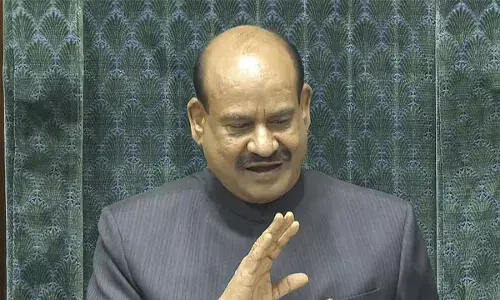

Budget may make provision for Rs 30K crores

The Finance Ministry is evaluating capital needs of state-owned banks, and likely to provide about Rs 30,000 crore in the upcoming Budget to help them meet minimum regulatory capital requirement in the current fiscal, sources said.

New Delhi: The Finance Ministry is evaluating capital needs of state-owned banks, and likely to provide about Rs 30,000 crore in the upcoming Budget to help them meet minimum regulatory capital requirement in the current fiscal, sources said.

The first budget of Modi 2.0 government is scheduled to be presented on July 5 by Finance Minister Nirmala Sitharaman on the backdrop of India's economy hitting 5-year low growth of 6.8 per cent in 2018-19.

In addition, the public sector banks would also require capital for the credit growth, which has just started picking up.

Five weak banks under the Prompt Corrective Action (PCA) framework of the RBI too need capital to maintain minimum regulatory capital ratios as per the Basel III norms. Besides, if the government goes for another consolidation like Bank of Baroda, the three-way merger would also require additional capital, the sources said.

It is to be noted that the government infused Rs 5,042 crore in BoB to enhance its capital base to meet additional expense due to amalgamation of Dena Bank and Vijaya Bank.