RBI's new rule to tackle with Online Cyber Fraud: Know the ways to get your money within 10 days

RBI’s new rule to tackle with Online Cyber Fraud

The fear of COVID-19 pandemic and the lockdown brought a tectonic shift in the payment habits of people in which they are opting for digital or contactless payments for their purchases from the previous existing cash payment mode.

The fear of COVID-19 pandemic and the lockdown brought a tectonic shift in the payment habits of people in which they are opting for digital or contactless payments for their purchases from the previous existing cash payment mode. Today, people are choosing online/ digital platforms to buy almost everything from grocery items, clothes to toys for their little one among others. This shift has also encouraged frauds to use different ways to cheat people and get their hard-earned money debited from their account by adopting different methods.

So the question props up here that what a person will or can do if his bank account is hacked and a certain amount is withdrawn from his account through a fraudulent activity? Do you need to bear the consequences? Interestingly, the Reserve Bank of India (RBI) has declared a new way to deal with cyber fraud.

In the modern world of digitization maximum number of daily transactions is conducted through online transfer by legal means. And in the same way, illegal activities of online transfer and cyber fraud also happens. Hackers acquire your bank account details and withdraw cash or transfer your hard-earned money to their accounts. They can also make payment through your account by illegal debit or credit card after hacking your details.

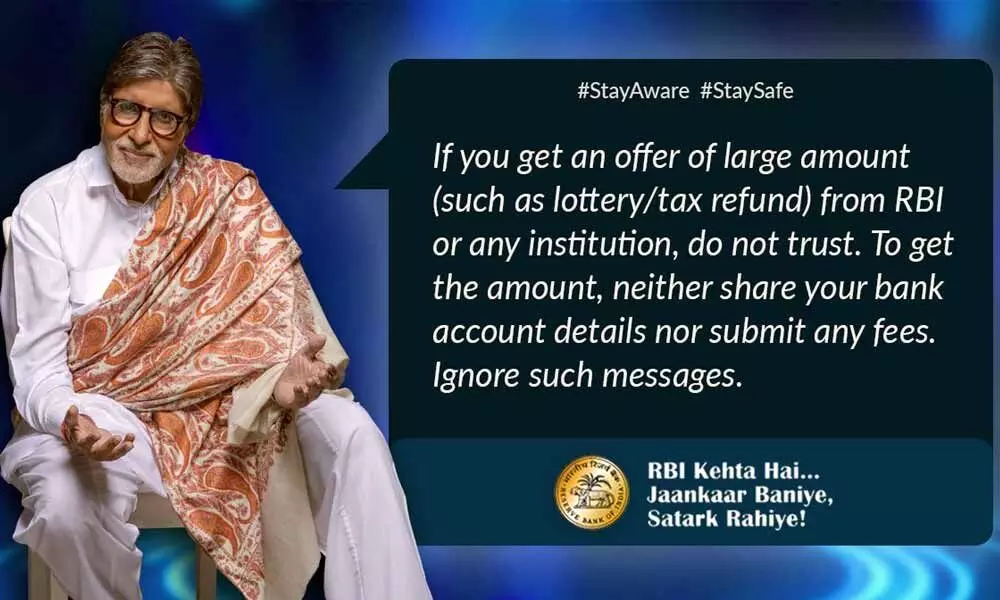

RBI in a tweet has said, "@RBI Kehta Hai... If you lose money through an unauthorised electronic transaction, your liability will be limited, even be zero, if you inform your bank immediately. #rbikehtahai #StaySafe #BeAware #BeSecure."

After losing money through cyber fraud people relent and treat that money as bad debts or lost. But they are unaware that the money can be recovered through legal means. RBI has revealed a possible way of recovering such money. But on one condition, cyber fraud needs to be immediately reported to the concerned bank without any further delay.

Now, most of you must be thinking how and when will the bank be able to bear the consequences of cyber fraud? And even after reporting such illegal transaction to the bank will the money be recovered? The answer is, yes. The thing is, taking the number of cyber frauds happening in recent times into consideration the banks have come up with the idea of taking insurance cover for cyber frauds.

The bank reports the fraud that has happened with the client to the insurance company. And in turn, the insurance company will bear the loss and pay back the money to the account holder. Insurance companies these days are also directly offering services to its clients to cover the risk of potential cyber fraud.

If a victim of cyber fraud reports the activity to the bank within 3 days of occurrence then there are chances that the customer will have to bear a minimum possible loss. The customer needs to report the matter within the specified time frame.

In a different tweet, RBI has said, "@RBI Kehta Hai... Stay Alert! Do not share your bank details such as PIN, CVV, OTP details with anybody posing as RBI or bank representatives. #BeAware #BeSecure #rbikehtahai #StaySafe."

The tweet adds, "Stay Alert! Be wary of messages, calls or links asking for KYC updation, card details, PIN or OTP."

The amount being fraudulently withdrawn from the account will be reimbursed within 10 working days. The RBI also reported that if the fraud is reported after 4 to 7 days then the victim may have to bear a loss of up to Rs 25,000.

For avoiding such online frauds and losses one can easily avail insurance offered by companies such as HDFC Ergo and Bajaj Alliance. These companies offer to cover the risk of potential online frauds and bear the loss, paying back the amount to the client. Recent times have witnessed an increasing number of clients availing such facilities.

For securing the money of the customers and avoiding such frauds RBI has recently issued new rules and regulations regarding Customer Protection Limiting Liability of Customers in Unauthorized Electronic Banking Transaction.