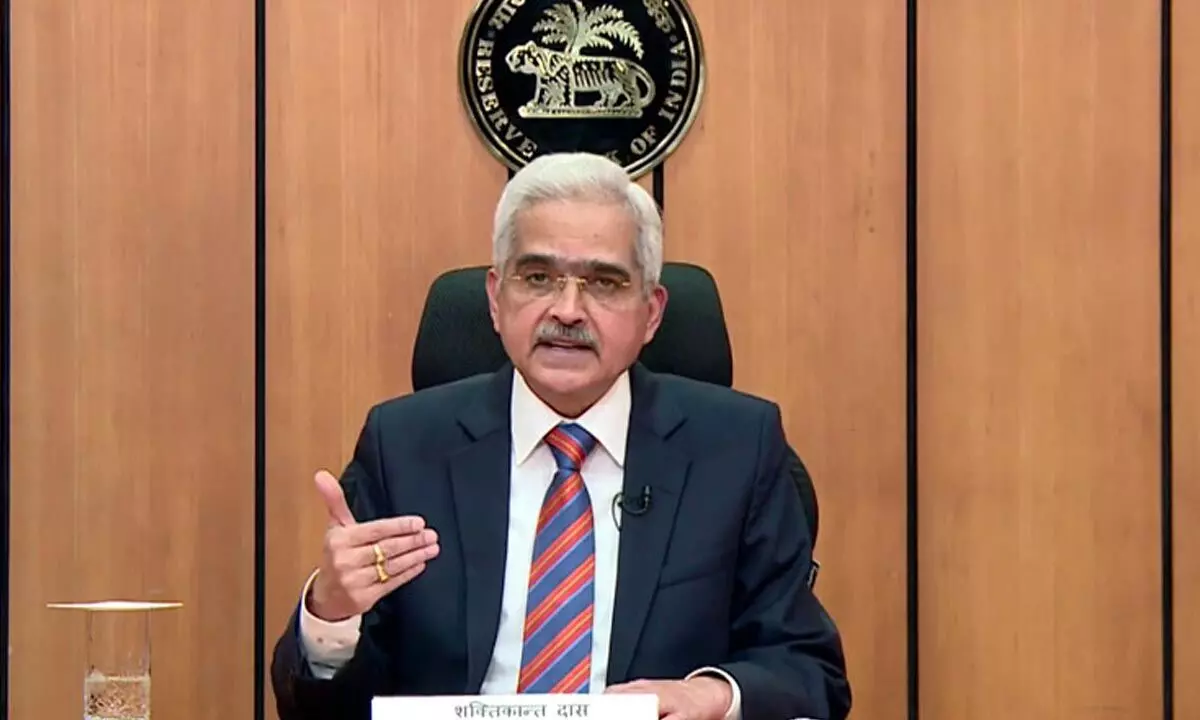

RBI to announce Monetary Policy tomorrow; likely to raise rates

RBI Governor Shaktikanta Das

The three-day RBI’s Monetary Policy Committee (MPC) meeting to review the interest rates in the country that started on Monday, June 6, 2022, will end tomorrow, i.e., on Wednesday, June 8, 2022.

The three-day RBI's Monetary Policy Committee (MPC) meeting to review the interest rates in the country that started on Monday, June 6, 2022, will end tomorrow, i.e., on Wednesday, June 8, 2022. RBI Governor Shaktikanta Das will announce the decision of the Monetary Policy Committee after deliberations.

With more focus on inflation, the Reserve Bank India (RBI) is likely to increase the interest rates this time. Economists have given a wide range of expectations from 25 basis points (bps) to 50 bps.

Recently, in an off-cycle policy review, RBI has raised its repo rate by 40 basis points (bps) to 4.40%, on May 4. Consistent rise in the inflation rate and falling demands have triggered the central bank to take this step.

Below are the expectations of some economists:

Suvodeep Rakshit, Senior Economist at Kotak Institutional Equities, says, "We expect the RBI to hike repo rate by 40 bps in the June policy meeting. However, we should be open for a rate hike between 35-50 bps hinging on how the MPC wants to reach the pre-pandemic repo rate of 5.15% or around that mark by the end of the August policy. The RBI is likely to hike the CRR in one of the upcoming policies but will be contingent on how it sees the durable liquidity panning out over the next few months. We expect another 50 bps of CRR hike by end-FY2023. Along with the repo rate hike, the RBI will also revise its inflation estimates higher, possibly indicating inflation remaining close to 7% for most of CY2022. We expect the RBI to continue focusing on taking inflation and signalling its intent to continue raising the rate and normalising liquidity, while not entirely losing its on growth given the uneven nature of growth recovery."

Lakshmi Iyer, Chief Investment Officer (Debt) & Head Products, Kotak Mahindra Asset Management Company, says, "The off-cycle rate hike has stoked expectations of front loading of rate hike decisions by RBI. With the US not yet relenting on moderating the pace and quantum of rate hikes, and inflation not showing immediate signs of abating, it seems yet another slam dunk decision to hike rates in the upcoming policy. The Quantum of a rate hike (40-50bps in our view) will be a key determinant in extrapolating the terminal repo rate for FY 2023. Though aggressive tightening is already discounted by the bond markets, the stance of the policy will continue to assume significance in the direction of bond yields."

Anuj Puri, Chairman - of ANAROCK Group, says, "There is little doubt that the RBI will further increase the repo rates in tomorrow's announcement of the monetary policy review. What remains to be seen is the quantum of increase. The rate hike could be anywhere between 25-50 BPS. If the hike is above 50 BPS, it may impact homebuyer sentiments, and thus residential sales. It is now inevitable that home loan interest rates will finally depart from the 'sweet spot' territory that they have been occupying over the last 2 years, and enter into the yellow alert zone of lower overall affordability."

Mr Puri added, "That said, as long as they stay clear of the double-digit red zone that they saw during the global financial crisis in 2008, we expect housing demand to continue - albeit at a marginally lower pace. Even at the height of the GFC, housing demand did not entirely evaporate. In India today, housing demand is driven by genuine end-user sentiment - the desire to own homes remains strong and will largely withstand marginal fluctuations in lending rates."

Suyash Choudhary, Head – Fixed Income, IDFC AMC, says, "In a surprising turn of events, RBI / MPC made an inter-meeting decision to hike repo rate by 40 bps and CRR by 50 bps. Though since the April policy market has been pricing for a faster normalisation (interest rate swaps had been factoring in front-loaded normalisation and cumulative hikes of 275 bps over 2 years), almost no one at all was prepared for an inter-meeting action. The Governor positioned this as a reversal of the inter-meeting 40 bps cut undertaken on May 22, 2020, and thus in keeping with the announced stance of withdrawal of accommodation as per April 2022 policy."