GST collection crosses 1 Lakh crore in October as the country marches towards economic recovery, says Finance Ministry

GST_Collection_Source_PIB

The Finance Ministry today said that Rs 1,05,155 crore of gross GST revenue has been collected in October 2020. Out of the gross GST revenue collected CGST is Rs 19,193 crore, SGST is Rs 25,411 crore.

The Finance Ministry today said that Rs 1,05,155 crore of gross GST revenue has been collected in October 2020. Out of the gross GST revenue collected CGST is Rs 19,193 crore, SGST is Rs 25,411 crore.

IGST is Rs 52,540 crore including Rs 23,375 crore collected on import of goods and Cess is Rs 8,011 crore including Rs 932 crore collected on import of goods. The total number of GSTR-3B Returns filed for October up to yesterday is Rs 80 lakh.

The government has settled Rs 25,091 crore rupees to CGST and Rs 19,427 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in October 2020 is Rs 44,285 crore for CGST and Rs 44,839 crore for the SGST.

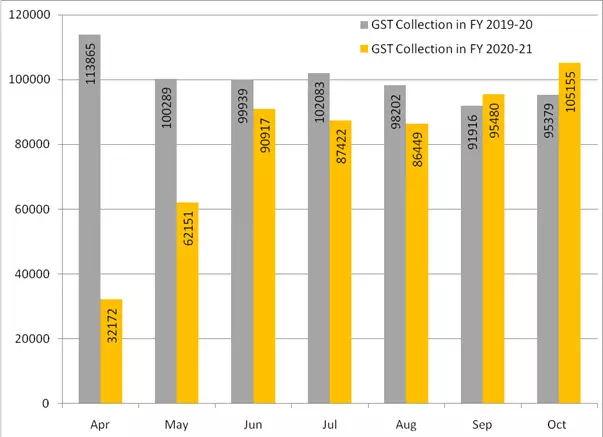

The revenues for the month are 10 per cent higher than the GST revenues earned in October last year. During the month, revenues from import of goods were 9 per cent higher and the revenues from domestic transactions including import of services are 11 per cent higher than the revenues from these sources during the same month last year.

The growth in GST revenue as compared to that in July, August and September this year of minus 14 per cent, minus 8 per cent and 5 per cent clearly shows the trajectory of recovery of the economy and, correspondingly, of the revenues.

The chart shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during October 2020 as compared to October 2019 and for the full year.