent.

FMCG, Metal, Energy, and CPSE indices closed with half a per cent gains. The India VIX is down by 2.05 per cent. The market breadth is positive as 1156 advances and 927 declines. About 96 stocks hit a new 52-week high, and 124 stocks traded in the upper circuit.

The benchmark indices slipped for the third consecutive day and formed a big bear candle on the weekly chart. It confirmed the bearish implications for the previous week's Evening Star Doji candle. As we forecasted last week, it is confirmed that the 18114 is an intermediate swing high. On a daily chart, the Nifty has formed an Engulfing candle and just closed on the 20DMA support.

The 50 DMA and the 200DMA are parallelly moved for another day. The MACD has given a fresh sell signal. RSI closed below the prior swing low. The Nifty also closed below the 23.6 per cent retracement level. For the second consecutive, it added the distribution day. Currently, the 50DMA (17165) is 1.75 per cent away. A close below 17165 and adding two more distribution days means the Nifty will enter into a confirmed downtrend.

The Elder impulse system has formed two consecutive bearish bars. For now, 20 DMA (17471) is immediate support. In any case, the Nifty closes below this level; the next support is at 17181, which is also 50DMA (17165). In any case, the 50DMA cross under the 200DMA will be a clear bearish signal. With these technical evidences it is better to avoid long positions. Any disappointment in Infosys and HDFC results in this long weekend will fuel the bearish sentiment next week.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)