Progressing towards ‘Viksit Bharat@47’ with head held high

The Union government in 2004 appointed a task Force on the revival of the structure, known as the Vaidyanathan Committee, which, in two separate reports, made several sweeping and far reaching, recommendations. Those recommendations led to a phased and conditional revival package, which covered areas such as financial structuring, legal and institutional reforms, improving governance measures, capacity building, strengthening the regulatory environment and introducing computerisation.

The government of India accepted the recommendations, and an institution, initially to be a subsidy of the RBI and, subsequently, to be fully owned by the government of India, called the National Bank for Agriculture and Rural Development (NABARD), came into being. It was to perform the functions of RBI’s agricultural credit department and also cater to the refinance functions of the Agricultural Refinance Development Corporation, which were in existence at that time. As a development bank for the country, NABARD was expected to usher in an era of sustainable and equitable development, of the agriculture and allied sectors and rural development, through participative financial and other interventions, innovations, technology, and institutional development.

Significantly, the Andhra Pradesh government had, even earlier, constituted a high-level committee, headed by P. V. A. Rama Rao, a former Managing Director of NABARD, with a remit like that of CRAFICARD.

In 1981, when I was serving as the Secretary to the Vice-President of India, a Cabinet note was received in the Secretariat, proposing the establishment of NABARD. It was a matter of great personal satisfaction to me to note the development. As the RCS of Andhra Pradesh earlier, I was closely associated with the task of putting in place the single window system for the Cooperative Credit Structure (CCS) in the state.

Time was when the share of agriculture cooperatives in the total institutional finance purveyed to the agriculture and allied sectors in the country, was as much as 50 per cent. That has come down over time to as little as 9.2 per cent. A development that speaks volumes about the lack of support to cooperative institutions, the lip service paid to their cause, by successive governments, notwithstanding. That section of the farming community, which requires credit most, remains sadly neglected,

As the years passed, the once vibrant CCS was in doldrums on account of several causes, including bureaucratic control, political interference and the repercussions of pernicious waivers. The noble intention of extending support soon degenerated into interference. One particularly unacceptable manifestation of political interference was the repeated postponement of elections by the central and state governments and resorting to the practice of appointing persons of their choice as office-bearers. President’s rule, instead of democratic governance, in a manner of speaking.

Concerned about the prevailing situation, the Union government in 2004 appointed a task Force on the revival of the structure, known as the Vaidyanathan Committee, which, in two separate reports, made several sweeping, and far reaching, recommendations. Those recommendations led to a phased and conditional revival package, which covered areas such as financial structuring, legal and institutional reforms, improving governance measures, capacity building, strengthening the regulatory environment and introducing computerisation. The outcome of NABARD’s implementation of that package has, however, been mixed, with financial cleaning up and governance improvement happening, but operational efficiency and autonomy remaining as challenges.

Compared to commercial banks and regional rural banks, the other two streams of institutional finance, the CCS continues to receive a somewhat step-motherly treatment, all the hoopla of support to it by the governments, notwithstanding. Reminiscent of Oscar Wilde’s legendary remark about George Bernard Shaw, that Shaw had no enemies but was intensely disliked by his friends!

Cooperatives have often come in handy when the central and state governments face gluts on agriculture commodities, leading to distress among producers. Along with other organisations, they are commissioned to step in and commence procurement operations and stabilise prices. They offer a floor price, determined by the governments, and of a reasonable level compared to the cost of production, which private traders will have to match, thereby providing relief to the farmers. The idea is primarily to push the price up, and not to buy substantial quantities.

The arrangement, however, has often proved disastrous for the cooperatives. For one thing, they are used as willing handmaidens of government policy, brought in when required and unceremoniously dumped thereafter. Instead of using them as agents, and offering a commission for the services rendered, they are asked to shoulder the responsibility of purchase and sale, responsibilities native neither to their aims and objectives nor to their ability.

Something similar happened in AP. Following floods and cyclones, paddy crop had become discoloured, or had sprouted, an organisation called Ricefed, a state-level federation of cooperative rice mills in the state, was forced to step in, undergoing similar travails.

Cooperatives have also been effective instruments of furthering the cause of providing succour to the underprivileged sections of society, such as contract labour, and small and marginal farmers. In the 1980s, an idea to form state-level federations of labour contracts and joint farming societies to revive grassroots level societies lying defunct.

A shining example of what a multipurpose primary agricultural credit society can do is provided by the Mulkanoor Cooperative Rural Credit and Marketing Society, Karimnagar. A society functioning under the wing of the Cooperative Development Foundation (CDF), also known as Sahavikasa, it was initially founded in Hyderabad under the name Samakhya. It focuses on promoting cooperatives as a means for comprehensive development of rural areas, through creating an environment where cooperatives can thrive as self-reliant, democratic, and mutual-aiding organisations.

Its primary goal is the socio-economic development of its members. It provides a wide range of services including credit, agricultural inputs, and training to its members across 14 villages, and engages in community welfare activities like health camps. It is noted for its significant annual turnover and large member base, as well as its role in shaping national cooperative policies. Its success has also been recognized nationally, with its president serving on the drafting committee for the New National Cooperative Policy 2025. I remember how, after a visit to the society as the then RCS, I came back with redoubled faith in the future of the cooperative system.

It was also around that time that the first steps were taken in Andhra Pradesh towards promoting the idea of mutually added cooperative societies. M Ramireddy, representing CDF, participated actively in the preliminary exercise. In later years, the legislation proved to be a precursor to similar steps at the national level, such as the amendments to the Multi-State Cooperative Societies Act and the Model Cooperative Act.

Recently, I came across an extremely informative and illuminating article by S. Mahindra Dev, Chairman and K.K. Tripathi, Joint Secretary of the Economic Advisory Council to the Prime Minister. Titled “Needed, a cluster based cooperative model”, it says “.........economic transformation, not from corporate boardrooms alone, but from the collective strength of cooperatives.......... with a vibrant member – base, rooted in democratic ownership........... enormous potential in transforming production into prosperity through active play of local skill and collective will.”

The authors point out that India’s two cooperative majors, Anand Milk Union Limited (AMUL) and Indian Farmers Fertiliser Cooperative Limited (IFFCO), top the global rankings, by turnover relative to GDP per capita, a reflection of the importance of India’s cooperative-led model of economic growth. They go on to recommend ‘a cluster – based cooperative model’, to streamline supply chains and connect producers with processors and global markets. They expect that the National Cooperative Export Limited (NCEL) – will enhance the quality of life of small and marginal farmers, by transforming export - oriented clusters into global agri value chain participants.

With some of the brightest of the people, now serving the country at one of the highest policy bodies, exhibiting such firm faith in the cooperative way of life, one can safely expect the movement to confidently march toward an era of sustainable development and rapid growth.

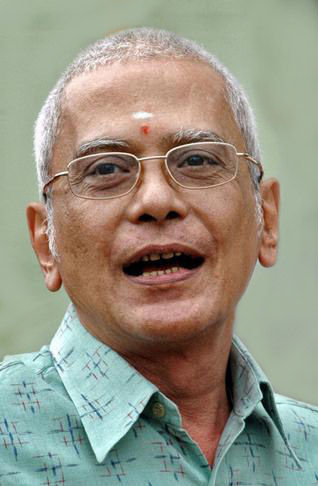

(The writer was formerly Chief Secretary, Government of Andhra Pradesh)