GST needs fine tuning

It was exactly a year ago that the NDA government introduced biggest indirect taxation called Goods and Services Tax (GST). Since then GST had become the most talked about issue by almost every individual in the country. There were both bouquets and brickbats.

It was exactly a year ago that the NDA government introduced biggest indirect taxation called Goods and Services Tax (GST). Since then GST had become the most talked about issue by almost every individual in the country. There were both bouquets and brickbats.

The brickbats were on account of the problems in compliance. It was also the most discussed subject both by the common man and analysts because it had affected all sections of society not just businessmen, traders and professionals.

With the opposition trying to make this as a major issue of campaign in the next elections and promising single tax rate under GST, Prime Minister Narendra Modi on Sunday made it clear that Mercedes car and milk cannot be taxed at the same rate. Taking a dig at the Congress party’s proposal, he said if one GST rate is introduced food items and commodities which are currently at zero or 5 per cent would attract 18 per cent tax.

One year down the lane, still there are many issues which need to be resolved. While celebrating the successful completion of one year of GST, the NDA government needs to speed up the process to sort out the knotty issues so that it can give greater confidence to the people. Several state governments still feel that there are many glitches which need to be sorted out. From initial jitters and resistance, it now has given way to general acceptance.

GST has helped in better compliance of tax framework. In the last one year, 48 lakh new enterprises have been registered and 11 crore returns were filed. GST has within one year of its launch led to over 70 per cent jump in indirect taxpayer base.

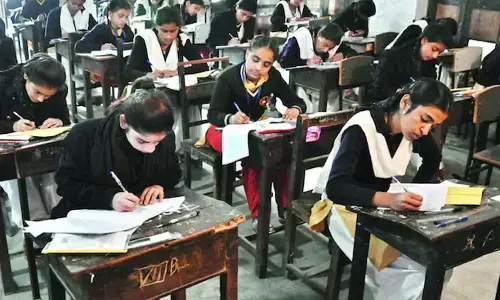

GST implementation started on text and note books, uniforms, school bags, pens, pencils from current academic year. GST is 12 per cent on all these products and as a result, prices of all books, uniforms and other products have shot up.

But there has been increase in consumer inflation as GST had put heavy burden on food and fuel prices. One positive aspect in movement of goods was that long queues of goods carriers at the state borders had become a thing of the past as check-posts disappeared and a seamless national market was created.

As many as 17 taxes and multiple cesses were subsumed into GST. Central taxes such as excise duty, services tax, countervailing duty and state taxes — including value added tax, octroi and purchase tax — were all rolled into one. Initially the business sector struggled with compliance but with the new returns form being introduced, the process hopefully will be less painful.

One sector which is still unhappy are the exporters as the refund mechanism like data matching law and procedures are complicated. Still there are many legislative changes that need to be introduced. Some of these relate to input tax credit and the requirement of paying tax up front on various transactions such as deemed exports and subsequently claiming a refund. A simpler tax filing regime, fewer slabs and a broader tax base are some things the government needs to address in the year ahead.