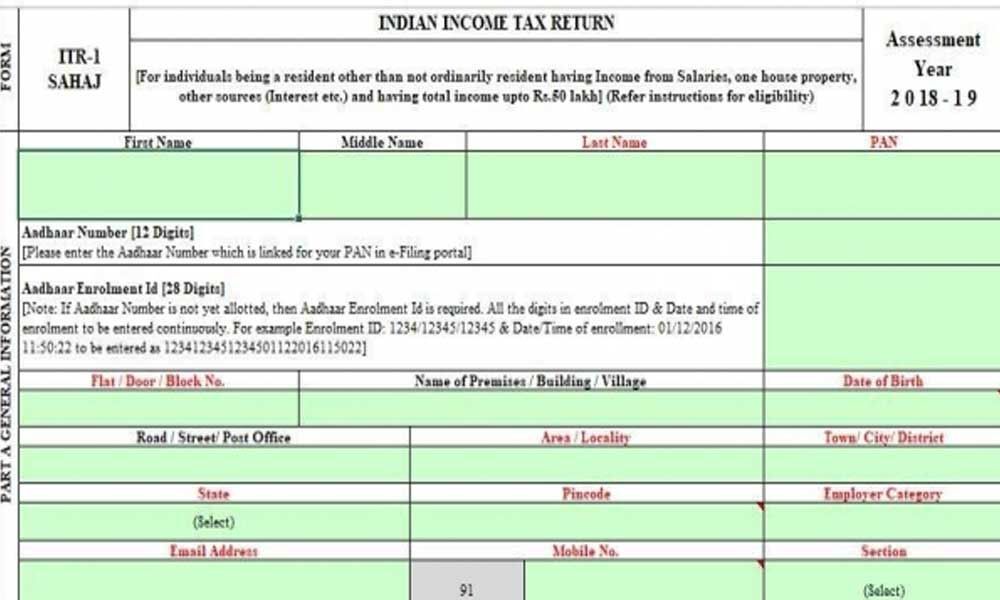

Income Tax Returns forms for 2019-20 released, here's all you need to know

While there has been no change in ITR-1 or Sahaj, which is to be filled by the salaried class, some sections in ITR 2, 3, 5, 6 and 7 have been rationalised.

NEW DELHI: The Centre has released new Income Tax return forms for individuals and companies for the assessment year 2019-20. The new form seeks more disclosures from the filers who claim exemption on a large agricultural income, directors on the boards of companies, individuals with properties or bank accounts abroad and those holding shares in unlisted firms.

While there has been no change in ITR-1 or Sahaj, which is to be filled by the salaried class, some sections in ITR 2, 3, 5, 6 and 7 have been rationalised.

Individuals, firms and companies have to file returns for the income earned in 2018-19 during the course of current fiscal.

- ITR-1 is filed by individuals having a total income of up to Rs 50 lakh, having income from salaries, one house property, other sources (like interest), and agricultural income up to Rs 5,000.

- ITR-2 is filed by Individuals and HUFs not having income from profits and gains of business or profession.

- ITR-3 is filed by individuals and HUFs having income from profits and gains of business or profession.

- ITR-4 or Sugam is meant for individuals, HUFs and firms (other than LLP) having a total income of up to Rs 50 lakh and having presumptive income from business and profession.

- Those filing ITR-3 and ITR-6 (companies) will have to disclose information regarding turnover / gross receipts reported for Goods and Services Tax included now in ITR-3 and ITR- 6 also.

The last date of filing ITR is July 31 for those who are not required to get their accounts audited.